A Playbook for Navigating the Volatile Ad Monetization Market

1:1 No Holds Barred Interview with Josh Chandley on how algorithmic collusion, AppLovin's dominance, and the death of waterfall pricing created a perfect storm

As the environment for mobile ad monetization changes, new winners emerge.

Advantage flows to the kinds of games and those companies best able to leverage the changes.

One of the sharpest minds in mobile UA and ad monetization is Josh Chandley, founder & COO of WildCard Studios.

We held a direct, no-holds-barred discussion on the current state of ad monetization, including key macro trends, strategies for success, and the potential future for admon.

We got hella insights in the discussion below. This time, we had some audio problems, so this is a text-only interview.

Don’t miss the most insightful discussion on admon in 2025! 👇👇👇

Top 5 Gaming News

Rust Mobile Officially Revealed with Trailer and Pre-Registration (RustMobile.com): Rust Mobile was announced with a trailer showcasing its core survival and PvP gameplay, with pre-registration open for Android and iOS.

Glen Schofield may have directed his last game due to funding bottlenecks (PC Gamer): Dead Space creator admits budget proposals for his new horror concept fell short, raising concerns over AAA project viability.

BioShock 4 Development In Turmoil, Leadership Replaced (Polygon): Cloud Chamber studio has reportedly suffered a major setback after failing an internal review by publisher 2K for the latest BioShock game. This has resulted in the replacement of key leadership. The report also revealed that a separate remake of the original BioShock was canceled earlier this year.

PS6 and New Handheld Specs, Price, and Release Window Leaked (Kotaku): A leak from a reported AMD presentation details Sony's plans for a PS6 (codename "Orion") and a new handheld (codename "Canis"). The PS6 reportedly targets a late 2027 or early 2028 release at around $499. The handheld is designed to play PS4 and PS5 games locally, not via streaming, and is rumored for a similar launch window.

The Push for $80 Video Games Stalls (Bloomberg): The industry's move to an $80 price point has halted, with major publishers now sticking to $70 for new releases. The reversal is credited to consumer pushback and the popularity of subscription services.

Top 3 AI x Gaming News

AI-Generated Content in Gaming: A Legal Minefield (Clyde & Co.): AI in gaming presents key legal challenges. Unclear copyright ownership for AI-assets creates infringement risks for developers, as laws favor human authorship. Replicating performers raises labor and personality rights issues, while developers are also liable for preventing AI from generating illegal content during gameplay.

Former GTA 6 Artist on AI: Useful, But Flawed (GamesRadar+): A former Rockstar artist says that while AI is useful for tedious tasks, it cannot replace human creativity and often produces low-quality, flawed results that require expert correction.

India's First Gen-AI Animated Drama 'Bedard Piya' Now Streaming (News18): "Bedard Piya," touted as India's first animated series created using generative AI. It is an adaptation of a popular Hindi story by Priya Yadav and is currently streaming for free on YouTube.

Well, folks, AppMagic has recently released its latest 1H 2025 Casual LiveOps report, which you can download for free!

Three key takeaways from the report:

