🗞️ Brawl Stars Godzilla event marked highest weekly revenue ever! | What you need to know

Plus: #1. The current state of early-stage game investment (Investgame report) and #2. Does Series AI acquisition of Pixelberry portend new trend in AI for games content?

Hey GameMakers,

One realization I made this past week that I often forget is that “Work is fun!”

That’s right, I said it. Sometimes we over-index on worry and concerns about outcomes and forget that the people we work with, the relationships we’ve made, and the products we work on are pretty damn cool.

Don’t forget—I know I have. One approach to work is to focus on the creative process, what we have control over, and doing the best we possibly can to create a product we’re proud of. Don’t stress about what happens from there and what the outcome of the product’s success will be. [Rick Rubin, Steve Jobs]

Next week, July 24th, I’ll be in LA (Venice Beach), hosting a ridiculously awesome gaming event with CleverTap. You should come if you can!

More info below:

Date: July 24, 2024 (Wednesday)

Time: 4 PM - 8 PM

Keynote (4:30 PM): Alex Seropian (founded Bungie, hosts dope Fourth Curtain podcast)

Panel #1 (4:50 PM): The New New Game Development Model

Tim Morten (reviving RTS from his experience on StarCraft 2), Slim (made a little game called Valorant), Stephen Bell (CCO at Gardens)

Panel #2 (5:50 PM): Top 5 Gaming Trends

Ken Wee (CSO at Activision Blizzard), Giovanni Ducati (Studio Head at WB, led Apex Legends Mobile), Robin Guo (Gaming Investment Partner at a16z)

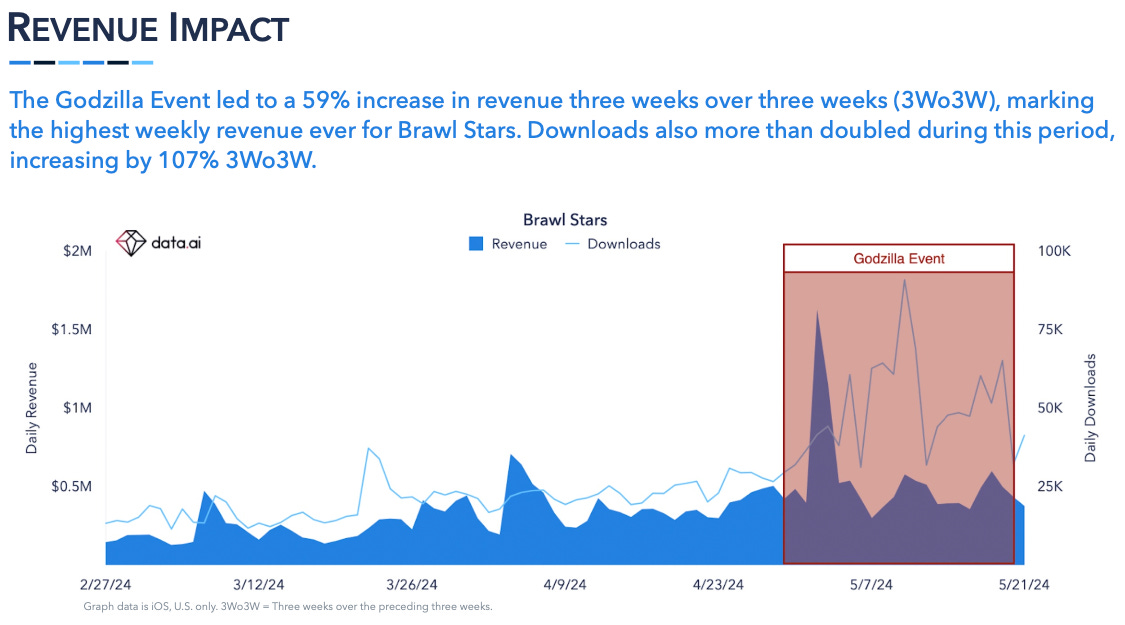

A recent Liquid & Grit product roundtable in partnership with an incredibly handsome game executive shows us the massive impact of the recent Brawl Stars Godzilla event. The highest weekly revenue ever for Brawl Stars! What you need to know as a game developer about this unique event.

