Four Growth Paradigms: Zynga, Applovin, Skillz, and Jam City (Part 2 of 2)

As game companies struggle for growth, 4 different strategies for growth are compared

Today’s post is a continuation - Part 2 of 2 - to the newsletter post sent out on Monday. If you missed part 1: Click Here

If you enjoy these posts and aren’t already subscribed, feel free to do so here:

🎧 Listen to GameMakers content on Spotify or Apple Podcasts 📺 Watch on Youtube

#3. Skillz

Unlike the other F2P game companies, Skillz is playing especially fast, loose, and risky for growth. Further, their business model is differentiated from a pure content play in that they enable a competitive matching and wagering service that sits on top of content developed by other game developers.

To date, they have achieved some scale against 2 specific game sub-genres: Bingo and Solitaire. However, the big question mark for growth will be around whether they can scale to a much wider audience and against other game genres.

From Skillz’ prospectus, we note that:

For the year ended December 31, 2020, Solitaire Cube and 21 Blitz (each developed by Tether) together with Blackout Bingo (developed by Big Run) accounted for 79% of our revenue. Games developed by Tether and Big Run accounted for 87% of our revenue for the year ended December 31, 2020

The estimated download performance of Solitaire Cube, Blackout Bingo, and 21 Blitz:

Note that Skillz’s current flagship titles have been declining even with COVID and 2020: the best year in the history of F2P gaming. Having said that, don’t be surprised to see some downloads or reported revenue spike: word on the street is that a new game from Big Run may do pretty well. However, longer-term, this whole model has yet to prove scaled and profitable product-market fit.

Accounting Shenanigans:

The more disturbing issue to note is that much of the current growth in revenue reported by Skillz could largely be due to accounting shenanigans.

As reported by Eagle Eye Research on Skillz:

We believe the company is round-tripping their revenues and sales and marketing expenses:

They issue Bonus Cash to incentivize user engagement, which they record as an expense. Users then wager this Bonus Cash which generates revenues for SKLZ. Effectively, the company is recognizing revenue from “virtual” money it gave its customers to spend although no real cash is generated in the process.

We believe management has the ability to manufacture whatever revenue figure they desire. They can simply decide to issue more Bonus Cash which quickly converts into revenue as it is spent. We do not allege willful misconduct but simply point out that the risk exists

Recent high-profile failures and frauds involving round-tripping include Luckin Coffee and ComScore. Both companies were coincidentally audited by the same audit firm as SKLZ’s

Skillz Outlook

In summary, I have huge concerns about the medium to long-term growth prospects for Skillz. They face existential threats based on app store policies from Apple and Google that could potentially shut down their business at any time, have accounting issues, face declines in their core games during the best year in the history of F2P gaming, and have yet to prove scale in other game genres. Skillz represents a high risk, but potentially high reward company if they can get more games to work out. Further, as a platform company, they should see much stronger scale economies if they are able to make things work.

#4. Jam City

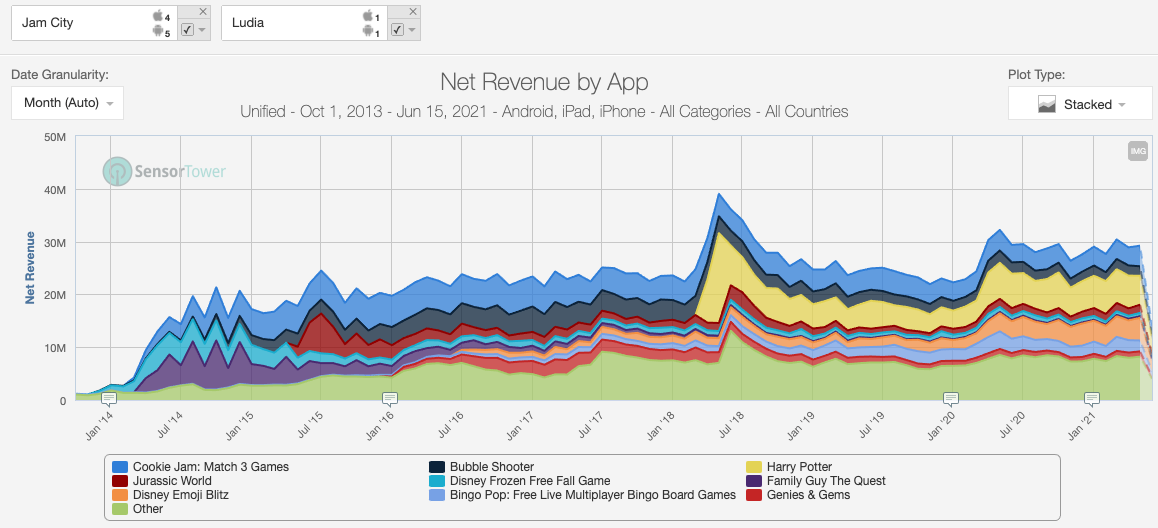

With all of the mid-tier scale M&A targets gone, Jam City (which will combine with Ludia and go public via SPAC later this year) appears to be taking a dual-pronged growth strategy: #1. early-stage M&A and #2. IP licensed games.

#1. Early-stage M&A:

With only $115M of cash post-SPAC transaction, you have to think that Jam City will try to go for cheaper, earlier stage acquisitions to beef up its content pipeline

You should expect deal structures similar to recent ones from Embracer that focus on earn-out to reduce the upfront purchase price and mitigate the risk of acquiring pre or early revenue-based game studios

#2. IP Licensed Games:

Jam City has been increasingly moving towards launching licensed IP-based games. We’ve seen this with the launch of Harry Potter: Hogwarts Mystery, the acquisition of Disney Emoji Blitz, and now with the acquisition of Ludia who are IP specialists

As noted in last week’s newsletter, IP based games may benefit from IDFA deprecation so it’s not a bad move

Also note, all of the future pipeline releases highlighted by Jam City are IP based:

Jam City Outlook

As much of a fan as I am of Jam City and a lot of the people working there, honestly speaking, I think they will be challenged for growth. Any company can break out with a single hit game, so there’s always the potential for a big hit and massive growth off of that hit.

However, historically both Jam City and Ludia had not been on a super high growth revenue trajectory:

Finally, Jam City is banking on new game development to provide basically all of their growth:

Conclusion

In conclusion, all 4 of the companies cited in this post series represent very differentiated approaches to the big question of 2021: how do we continue to get growth?

Just to be clear, I’m a huge fan of all game companies and realize how difficult it is to find any success in our market. Despite the challenges I see for these companies, I definitely hope all of them achieve great success. We live in an infinite world!

I am also happy to speak to any representatives from the companies mentioned and publish a response to any of my thoughts above. Just let me know!

LILA Games is building one of the most ambitious shooter games ever designed! We are currently hiring aggressively in Bangalore, India. See below.

Visit our website!

LILA Openings (Bangalore or Remote):

LILA Openings (Bangalore Only):