Is Monopoly GO really "PROFITABLE"?

What if Monopoly GO is profitable or not? What does that mean for the industry?

This post is written by Matej Lancaric & Joseph Kim as a cross-post collaboration. If you are interested in mobile growth, you should absolutely sign up for Matej’s Brutally Honest newsletter on Substack.

At face value, Scopely’s Monopoly GO! mobile game seems to be the breakout success of 2023. The game, heading towards the end of 2023, was regularly a top 3-ranked mobile game by worldwide revenue.

Since its launch in March of 2023, the game has amassed about 101M downloads and ~$870M in net revenue to close out 2023. The game is clearly on track to becoming one of the few rare games that achieve over $1B in life-of-product revenue and is nearly there from a gross revenue perspective.

By almost all accounts, this game is a massive success. 2.5 Gamers discussed the game right after the global launch in one of their episodes:

Or is it? Let’s compare Monopoly GO to games like Royal Match or Coinmaster.

What does it mean for a F2P game to be profitable? (JK)

A tricky issue about the mobile games business and the free-to-play model generally has been the definition of “profitability.” There were many “profitable” games during the era of ZIRP and the age of highly optimistic UA spreadsheets calling profitability for games that were not truly profitable in the most basic sense.

In other words, if I spend $10 to gain a user, does that user pay me back over $10 on average? Or does my highly optimistic UA spreadsheet suggest that after a very long payback period, we will hopefully get over $10 back?

Let’s be clear: in the past, many declarations of profitability for games have largely been more theoretical than actual. That’s not to suggest that Monopoly GO is not “profitable,” but we would like to highlight there are many nuances to this word. What many people in the games industry describe as “profitable” may not actually be profitable in the common layman’s sense of the word.

So, let’s break down just how many flavors of profitability the bean counters can come up with to obfuscate a game’s true financial performance.

“Profitability” Trick

Operational Profitability

It makes more revenue than operating costs but does not include other costs such as contribution of fixed costs and recovering development costs; in some cases, it may not include royalty fees to licensor Hasbro for Monopoly (which may be something like 20% of revenue), contribution to fixed costs like office rent, contribution to central or HQ/publishing costs, and other costs which could get excluded by accounting classifications of costs.

A big part of understanding profitability also involves the notion of payback.

Because we are in an F2P monetization model, payments occur on an unscheduled and often times unpredictable basis. Also, payment, or more specifically, bookings in a game, creates a liability for services or virtual items to be delivered for that revenue, which may also be unpredictable.

In other words, a player may spend $100 in a game but only buy $20 in virtual game items, the balance of which may be spent later.

UA Modeled Payback Profitability

On top of all of that is the notion of payback. So when a UA marketer advertises and acquires a user for a game for, say, $10. That player may monetize on day 1 or 90 and any day between or after. We don’t know.

We do have models based on historical data and averages; hence, “profitability” is a model in this context. It’s based on a model for how much a game will recover in a way that has been modeled by a human being with some judgment involved.

And as with all models and anything you ever put into Excel, these models can be easily manipulated.

There are so many tricks you can play here… more details maybe Matej and I can cover in a future blog post.

Adjusted EBITDA

On top of all of this stuff, you have financial reporting, and how you do your reporting, you have ways in which you can window dress through measures like Adjusted EBITDA or other measures that may be true or not true to the true financial situation.

Scopely’s user acquisition efforts on Monopoly GO (Matej)

What do we have here in the UA channel mix? Ah well well well, every-fucking-thing:

Biggest channel? Yeah, Applovin. But then what is interesting is the second place which was Mintegral at the time of the global launch! And it’s interesting because when we were in KR we visited a few companies and Mintegral was mentioned in our UA discussions a few times. They introduced ROAS campaigns at that time which seemed to work very well for companies I work with. Then there is Google and Ironsource! Aaaand everything else …

So the word on the street is that they are spending around $2.5mil a day. When I was looking at the UA mix, the creatives, and the revenue growth I would actually believe it. Then I made some other calculations/estimations and I might say they could be spending even more.

