📡 1. Social Casino Outlook (SciPlay's Joe Byrne), 2. Apple Device Ad Server 😱 , and 3. The Open App Markets Act Gold Rush 💰💰💰

GameMakers Games Radar Thursday

Happy Games Radar Thursday,

Here is an I. game alert, II. word on the street, and III. question to consider this week…

🤫 Shh!!! Don’t tell anybody, but if you haven’t already subscribed to this super-secret newsletter consider joining now:

🎧 Listen to GameMakers content on Spotify or Apple Podcasts

📺 Watch on Youtube

I. Game Alert

Quick summary:

This week, instead of a single game we take a look at a specific category of games: Social Casino!

In particular, last year I hypothesized that social casino games may become negatively impacted by IDFA deprecation. These games typically have 2 year+ payback windows on advertising spend for acquired players. Therefore, the loss of value or payments/events based targeting theoretically could limit user acquisition.

To get the general pulse of the social casino genre and to also determine how to think about data analysis, I spoke to Joe Byrne Director of Business Development and Strategy at SciPlay. He discusses his thoughts on emerging trends, what to look for in the data to inform product strategy, etc.

My talk with Joe Byrne is below:

Social Casino Data Check

Let’s check the data on the general direction of revenue and downloads for the social casino category. One way to do this is to take the top game from a representative sample of top social casino game companies. I included:

