Market Wire | January 9, 2023

M&A Outlook in 2023, D&D's Debacle, Paid vs. Organic UA in 2022, SEA Freezes Salaries, China Licenses Spark S. Korean Gaming Stocks

Hello! I hope your New Year is getting off to a good start. I know it’s a bit past the New Year, but I also wanted to share this post which some folks found helpful.

I know I have.

William Barclay wrote the original daily philosophy book before Ryan Holliday popularized the format. Barclay’s January 1st note from his book Through the Year with William Barclay is as follows:

Also, market data is back in a slightly modified format; see below.

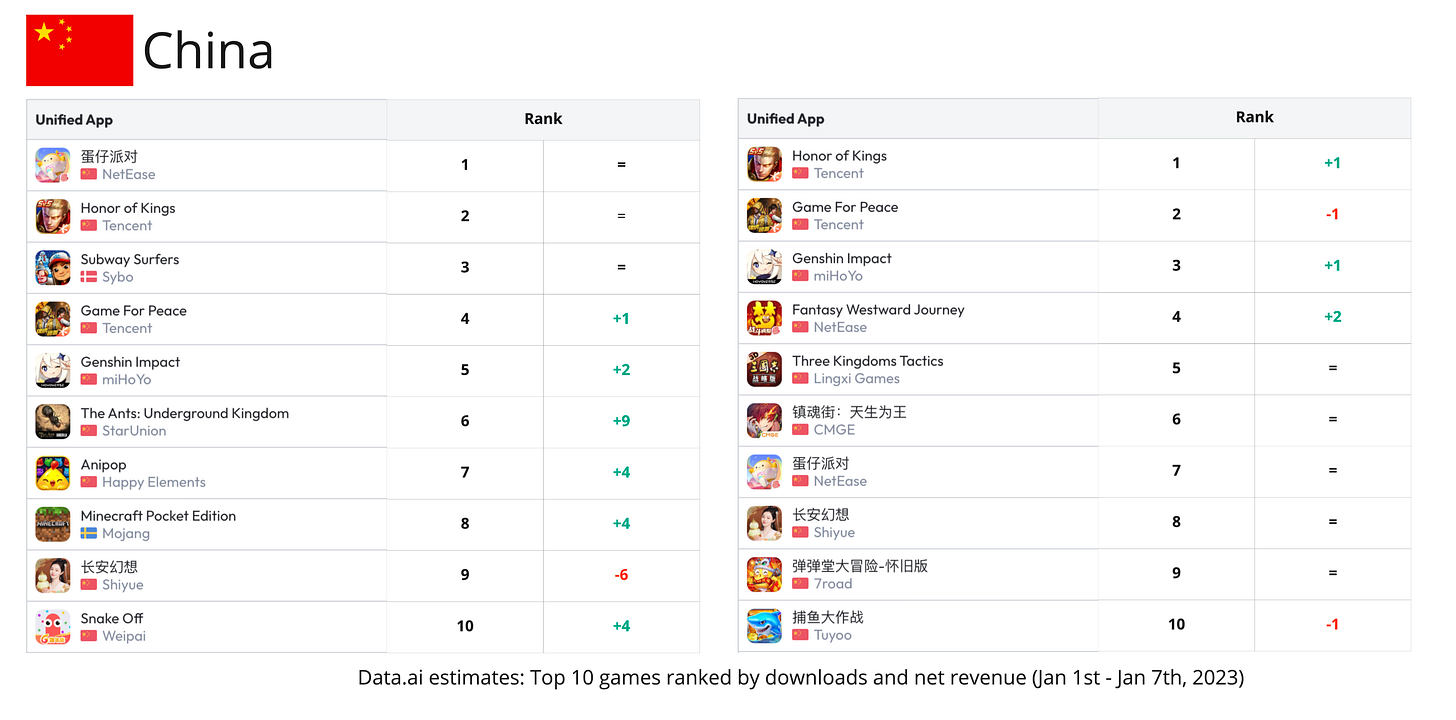

Top 10 Charts

These charts are hard to see; you can click on them to get a better view. We’ll try and make these easier to read next week!

Market Data

Top 10 Publishers by Revenue Rank

Many top publishers moved up as MiHoYo got bumped out of the top 10 this week to #12. They lost about as much revenue as Tencent gained last week, which was fairly significant.

Expect more volatility as we see significant shifts in weekly revenue.