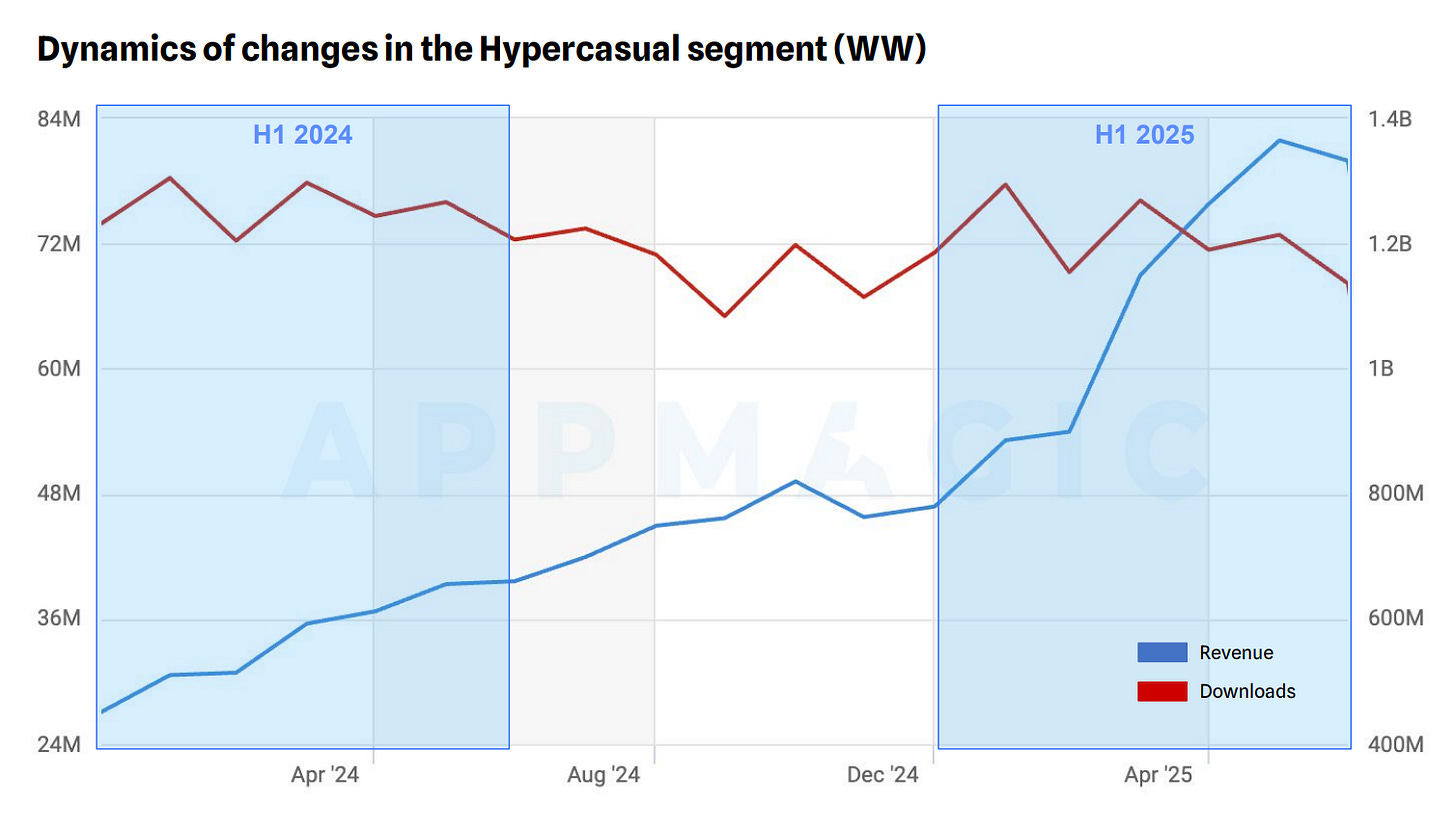

#1. Revenue and downloads are up!

#2. Yes, Hybrid-Casual is for real. Definitely read Josh Chandley’s thoughts on this phenomenon below for more context.

#3. Race was the most used hybrid casual mechanic for liveops.

For more detailed information, including market data, event information, and mechanics data, download the full report.

The game we didn’t know we needed: Waifu Tactical Force!

Microtransactions are so much fun!!!

Ubisoft on a roll…

🎙️No Holds Barred 1:1 Discussion on Future of AdMon

Speakers:

Joseph Kim. CEO at Lila Games (Host).

Josh Chandley. Founder & COO at WildCard Games.

**Joseph Kim**

Welcome, everyone. Today, we have Josh Chandley, a world-class ad monetization expert, here to discuss the most impactful trends shaping mobile ad monetization.

We can certainly cover header bidding, but what else is going on?

Also, could you start by discussing the general trend of a higher mix of hybrid monetization between IAP (in-app purchasing) and IAA (in-app advertising)?

**Josh Chandley**

I used to hear from friends running hardcore or 4X games that they didn't want rewarded videos because those ads would pull players away for minimal revenue. But revenue reporting for ads has gotten much better.

I remember when we first got user-level revenue postbacks. Before that, you only saw averages. If you had one player with a $2 CPM and another with a $500 CPM, you might just be told your average was $15 per thousand. It was impossible to see the value of showing a rewarded video to a specific player.

Now, we can see that the value of an impression from an IAP whale is much higher. The ad networks know that player is valuable and will bid very high CPMs to reach them. This means that if a player is at a pinch point in your game, giving them a rewarded video for soft re-engagement is often additive. The price magically adjusts; you won't get a low CPM for a user who has spent a million dollars in your game.

This is why hybrid monetization with rewarded video is working so well. For non-paying players, you can easily drive 50 cents a day in ARPDAU in the US, which is very incremental revenue even for hardcore games.

**Joseph Kim**

In previous conversations we’ve had, you’ve also mentioned header bidding. Can you speak to that?

**Josh Chandley**

Zooming way out, I see two major trends. The first is the industry-wide embrace of header bidding, or real-time bidding—whatever you want to call it.

The bigger implication is that the mediators, and when we say mediators, we really mean AppLovin, now gatekeep everything. When you ran a waterfall, you had a lot of ability to shape your demand and see who could bid where.