Playtika’s Slotomania

DoubleU Casino’s DoubleDown Casino

Scientific Games’ Jackpot Party

Huuuge Games’ Huuuge Casino

Aristocrat’s Big Fish Casino

PlayStudio’s POP! Slots

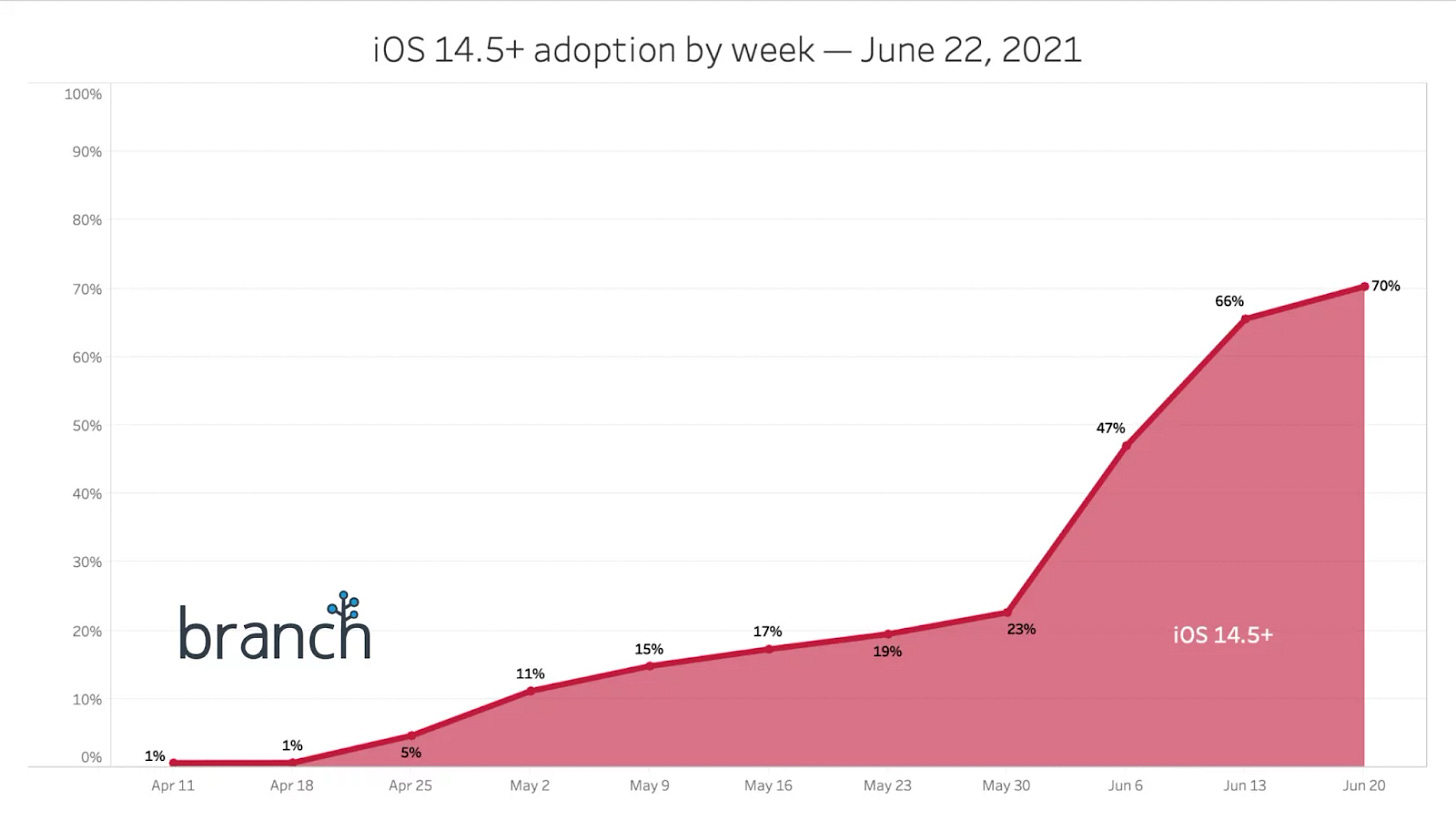

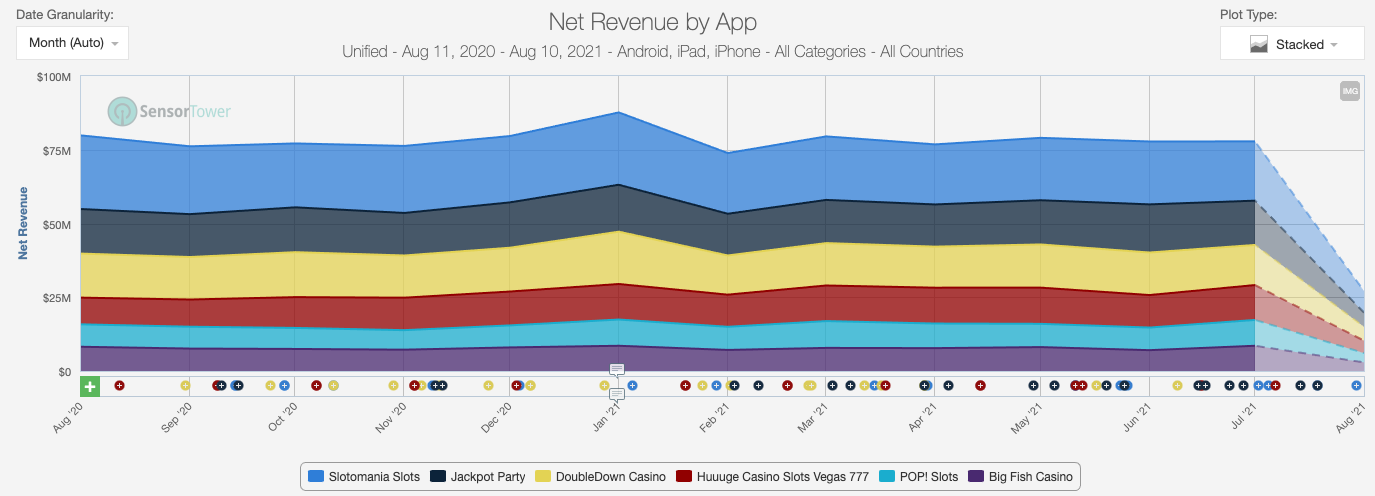

Note that, we should start to see a ramp in impact from IDFA deprecation from May but increasing and more fully through basically today (August):

Worldwide, unified net revenue:

Based on the data, we notice revenue has been holding fairly steady since the introduction of IDFA deprecation in May, June, July.