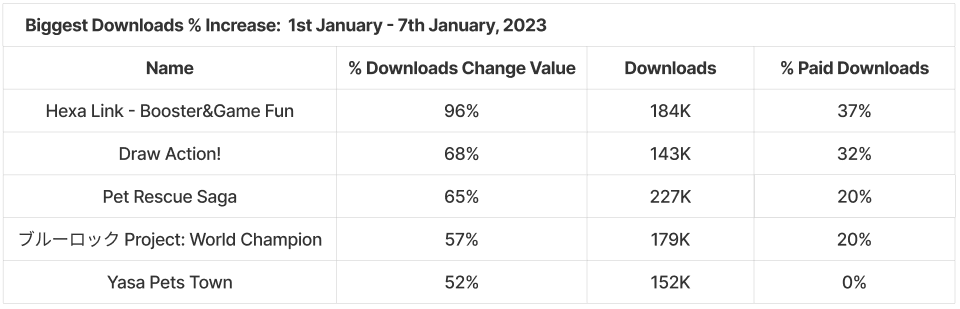

Top 5 Trending Downloads & Revenue

Downloads:

Yasa Pets Town getting nice download volume with $0 paid user acquisition? If anyone knows what they are doing let me know!

Revenue:

+97% increase for Project: World Champion!

Top 5 News

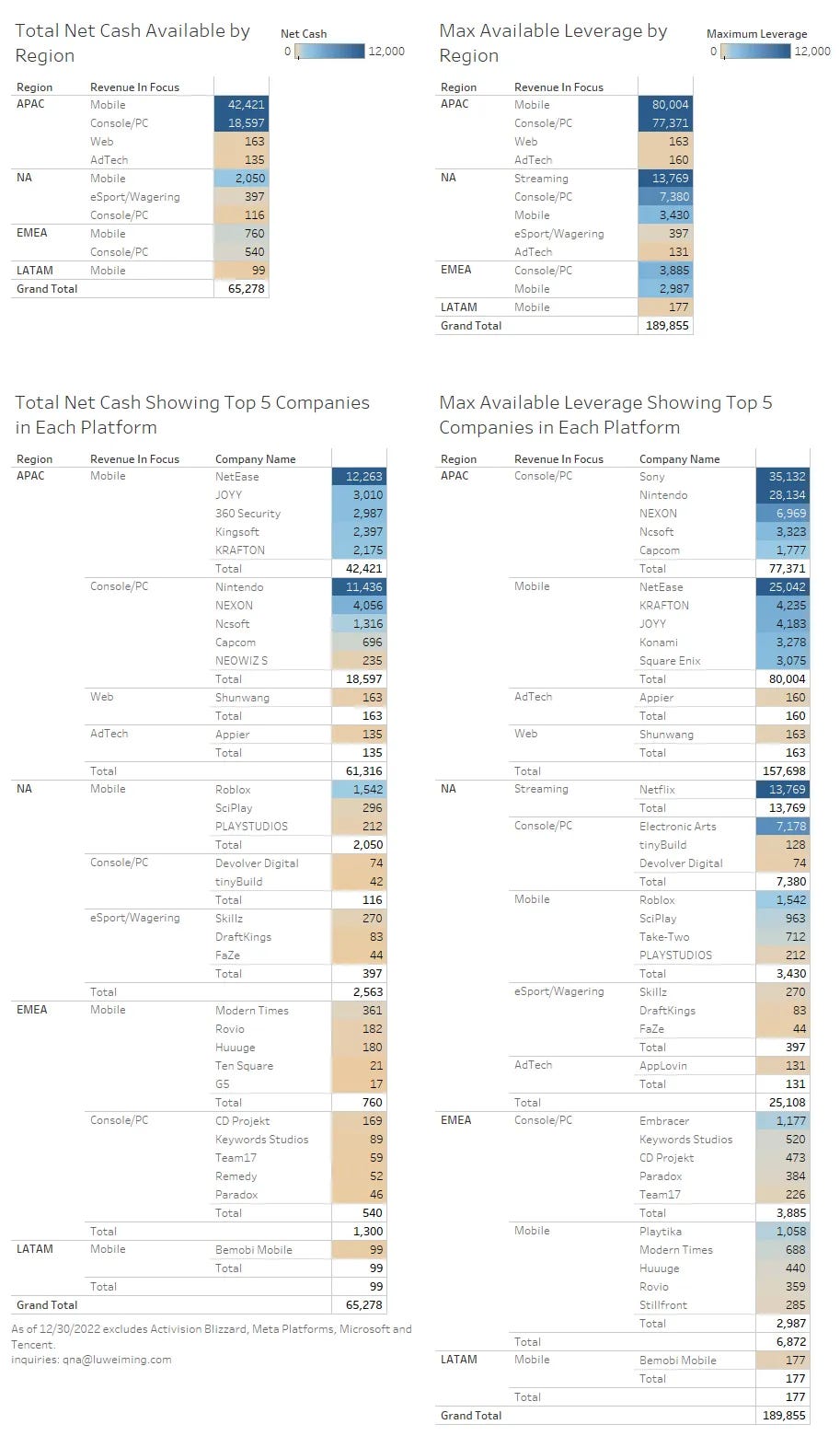

#1. M&A Funding Capacity of Public Gaming Companies in 2023 (Weiming Lu)