The transition to bidding has been interesting, especially for smaller publishers. They often see impressions jump up while CPMs go down, which can be very hard to manage.

**Joseph Kim**

Before we move forward, for the executives and product managers listening, could you explain what header bidding is?

**Josh Chandley**

Definitely. When I started in ad monetization in 2011, mediation was old-fashioned. We used a system called a waterfall, which I first used with MoPub. We would go to Google and ask, "Do you want to buy this ad impression for a $90 CPM?" They'd say no. Then we'd go to another network, like AdColony or AdMobi, and offer it for $82, and so on down the line until someone said yes.

This process could be slow, sometimes taking 25 seconds for a long waterfall, but you would find the highest bidder. The advantage was control. You could shape demand and decide which advertisers could buy your inventory. If an ad network had low-quality ads, you could choose not to offer them lower-priced spots. For a 4X game, you could prevent selling low-quality inventory to a whale.

The problem is that waterfalls are slow, and price discovery is difficult. If a major ad network only has four or five price points to choose from—say, $10, $50, or $100—they can't buy as many impressions as they might want to.

Twitter's MoPub was the first to launch advanced bidding. The idea was that each network simply tells you what it’s willing to pay for an impression, and the highest bid wins. The advantage is that you can have 10 or 12 networks all bidding at the exact same time. It's an incredibly fast auction.

Because everyone is bidding simultaneously and can bid as much as they can afford, you theoretically get higher prices.

**Joseph Kim**

People have been saying header bidding is coming 'next year' for the last ten years. Why is it for real now? Is it still just talk?

**Josh Chandley**

It's true. I remember when Max was acquired by AppLovin a few years ago, the whole promise was that they had cleaner pipes and were built for real-time bidding. But even they had to realize the ad networks didn't support it—they were too slow, and it was too hard.

Massive networks like IronSource and Digital Turbine only rolled out support for MAX bidding last year, so it has taken forever. However, one of the big changes is that in the Wildcard stack, in the first half of this year, bidding surpassed 95% of revenue. The waterfall has now shrunk to just 5%, which is mostly Google Ad Manager and some other niche networks.

What's interesting is that for a long time, two things happened simultaneously. First, we saw header bidding adoption slowly going up. Second, in almost perfect correlation, we saw CPMs going down. We saw a huge number of ad-monetized businesses fail, and the hyper-casual genre essentially disappeared because ads were no longer profitable enough.

It's hard to tell if that's a coincidence because other things were happening at the same time. The end of COVID had a negative impact on IAP, and when IAP-monetized companies backed down their bids, CPMs dropped. We also had a post-IPO hangover from ironSource, Unity, and AppLovin, which may have made them less competitive. There were also rising interest rates and the acquisition of MoPub.

With so much going on, it's hard to be certain, but there is a very interesting correlation when you look at the adoption of bidding and the decline in CPMs. Why do you think that is?

**Joseph Kim**

Somebody's stealing margin.

**Josh Chandley**

Yes, I think there are two interesting things happening right now. One is a trend within our industry, and the other is a larger meta-trend. I read an article in *The Atlantic* last year titled, "We're Entering an AI Price-Fixing Dystopia." It argued that algorithmic collusion is spreading to more industries and that existing laws are not equipped to stop it.

The article was about the change in hotel pricing in the United States. Over time, hotel prices have shot up at an astonishing rate while vacancy has dropped very slowly. The cost of travel and hotel profits have skyrocketed. It turns out that all the major hotels moved to dynamic pricing, but none of them do it internally. They all pipe their data to a single company that sets prices for all of them. As a result, the entire market started raising prices in unison.

Now, let's connect that to the move from waterfall to header bidding. The person selling the ad impression no longer shapes demand. Instead, the ad networks' machine learning models are constantly training to extract the most margin. It’s not a deliberate conspiracy with humans talking, but if everyone is A/B testing ways to improve their margin, it's totally possible that these algorithms start collaborating and incrementally lowering prices.

We're seeing this in many industries. So one real challenge for developers is how to control pricing in a world of dynamic, header-bidding-based auctions. That's the first big challenge. The second is that when one player dominates a market, they deserve to take more margin simply because there's no competition.

**Joseph Kim**

Depends on how you got there.

**Josh Chandley**

Well, you get to take your share. Maybe "deserve" is the wrong word for some people, but I'm an ardent capitalist.

**Joseph Kim**

Sure.

**Josh Chandley**

So let's just name it: In MAX mediation on iOS, AppLovin routinely has a 65 to 70% share of voice, while the runner-up usually has less than 10%. With such an incredible lead on iOS, they would be crazy not to increase their margins.

**Joseph Kim**

Right.