Plus:

In its latest quarterly gaming deals report, Investgame shows that private and early-stage VC gaming investments seem to be slowly recovering. However, we still have a ways to go from the COVID boom highs. Further, Asia now dominates early-stage gaming investment… as it should.

Series AI announced the acquisition of Pixelberry Studios, the “Choices: Stories You Play” mobile game makers. Is this the first domino to fall in an emerging trend of AI taking over game content treadmills?

🚀 Brawl Stars Godzilla event smashes records!

In a recent product roundtable collaboration with Liquid & Grit, we examined the recent Brawl Stars Godzilla event (April 29 - May 15, 2024) to evaluate what we can learn from the event’s crazy success.

First of all, let’s take a close look at the impact of the event:

Note Godzilla event’s impact on game performance:

Highest weekly revenue ever

59% revenue increase and 107% downloads increase 3Wo3W

What was the event, and why was it so special?

#1. A game mode

A new 3x3 game mode in which each team tries to do the most damage to the city. Further, one of the players on each side could become Godzilla or Mechagodzilla.

Players earn monster eggs from performance in the game match. See below.

#2. Temporary power progression that impacted multiple game modes

Mutations boosted brawler power but were only active in the Godzilla City Smash and two other game modes. The two active modes in which mutations had effect rotated.

Note that the key to selling power here is that the impact of the power was temporary and rotated.

#3. A club, aka “clan” event and integration with a focused clan objective

A coordinated club event awarded a free “Buzz Godzilla Hypercharge” skin to contributing club members for collecting 1250 monster eggs through the event.

This event created a lot of social pressure and potentially helped drive re-engagement and additional downloads to the game.

For more information and a deeper discussion about this event, you can check out the Product Roundtable hosted by Liquid & Grit below:

🎧 Listen on Spotify, Apple Podcasts, or Anchor

Hosts:

Joseph Kim. CEO at Lila Games.

Brett Nowak. CEO at Liquid & Grit.

Note: Someone on the Brawl Stars team has corrected one of my comments about the event. Contrary to my assumption, the event was not expensive. So despite introducing a new game mode, impacting multiple other game modes, adding powers, club integration, new skins, etc., the development effort was “minimal.” I don’t have explicit permission to share my conversation, but let’s just say the development cost was shockingly low.

Also, check out: I partnered with Matej Lancaric and 2.5 Gamers at the beginning of the year, discussing the overall change in Supercell’s liveops strategy concerning Brawl Stars. Video below:

🇨🇳 Game investment is still down but slowly recovering. Asia gaming is the future!

Investgame’s recent gaming deals report suggests that we are in for a gradual recovery concerning game investment.

If we compare Q2 over five years at a high level, we can see that 2023 potentially marked a low point from the highs driven by Covid expansion in 2021 and 2022.

The data below suggests that while VC early-stage investment is lower than during Covid expansion years, relative to 2020, it’s likely at a healthy level.

In contrast, however, is the late-stage gaming activity, which certainly seems to have fallen off a cliff.

With M&A and public offerings also down (see the first chart), continued early-stage investment will likely be negatively impacted if later-stage exits remain constricted.

The most interesting takeaway from Investgame’s report is where the money is going. As depicted below, Asia accounts for the majority of investment, more than all other geos combined.

If trends continue, we should expect this trend to strengthen over time. Currently, Asia and China, in particular, are killing it.

Also, WTF is going on with Steam? The platform continues to grow despite a lack of innovation.

Finally, a shout-out to Bitkraft (an investor in Lila Games) and a16z for dominating the early-stage game investment charts:

If you’re looking for game investment for your gaming startup, you should hit up this guy:

🤖 What Series AI acquisition of Pixelberry suggests about the future of game content

Series AI, a new gaming startup focused on AI-developed games, recently announced the acquisition of Pixelberry, the company behind the game “Choices: Stories You Play.”

Series AI has been working on a technology platform called the “Rho Engine,” described as an “AI-native, multimodal full-stack platform” developed “to streamline game creation, allowing for faster and more efficient development processes.”

Anecdotally, I have been tracking a number of capabilities to accelerate game development processes. Many of these capabilities are, for now, too early. Still, based on these early indicators, we can grasp how potentially impactful AI will be in terms of costs and capabilities across the board in game development, from art to engineering and even design.

It makes sense that text and 2D image-based content generation should be the initial beachhead. Large language models tackle this problem quite easily.