Audience overlap

Creative mix

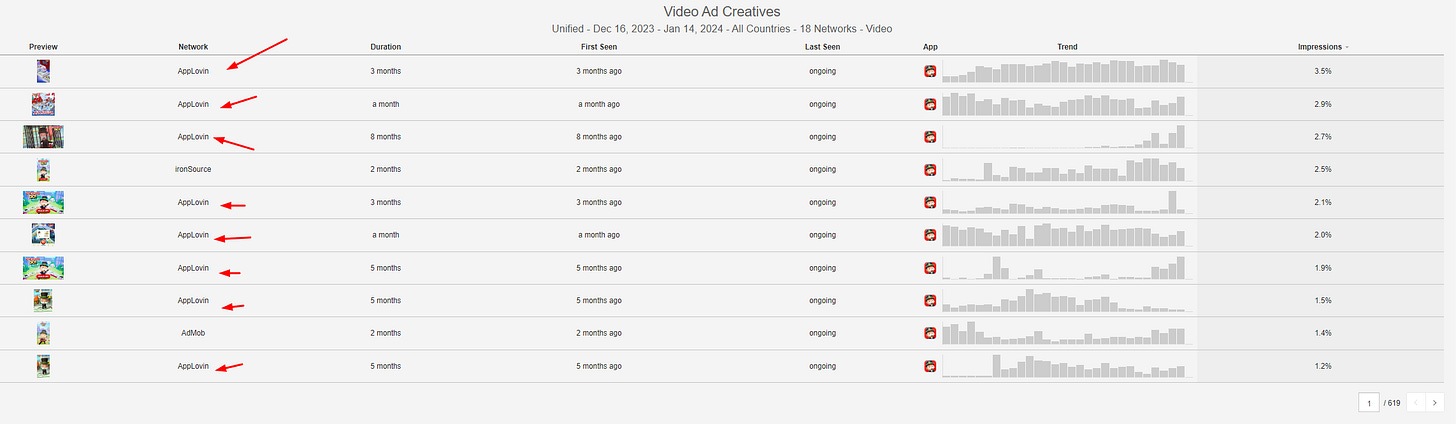

The biggest spend goes to playables. They went pretty big on playables after the global launch, since at that time it was only about playable end cards. They are quite big on Applovin, Liftoff, Ironsource and Unity (which seems to be off now)

We can check those playables here:

In terms of videos we can see all kinds of stuff:

3D board action with Mr.Monopoly (Milburn!)

Time pressure videos

ASMR dice

Different hooks

Live action videos

Playables

Playable end cards

And also localised videos.

Bonus points: Statics are also leveraged heavily.

The only thing I am missing is Jennifer Lopez or any other celebrities! I am not sure how would that work with the Monopoly IP.

Upgrade to paid

Estimate for Monopoly GO “profitability” (Matej)

I originally thought the CPIs were around 30-40 USD in the US because of the genre. Plus the rumour was they are spending $2.5 mil/day since the global launch. At our two & a half gamers + Loadcomplete yacht party in Busan, South Korea

We discussed with multiple other developers and marketers that the CPI is around 15-20 thanks to the power of the Monopoly IP

CPI graph

I worked on multiple social casino games and Real money gaming apps and CPIs were quite high as you can see on the screens below!