**Josh Chandley**

When we talk about margin in games, we think of the delta between what an ad network charges an advertiser and what they pay the publisher. But for ad tech networks, they don't call that margin—they call it revenue. We've seen AppLovin's revenue explode much faster than the rest of the ecosystem as they've taken over with MAX. This strongly implies a competition issue, allowing them to extract a lot of margin.

To summarize, ad monetization faces a unique problem. The algorithmic shift from waterfall to bidding has taken away our negotiating power against the ad networks, even if it's not outright price-fixing. On top of that, we have the same issue as the UA side: one network is so dominant that it gets to take a huge margin. It's not surprising that we've seen CPMs consistently flatten or drop over the last several years.

Post-COVID, a surprising number of ad-monetized companies went under because CPMs dropped so quickly. It's scary. Imagine if you were selling IAP packs and suddenly your revenue per transaction dropped by 40% in a way you couldn't control. Peak to trough, we saw CPMs drop by over 40%.

Now, combine that with a dominant player like AppLovin taking a larger cut. It's like if Apple suddenly said they were going to increase their fee.

**Joseph Kim**

Or if they had a dynamic platform fee, saying, "Hey, we're taking 50% today!"

**Josh Chandley**

Exactly. Imagine combining those two things—it's incredibly challenging. This is why companies like Rollic, Homa, and Voodoo are all moving toward a much more hybrid approach.

**Joseph Kim**

So, it sounds like we've covered the motivation behind IAA games adopting a hybrid model. But what about IAP-heavy games going hybrid?

**Josh Chandley**

It makes good business sense. Let's go back for a second and ask why hyper-casual games existed. People used to talk some pretty hard smack on hyper-casual, saying, "You're paying 50 cents a user just to make 55. Your ROAS is 110%." Meanwhile, I’m going to double my money over two years.

The hyper-casual response was, "Who cares about how much you make over two years? The accountants care about your IRR." If I can turn over a 10% profit every month, my internal rate of return is well over 100% in a year, while you're taking two years to get that far.

I bring up IRR because ads juice your IRR for a hardcore game. If you add a 10% revenue boost with rewarded video, half of that boost will come in the first 30 days. You're moving all your payback windows up and increasing the rate of return you're getting on your money. Maybe your total yield only goes up 10%, but your internal rate of return should jump quite a bit.

In an age where we're trying to figure out ways to make more money, and we're still in a layoff era, that's really attractive.

**Joseph Kim**

Historically, the concern for heavily monetized games adding ad monetization was cannibalization.

To make watching an ad worthwhile, you have to offer a significant reward, which could potentially cannibalize your IAP. How is that being addressed now? Is it through segmentation, where you don't target ad monetization to your higher IAP-spending audience?

**Josh Chandley**

It's actually pretty simple. The goal is to have a recommendation system that determines whether it's more profitable to show an IAP offer or a rewarded video offer. One has super-low revenue per conversion and a super-high conversion rate, while the other does the opposite. It gets a lot easier when you think about it from that perspective.

We've already gotten quite good at recommendation systems in games and know the average value of showing an IAP offer. It's even easier for IAA. If you show an offer and that person earns a $50 CPM, it means you're going to get 5 cents every time they watch that ad. You can just do a recommendation selection. If the average conversion rate is 40%, I'll get 2 cents when I show this. What will I get when I show that? You can problem-solve it in live ops, almost like you're deciding which offer to show. It's becoming much more solvable.

I'm even seeing some hardcore games do something very sneaky. If you're a bootstrapped or young company without a huge player base and ML department, you know who does? AppLovin and Unity. If you just show a user an ad after D1 or D2, their CPM tells you a lot. Because AppLovin and Unity have everyone's revenue posting back to them, they can tell you the net value of that user.

If you give that data to a scientist on your team, it ends up being one of the most deterministic predictors of how valuable players will be in your game. That data coming in early can be really helpful.

**Joseph Kim**

That's a great tactic. Josh, you mentioned a couple of things about maximizing ad revenue. We've talked about trends, so let's get tactical. As a publisher trying to maximize ad revenue, what are the best tricks?

**Josh Chandley**

I run a small, lean studio. We’ve tripled revenue in two years, and we're profitable with great margins. But we're not a $100 million studio, so we need to lean into bidding because it allows us to scale more quickly. It's just a reality.

The way we can compete is by creating competition. With the old-school waterfall, we manually created competition. So how can we do that in this new world? There's a lot of experimentation that can be done with things like ad frequency, but I’m focused on dynamic price floors. In the old waterfall days, the floor for an interstitial in the US might be $0.50, $2, or $2.50. In the bidding world, why not just have three ad units? One has a 50-cent floor, one has a $5 floor, and one has a $50 floor. You can start enforcing prices and running auctions that only allow certain floors.