Today, costs and inflation have skyrocketed, making human-generated content increasingly expensive.

Hence, as we’ve seen with any major arbitrage opportunity, the shift from humans to AI will be a matter of when not if.

We’ve already seen US software engineering jobs arbitraged away from high-wage US workers by globalization and remote work:

Similarly, game development content pipelines will get arbitraged away from humans to AI.

What Series AI does with Pixelberry’s Choices game could be a great early indicator of what we can expect in the future. I don’t know anything about Series AI or their ability to execute well, but we should pay close attention, assuming they do a good job.

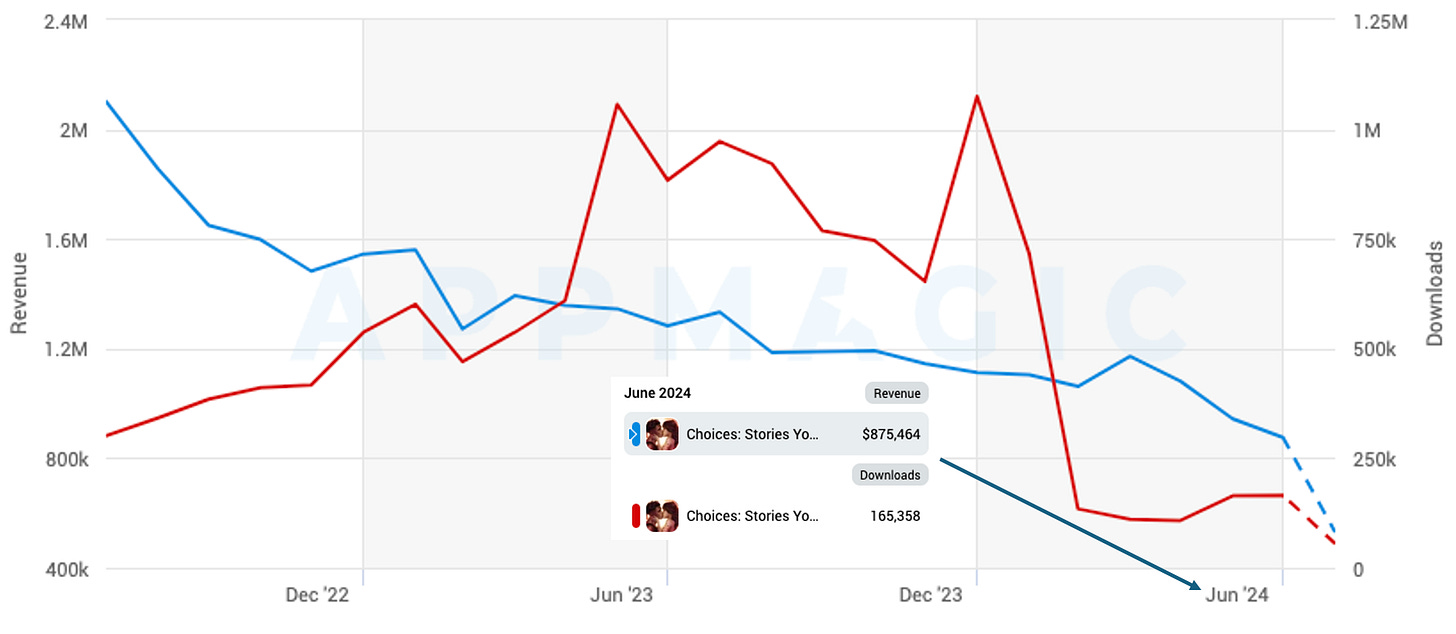

Concerning the acquisition, the game seems to be a prime target for Series AI. It was a game in deep decline and required a serious turnaround.

The game has been steadily losing revenue over the past three years:

Choices revenue dropped from $9.7M per month in January 2018 to $943K this past June 2024.

The sharp drop in revenue from February of this year is even more concerning. It’s possible that Nexon may have turned off UA to window dress metrics and started to shop the company/game at that time.

As we’ve seen with Brawl Stars, a great liveops strategy driven by a more robust content pipeline has great potential to improve the game's performance.

Regarding AI, I can’t emphasize enough how important this technology will be to the longer-term survival and growth of your career and the company you work for.