I am still kind of skeptical about the power of the IP, but let’s assume the CPI is indeed 20 USD in the US, then we can try to assume 10 USD in Tier1 and let’s say we see 3-5 USD in ROW

30% of overall traffic is US

15% is Tier1

55% is ROW

if we take the average of last months

we have 150k installs in US, 60k installs in Tier1 and 180k installs ROW

which means 2.2-3 mil USD/day in US, 600k/day in T1 and 540-900 in ROW = 3.35 Million USD per day which is a low estimate and could go to 4.5 mil/day based on the CPIs

Lifetime numbers

TOTAL DOWNLOADS 101,040,296

TOTAL REVENUE $871,081,393

US 33 mil downloads (33%)

US revenue $657,352,603

CPI vs SPEND scenarios (US Only)

10 USD = $330 MIL SPEND

20 USD = $660 MIL SPEND

30 USD = $990 MIL SPEND

Tier 1 (15% = 15 mil downloads = $150 MIL) + ROW (55% = 55 mil downloads = $150-180 MIL)

Conservative estimate is $1 billion with the total revenue close to $1 billion.

But I have a really hard time believing this game which is basically a social casino game has 20 USD CPIs in the US with this level of spend. Just look at the RPD comparison.

Revenue per Download metric does not include royalty fees to licensor Hasbro for Monopoly (which may be something like 20% of revenue - to be clear this is just an assumption)

So what? Takeaways

Ok, now, so what? What does that mean for the industry, and what are key takeaways?

Matej

There was one funny discussion I had with a former Scopely employee, she or he mentioned that I must have turned their office upside down when they read the article. Alarm bells are all over the place since they take these articles very seriously. Well, they even released a statement after the article.

This person also mentioned that according to the discussion she or he had, they claim the Monopoly GO has profitable campaigns on Day 30. Which to me seems even more ridiculous. If this is the case, why they don’t pour all the money in all the channels and buy all the fucking TV inventory in the US? There is something very fishy happening. If everybody is saying all these super positive things, it just doesn’t feel right.

I believe the projected ROAS is 100% at some point in time - if I have to be very adventurous let’s say it’s profitable somewhere between d180 to d365. By all means the UA & creative work is outstanding. The game is great and makes a shit ton of money. But if it’s so profitable on all fronts, why they don’t spend more money? Why they don’t use the good old Machine Zone Arnold Schwarzenneger approach in marketing? it just doesn’t add up.

JK

My own take is that I would define Monopoly Go as “successful.” I’m not saying profitable, but I am saying successful. If you ask me if the game is profitable, I’m going to have to ask you to tell me your definition of profitable first.

Also, you have to think from the perspective of Savvy, which is trying to spend an additional potentially $30B on gaming acquisitions. It makes absolutely no sense to operate Monopoly GO, given their intentions, for profit rather than scale. Why? So they can spend $31B on gaming acquisitions? Makes no sense. Again, this whole discussion and hand-wringing from folks about profitability is a bunch of PR nonsense. Define it, and then let’s talk.

When the game first came out, I played it a bit. Not much. But there was nothing there that struck me to suggest that the game had great metrics at that time. I think the game to me should have had decent metrics, not great. Now I’ve seen a lot of crap on my LinkedIn feeds suggesting the game is a master class of this and that, so maybe they improved a bunch of stuff in the game. But early on, I would be shocked if the metrics were great and warranting a #1 game of 2023 at that time.

Another feature of these games, whether a 4X, a Coin Master type of game, or Clash Royale, is that ARPU curves generally go up and to the right. And that’s great for longer-term ROAS recapture. So again, even if the game has a negative cash flow profile in the short term, if you have infinite money like the Saudis do, you can wait to get your money back over a longer period of time.

Having said all of that, I also agree with Matej that there is some basic math that doesn’t quite add up. And I don’t think Monopoly has the economics of a Royal Match or Coin Master or Candy Crush.

Note that Monopoly needs to pay out royalties to the IP licensor. So the game has to actually be significantly better than those other games, even to be equal. To me, this is the deal breaker on the economics.

But on the flip side, you are also dealing with a company like Scopely, which has a lot of remnant ad inventory from their games portfolio, like Stumble Guys and some of their other games. These may give a lower cost basis for UA to Monopoly… which, again, based on how you do your accounting for those remnant ad placements, can pull you down another rabbit hole of arguing about profitability or not.