I'm seeing that we're starting to figure out ways to slowly pull back in pricing power with dynamic auctions that we used to have only with a waterfall. That is one of the biggest impactors I've seen in terms of moving CPMs.

When bidding took off, impression count moved way faster than revenue count. A lot of companies, like Google, have infinity demand. If you make a request, they can give you an ad, though it may be so irrelevant to your game that it's almost worthless to show. As we moved to this bidding world, fill rate stopped being an issue. The question became how to extract revenue from that 100% fill rate without spamming users and surrendering long-term retention. The tools we had were only built to maximize pure ARPDAU.

So, I think dynamic ad floors are going to be a huge area of growth. I don't think the largest ad networks that control mediation are super-incentivized to allow that, but it is an area of growth. The other thing we can do is encourage as much competition in your waterfalls as possible. That isn't just about adding infinite SDKs to your game; it's also about collaborating with the networks that are growing, especially the big three growers I see now: Unity, Moloco, and Mintegral. Having more competition is good, and that sets up a bull case for ad-monetized games.

**Joseph Kim**

When you think of some of the mistakes or lessons learned from your past, any lessons you can share?

**Josh Chandley**

Earlier in my career, we were adding IAPs to a game called Ultimate Cribbage. The team that designed the IAPs was composed of ad monetization people, and when they added them, it failed. They concluded that IAP simply doesn't work in that game. But another possibility was that the team just didn't know how to do it properly.

In my case, we actually did successfully add IAP to that game, and a good portion of its revenue is now from IAP. The original team just didn't have the right expertise, so they didn't know what to do. It’s hard to be successful when you're running blind.

**Joseph Kim**

Different studios have different philosophies on A/B testing. Some run tests until they reach statistical significance, while others just look for directional signals. What is your philosophy on how many data points you need before you feel comfortable with your ad monetization tests?

For example, how many players would you want to run through a test before you feel you have enough data?

**Josh Chandley**

I have developed an irrational hatred of the term "statistical significance."

**Joseph Kim**

It's very expensive.

**Josh Chandley**

It is, but it's also a spectrum. Something could be 60% statistically significant or 98% significant. The question is, what do you need, and what’s the risk in that circumstance? We all want statistical significance, but the real question is how sure we need to be.

**Joseph Kim**

We're not going to get into a Bayesian versus Frequentist debate, are we?

**Josh Chandley**

One of the magical things about ad-monetized games is that the amount of signal you can get per player is massive. In the US on iOS, if 80% of your players don't earn you at least 50 cents, your game is broken.

When you're aiming for statistical significance to measure D30 ARPU or an LTV proxy, you can get there with cohorts of 15,000 to 20,000 users and still reliably detect a 4% to 5% gain.

It gets messy when you try to understand the interplay with IAP. As soon as you factor that in, your 20,000-person cohort might only contain 1,000 to 2,000 purchasers at most, which makes it tough.

**Joseph Kim**

Let's say you aren't at scale yet. You can optimize for Ad ARPDAU, but showing too many ads might hurt your long-term retention. How do you approach optimization in the short term, before you have enough data to build out your full ARPU curves?

**Josh Chandley**

A term I use a lot is that we just need to "drunkenly meander in the right direction." If we bounce off some walls, that's fine. For a new title in a new genre, I recommend going live with a default ad frequency that roughly matches your competitors.

When the game feels complete, run an A/B test with different frequencies: a little slower, much slower, a little faster, and much faster. Put 10,000 to 20,000 new users in each variant, and then just walk away for two or three months to see how that matures to D30, D60, and D90.

You have to be okay with the fact that these deep trade-offs are unknowable in the short term. With one of our early games, we ran a test with over 50,000 users per variant. The winning strategy only became ARPU-optimal around day 90 or day 105. It can take a very long time to tease out the trade-off between today's revenue and tomorrow's retention.

This is especially true with ads. Showing more ads makes the experience tougher for the player, but you're also directly giving competitors a chance to pull them out of your game. Balancing that risk takes a lot of time.

**Joseph Kim**

You mentioned adding more ad networks to your stack. How do you evaluate your ad tech partners, and how do you know when you've added too many?

**Josh Chandley**

Ultimately, it has to be incremental.

I don't care what share of voice they take. In a world where AppLovin is taking a minimum 60% share of voice on iOS, if a new network can make AppLovin pay a little more, that's fine. We think about it from the point of view of maintaining competitiveness long term. We don't worry about their incremental share of voice; we're looking at incremental ARPDAU.