Weiming Lu does a great job diving into the numbers to characterize the potential M&A funding landscape for public companies moving into 2023.

2022 was a historic year for gaming M&A, with a record-breaking $100+ billion in gross transaction value. This included two mega deals worth over $10 billion each (Activision $68.7B and Zynga $12.7B), all first-time for the industry.

NA deal value was dominant! USA! USA! USA!

However, when Weiming excludes the bigger >$1B transactions, it’s easier to see that EMEA has been making strong, consistent gains over the past 10 years!

Weiming has a nice analysis of funding capacity by examining net cash and applying leverage to see what the maximum potential for M&A is in 2023.

“According to my analysis, publicly-traded gaming companies (excluding Microsoft, Activision, Tencent, and Facebook/Meta) have a net cash total of over $65.28 billion, with 93.95% ($61.32 billion) coming from APAC.”

“Net cash isn't the only indicator of a company's financial strength. By applying a 4X EBITDA leverage, we can see that the total firepower of these companies increases to $189.86B.”

“This measure is intended to illustrate the maximum affordability of these companies in simple terms. Additionally, it's important to note that companies have different M&A strategies or limitations. For example, Nintendo traditionally doesn't engage in direct M&A with gaming developers and publishers, and Sony and Netflix may not be ready to leverage their entire business into gaming.”

You should check out his full post and subscribe to him too! Weiming concludes with a few key points I’d like to highlight:

“In 2023, it is likely that ‘austerity’ and ‘survival’ will become the focus for most companies, as the current environment makes ‘growth’ a luxury.”

“Many companies' runways are getting shorter and there is no indication of when the macro environment will improve. These factors may prompt further consolidation in certain areas.”

“For financially strong companies still seeking growth, the current low market multiples could be a strong tailwind. As the gaming industry shifts towards a platform-agnostic experience, acquiring companies with proven products, loyal audiences and talented teams at low EBITDA multiples may be a less risky option than investing millions of dollars in marketing with a hoped-for 12~24 months ROI just to breakeven (RPG, MMO, social casino and strategy genres).”

#2. D&D’s Open Game License Debacle (Naavik)

Fawzi Itani from Naavik highlights important strategic considerations IP owners face with their gaming IP. He focuses on two primary efforts right now by Hasbro-owned Wizards of the Coast (Magic the Gathering, D&D, and Pokemon Trading Card Game) around their D&D IP:

Restructure their game projects: recently canceled five game projects

Making big changes to the way the D&D “Open Game License” works

Fawzi notes that, from Hasbro’s Q3 report, digital gaming for WOTC is declining:

It’s clear that WotC is in a tough transition period. Magic: The Gathering is currently suffering from an overabundance of card printing and card types, and D&D is pivoting its strategy as Hasbro wants to prioritize its digital gaming segment for higher operating margins (in comparison to its toys segment, which drive low margins). WotC has yet to find its killer use case in digital gaming, though, beyond physical tabletop role-playing games (TTRPG) or card games that leverage IP in much the same way as YuGiOh Master Duel or Marvel Snap have found success.

In the current market, it certainly makes sense for game publishers to scale back on quantity vs. higher quality for game products. Hence, the current move to restructure future pipeline was likely inevitable.

The Open Game License (OGL) issues are nuanced and interesting.

In a previous post by Fawzi, he explains the OGL:

“A few years back, D&D opened up its IP for anybody to create games under the D&D brand, with D&D taking a royalty through their marketplace Dungeons Masters Guild. Open sourcing their IP essentially created a whole new fervor around the brand — experts could create more beginner-oriented guides and experts could create games they’ve always wanted like the famous Pathfinder.

Anyone who buys a game under the OGL will also likely buy the original version of the game (D&D wins twice). But for the parent brand, the OGL gives fans the ability to engage with the IP in a wholly new way — creating worlds themselves —and importantly, allows the brand to build vertical marketplaces for its IP. This is not only more revenue potential because of the marketplace, but also more opportunity for the root brand to better understand consumer preferences, both creators and players. There are tens of thousands of variations of this for D&D alone.”