Worldwide, unified downloads:

However, when looking at downloads we do begin to see some decline:

It’s too early to draw definitive conclusions, but it doesn’t appear to be seasonal. Further, as is typical in long ARPU growth games, we should expect revenue impact to trail downloads by a few months.

Just to be clear, social casino isn’t going anywhere. However, I would expect this is a time for some jockeying and the potential shifting of market leadership.

Now would be a good time to talk to some experts on user acquisition to get more context… stay tuned! And be sure to subscribe so you don’t miss what’s coming up next…

II. Word on the Street

Scopely has instant games FOMO?

IDFA Deprecation Perspective: “The Facebook multi-party computation [stuff] isn’t gonna go anywhere. Apple, however, doing a device-based ad server… people need to watch out for this. This would basically be game over.”

On The Open App Markets Act: “Unity already has their Unity Distribution Portal. Unity doing their own App Store is not a big jump.”

Is FunPlus working on a 4X Metaverse?

WOTS MEME

III. Question For You

With every big change, new opportunities are created and new winners and losers will emerge.

That’s the case with IDFA deprecation, AND that will likely be the case if The Open App Markets Act gets congressional approval.

This bipartisan bill would place new restrictions on how App Stores including Google Play and Apple’s App Store operate. In summary from Wall Street Journal:

“Their legislation would bar the companies from certain conduct that would tend to force developers to use their app stores or payment systems.”

“It also would obligate the companies to protect app developers’ rights to tell consumers about lower prices and offer competitive pricing.“

“It would effectively allow apps to be loaded onto Apple users’ devices outside of the company’s official app store.”

Further, this CNBC article suggests:

“The bill targets, in part, the in-app payment systems for companies that own app stores with more than 50 million users in the U.S.”

Assuming the above is true, that would mean that app stores from Nintendo, Sony, Microsoft, and Valve would also be impacted.

So, the big question is:

What will be the impact of the Open App Markets Act if passed into law?

Let’s poll our readers for implications!

#1. Biggest Winner:

Who will be the biggest winner if the Open App Markets Act passes?

1. Epic Games | vote

2. Unity | vote

3. Roblox | vote

4. Valve | vote

5. Microsoft | vote

6. Xsolla | vote

7. Applovin | vote

8. A Different Company | vote

See results

#2. Epic’s Market Share Potential

What would Epic's App Store market share on iOS be if they were able to compete in that market?

1. < 10% | vote

2. 10% - 25% | vote

3. 25-50% | vote

4. 50%-75% | vote

5. 75%-90% | vote

6. 90%+ | vote

See results

IV. Follow Up | The Metaverse

In last week’s newsletter (📡 1. StarLark's Golf Rival Acquired for $525M, 2. Splinterlands Blowing Up!, and 3. Metaverse Now!), we asked the audience what their thoughts are on The Metaverse. Results below.

When is the Metaverse?

😲 Amazing that 65% believe that significant Metaverse revenue occurs within the next 5 years!

What is the Metaverse?

😂 LOL! b.s. intellectual posturing tied for first with a shared experience platform.

Announcement: India F2P Conference

Details:

Date & Time: August 26, 2021, at 10AM IST (India Standard Time)

Focus: Discussions and sharing of best practices to help evolve and strengthen the Indian F2P game development community

Format: 5 sessions covering industry growth, strategy, game design, technical challenges, etc.

Speakers: We have an all-star cast of speakers from the best F2P gaming companies in India, check out more information below!

More info and signup: https://indiaf2p.splashthat.com/

LILA Games is building one of the most ambitious shooter games ever designed! We are currently hiring aggressively in Bangalore, India. See below.

Visit our website!

LILA Openings (Bangalore or Remote):

LILA Openings (Bangalore Only):