The challenge is when we start to see trade-offs. Especially on Android, you can have library issues where different networks have conflicting libraries. It's hard to measure, but we always look at the technical drawbacks of having an SDK in the game. How much does it slow load time? How much does it affect our crash rate?

We do a very tough calculation to understand the value of our crash rate going down versus our ARPDAU going up. We have to run those calculations, which can be an A/B test and can take a while, to understand the long-term impacts.

It's very complicated to determine what's best long term. Then there's a separate question: How do you decide who to test first? Even in MAX, there are two dozen-plus bidders, and you probably can't run 15 or more SDKs in your game. Kelly and I are aligned on this: We want ad networks who collaborate to de-risk those tests for us.

That means it comes down to incentives. We might know one network is bigger than another, but what will they offer? Will they give an integration bonus or preferred payment terms? For an ad-monetized company, your internal rate of return is your superpower. Your yield is never going to be 300%. If someone offers you net 30 instead of net 60, it effectively doubles the velocity of that money.

I've also seen major ad networks loosen up on payment terms for UA when you integrate on the ad monetization side. Imagine you're a small studio and you go from net 30 to net 60 on UA. If you can recoup a lot of money and pay for a third of that user before you even have to pay for them, that's really advantageous.

It's not just about what's good for the game, but also about the business terms and how they affect the flow of money through your business. It gets very technical in that area.

**Joseph Kim**

How would you respond to some game studios that advocate for limiting the number of ad network partners to integrate?

**Josh Chandley**

I don't agree. I think if you want to create a world where there are only three or four ad networks left, then we should limit our partners. But if we want to have as much negotiating power as possible in the long term, we need more networks.

Fine, maybe an ad network only adds half a percent to your ARPDAU, but they might take up two or three percent of your revenue. In doing so, they create demand. And if you can get terms with them where they pay you faster, your CFO will tell you that improves your internal rate of return.

On the product side, if we can ship every feature and get a 25% boost each time, I'd rather do that. But in my perspective, the "taking out the trash" of this business is really about compounding five or six 3% winners to get a 15% or 20% net gain. We have a lot more than five ad networks in our stacks. I'm looking at it right now and can count well over a dozen.

Getting them in there cleanly is a technical challenge, I'll admit. But our dev team is good.

Look at Tripledot. You can use online tools to see the insane number of SDKs they have in their games.

They are an incredibly performant and amazing business. They run on very low crash rates and have 12 or 15 ad networks. Even before their acquisition, they were doing raises at around one and a half billion because their business is so profitable and exploding.

**Joseph Kim**

What's your outlook for ad-monetized games going forward?

**Josh Chandley**

This is such an interesting time for ad-monetized games. I remember during COVID, it was almost free money. The amount of arbitrage you could create with ad monetization was incredible.

Our industry is funny in general because we are an arbitrage business. Often, our biggest spend isn't headcount; it's performance UA. That means that relative to other forms of entertainment, we have a lot of volatility. If our LTV drops 15% due to some economic situation, we might have to cut bids pretty aggressively. From that, we can see revenue drops of 50% or more.

I think it's even worse with ad monetization. Let's say you're an IAP game matching the hyper-casuals on internal rate of return, so you're an equally good business in theory. Your IRR is 50%, so maybe you're doubling your money on UA over two years. During the heat of things, these hyper-casual games were earning a 50% IRR, but they were turning their money around in a month. They were doing 105% ROAS—spend a dollar, make a buck and five cents, and turn it around.

The problem we saw was that when CPMs dropped, if you're making 105% and CPMs dropped 10%, now you're only making 95%. The volatility in some of these business models is incredible, and that's why we saw them evaporate.

However, this doom and gloom is backwards-looking. We had two incredibly powerful things pushing against us. We lost negotiating power in the auction process, and we lost it because there were fewer people on the other end of that negotiation. It was just AppLovin winning everything.

What's exciting is that since the start of this year, since January, we've seen CPMs jump by double digits internally. That's crazy. To put that in IAP terms, imagine your average transaction size jumped 10% from doing nothing. If that trend continues, we might see a hyper-casual comeback next year, and I think there's a good reason to believe that.

My personal hypothesis is this: we lost the ability to negotiate in the auctions, but we are now rebuilding that. With waterfalls, we used to just prevent networks from bidding on certain levels. Now, we are mastering dynamic floor management, where we can specify the minimum we will accept for every player. If you have a whale who always spends $100, no product manager would make them a $4 offer. But right now, that's how it works in ad monetization. Just moving the floors up and saying they can't have less than a $50 or $80 offer unlocks tremendous value.