The post summarizes likely key changes as follows:

“So, what has actually changed? The short answer is nothing yet. According to a leak and a blog post from D&D Beyond in late 2022, the proposed changes are severe enough to have put the D&D community in an uproar:

The OGL 1.0 (original) appears to be “no longer an authorized license agreement” according to the leaked language of the OGL 1.1. The OGL 1.0 gave creators a perpetual and royalty-free license, and has been around since 2000.

It’s clearer that the D&D OGL only encompasses materials for use of TTRPGs (e.g a PDF). Other IP use (e.g video games) will need a custom agreement.

Any creator making over $50K in OGL revenue per year will need to report that revenue.

Any creator making over $750K in OGL revenue per year will pay royalties to WotC starting in 2024 (royalties make up about 8% of Hasbro’s revenues).

OGL games funded through Kickstarter get favorable terms.

Roll20 and Fantasy Ground will be the preferred digital tabletop partners for D&D.

Many of these processes will be handled through D&D Beyond (acquired from Fandom in 2022)”

RPG and D&D have huge potential for games, and we should expect changes in the way licensing models work in the future. So this is a good area to keep an eye out for.

#3. How did organic and paid acquisition channels perform in 2022 (Adjust Blog)

Mobile marketing platform company Adjust has released an analysis of organic and paid acquisition channel performance in 2022.

Some highlights:

“As of Q3 2022, there are more than six million apps across Google Play and Apple’s App Store, making the mobile app market more competitive than ever.”

“According to Adjust data, in 2022, 58% of global installs of all apps were organic, and 42% came from paid channels.”

“Paid installs decreased and organic installs surged in the last two quarters of 2022. In Q3 2022, organic made up 61% of all installs, with only 39% from paid sources.”

“The gap at session-level between paid and organic users is far wider than for installs. Organic users accounted for an impressive 72% of total sessions, with paid coming in at 28%. This indicates that users who download an app out of interest and curiosity are more likely to invest more time in-app and use it for longer.”

“Organic users also clocked in more sessions per day than paid users. On average from Q1 2022 - Q3 2022, organic users started at 2.11 sessions per user per day on day 1. This figure dropped to 2.04 on day 3, 2.02 on day 7, and by day 30, it reached 2.01. Paid users logged 1.98 sessions on day 1, 1.92 on day 3, 1.9 on day 7, and 1.93 on day 30. While organic users recorded a higher number of sessions than paid users, the number of sessions for both stayed consistent from day 3 to day 30.”

Quick note to Adjust: please label your data better! You label the first chart but not the rest. Details!

All of this data is consistent with what we’ve been seeing all along, a decrease in the capability of paid UA to generate high-quality users. Attribute that to whatever you want ATT, macro-economy/recession, COVID hangover, etc.

Clearly, we are in a new market for user acquisition that will likely be challenging for at least another 2-3 years.

Adapt or die!

#4. Sea Ltd freezes salaries for most staff at end of 2022 (PocketGamer.biz)

Yikes!

“Sea Limited, Singaporean ecommerce company and owner of mobile developer Garena, announced that they would be freezing salaries for unpromoted staff and paying out lower end of year bonuses at the end of 2022.”

“The company saw a $1bn loss in the final quarter of 2022, with the company shutting down projects and laying off staff.”

“Sea have faced numerous issues, not just from their digital entertainment division Garena and the losses faced in their various mobile titles, but also in terms of ecommerce which is another area Sea specialises in.”

“Free Fire also took some knocks, with the game being banned in India back in February due to its links to Chinese companies and tension between those two countries.”

This is a high-level trend occurring throughout the gaming industry right now. As noted in previous posts, big game companies are generally preparing for hard times ahead for the next few years.

It would be interesting to talk headwinds and tailwinds for 2023 (ping me if you’re interested). For new game development, currently, I’m in the pessimistic camp for mobile for the next 2-3 years and the optimistic camp for PC/console.

#5. South Korean Gaming Stocks Are Soaring (Josh Ye Tweet)

Some people don’t realize just how big and important the Chinese gaming market is. For mobile, it is the 2nd biggest market after the US, accounting for approximately 18% of the overall worldwide market, according to data.ai estimates.

Note the impact on South Korean gaming stocks when China announced it is resuming publishing licenses:

You can also read Josh’s Reuters article below:

Highlights of some of the games approved:

Pokemon Unite

Synced Off Planet

Don’t Starve

Valorant