The other thing we're seeing is that competition is finally returning. AppLovin finally has competitors, especially on iOS. This whole year, we've seen Vungle continue to gain traction. In Wildcard's stack, we've seen Vungle gain share of voice by over 50%. The team over there is doing incredibly well. But there's also this new threat emerging for AppLovin that no one's talking about.

**Joseph Kim**

I'm all ears.

**Josh Chandley**

What's old is new again: it's Meta and Google. Before IDFA went away, their combined share of voice was roughly equal on iOS and Android. When it disappeared, they bet on SKAdNetwork, while everyone else bet on fingerprinting. They lost that bet.

On Android, those two networks add up to 35% or 40% of mobile ad revenue, while on iOS it's only 5% to 6%. We see AppLovin taking 40-45% on Android, but on iOS, they take 65-70%. Just this month, Meta started rolling out probabilistic attribution on iOS. You can run UA on Meta, Meta can buy ads with Meta Audience Network, and you can measure ROAS again for the first time since IDFA went away. Google has announced they will do the same before the end of the year.

**Joseph Kim**

So, does this mean Tim Cook doesn't want to kill Meta anymore?

**Josh Chandley**

I don't know.

**Joseph Kim**

I'm just joking.

**Josh Chandley**

What it does mean is that a lot more competition is coming, especially to iOS. When we have competition and we gain back those margins, if CPMs start to climb, we could see hyper-casual coming back. That's going to be really interesting to see.

**Joseph Kim**

I'd like to talk about other trends, but first, I have a couple of quick questions about team structure. If you're a publisher, maybe a small one, and you want to build an ad monetization team, how should you think about it? Do you hire a part-time person, a full-time person, or ten people? How does that scale, and what do those people do?

**Josh Chandley**

I handle a much smaller team. At Wildcard, we integrate ad monetization into the user acquisition team. We view it as a cycle where we buy from the ad network and then sell to the ad network. We establish a relationship with the ad network rep where, ideally, the same person we talk to for UA is the same person we talk to for ad monetization. We tell them, "We're going to buy from you, but you're going to buy from us."

That relationship is one-to-one, and it works really well. If I scale spend on Unity or Mintegral for UA, I will immediately see them gain share of voice in my ad monetization stack. If I buy more users they recognize, they're going to win more of my auctions. The relationship is symbiotic, so we have one centralized team that manages both.

**Joseph Kim**

I won't name the game studio, but someone in ad monetization told me a big part of their job is getting on the phone with their ad network partners and just screaming at them. Does that actually work? Does it matter anymore?

How do you think about team structure and skills for admon folks to do well at their job?

**Josh Chandley**

It depends on the team and your situation. The counterpoint is that when you're in a bull market for CPMs, the volatility potential is incredible. At Wildcard, I don't run UA directly. I have a leader who runs my UA team, and I'm proud to say she's intimidating.

Let's talk about a scenario that might be coming back soon: hyper-casual games. This is a fascinating topic that no one is talking about right now, but in a year, we all will be. If you can take a dollar and make it a dollar and five cents in a month by integrating your ad monetization and UA teams to negotiate as one, you can achieve something powerful. If you can recoup in a month while your UA payment terms are net 60 and your ad monetization payment terms are net 30, you can scale for free.

I believe so strongly in integrating those teams, especially when you're talking about these high-frequency, low-margin IRR monsters. When you can work very closely with your partner and put a leader in a spot where they can figure out how to maximize business scale—not just LTV or ad quality—some really interesting things can be done.

Everybody out there can get paid for their ads on net 30, and some networks will even pay you net 15. There are also networks that will let you pay for UA on net 60 and net 90. When you spread your payments that far apart and have payback periods as tight as we do in some instances, you really can scale for free. If you're talking about growing a business incredibly fast or reducing the debt you have to take out by 50%, that's just incredibly powerful.

The reason I believe in having one lead run both is because it allows us to problem-solve directly with those ad networks and have tough conversations. That person is aligned directly with the business, not just responsible for one side. I'm super serious about it because Wildcard almost died. We had a really bad period when CPMs declined, and we had to problem-solve very hard. But we've seen the kind of scale and power that that can unlock.

The way we do it at Wildcard is that the Admon baby isn't torn in half, but the legs have been torn off. Most of the ad monetization function does belong to UA, but a lot of things—like frequency testing, who sees ads, what kind of ads, and when they see ads—we view as product work. We view the growth leader as the person trying to unlock scale for the business, and we view the product leader as the person trying to maximize LTV. When we think about ad monetization, those tasks split pretty cleanly along those lines.

For instance, if your game has a 1% versus a 0.1% crash rate, your product guy is the person who's talking to those devs the most, and he's also the most equipped to make those trade-off decisions. I try to put the right decision in the right decision maker's hands. At Wildcard, we think a lot about handling that at a small scale. Frequency testing and even price floors are being shifted heavily into product, while who we do business with and who's involved in what auctions is very much a growth strategy.

That's how we split it. We actually don't have a single ad monetization professional at Wildcard. Everyone does parts of the job. That's very sad for me because running ad monetization was one of my first jobs back in 2011. But there are no waterfalls. We try to make sure that when it comes to trade-offs between ARPDAU and LTV, or what kind of ads to show when and where, the product manager is really strong. It's like having a product manager on a small team who doesn't know IAP when you're making a 4X game—you can't have that. We work very hard to integrate that directly into the product team.

**Joseph Kim**

How do you think the role or the impact of admon will change in the future?

**Josh Chandley**

I'm going to zoom so far out that nobody can see me anymore. There's a big difference between a spot market and a futures market. A spot market is where you're buying and trading oil or bananas today. A futures market is where you're buying it for a price set in three months. Unsurprisingly, futures markets are substantially more volatile.

Why am I talking about this? I think the IAP ecosystem is very different from the in-app ad (IAA) ecosystem. With IAP, you're buying a known quantity—the player and their earning power. It behaves a lot like a spot market. But I often joke that at Wildcard, I'm not buying players; I'm buying CPM futures. I'm actually betting on how much what I show them is going to be worth later. I have no idea. I can't say my average transaction size is X. I'm literally betting on futures. What will AppLovin give me in six months for this ad? That's a futures market, and futures markets are more volatile.

I think ad monetization has been very underestimated, and we've seen an incredible amount of death and destruction over the last five years. How did CPMs fall 45% when IAP revenue only fell something like 5% or 10% post-COVID?

Well, here's how it works. IAP drops 10%, so those advertisers bid 10% less. Ad-monetized games then make 10% less, so they have to drop their bids by 10%. But because they both sell and buy the ads, when they drop their bids, they're also reducing CPMs. When they reduce CPMs, they reduce their own LTV. So their ROAS drops again, and they have to reduce bids again. You end up in this vicious pull-down cycle where we dragged down CPMs over 45% and killed a bunch of ad-monetized companies. It sucks, but it happened.

Futures markets are objectively more volatile than spot markets. Ad monetization is a futures market. I'm not saying that makes it better or worse; I'm saying it makes it different. Well, now CPMs are starting to go back up. That means ad-monetized games' LTVs are increasing, so pretty soon they're going to start increasing their bids. And when the whole ad-monetized ecosystem increases their bids, that will increase CPMs, which will increase LTVs, which will increase bids. It's going to be cyclical. The same thing that made hyper-casual evaporate so quickly is going to be the thing that drives it back.

I think the fact that we're seeing these strong, bullish signals in the market—like IAP games finding more margin through webshops, Vektor fighting against AppLovin to create pricing power, and the return of Meta and Google—is creating pricing power for us. And we're actually seeing that play out in CPMs. I've seen this story before, both up and down. It's a crazy ride, but it's really fun to be buying futures when futures are going up 10% every six months.

The thing I think no one's talking about right now is that we're at the start of this next positive cycle. That's going to be really interesting to watch. When you see futures markets and things get super frothy, tons of high-frequency things emerge that are incredibly profitable. That's just normal with any market. I think we're going to be seeing stuff like that again. There will be opportunities to come in, quickly make money, and scale very quickly with ads coming very soon. Right now, the companies that were doing that before are really 50/50 or even 70/30 towards IAP. That next shift is coming back again. It's just going to be fascinating. I'm optimistic, for once.

There are two places where we see it. First, dynamic price floors. Right now, I'm seeing some cute implementations where we have the same ad unit at three or five different floors. But the ability to have segments of one for price floors and really understand, "No, for this player, I'm not going to take less than this," is going to be incredibly profitable.

The same thing goes for ad frequency. Right now, most games have a fairly basic implementation of how often to show ads. We might A/B test or have some segmentation, but look at the IAP games. The most sophisticated games aren't just saying, "If they last bought $10, offer them $20." Most of it is machine learning and AI helping make those predictions. That still hasn't made it to ad monetization outside of the biggest studios. As that comes in, we're probably going to see either higher CPMs and higher retention or, in some cases, some games get much more aggressive. It's going to allow us to test and optimize much more quickly. Admon has been a much more coarse thing in the past. It's cool.

**Joseph Kim**

Any final message for our audience?

**Josh Chandley**

I'm Josh Chandley, co-founder of Wildcard Games. I own the company vision, and I lead product, growth, and game development. We're profitable, rapidly growing, and it's a great team to work for. If you want to hear more from me, you can follow me on LinkedIn. Thanks.