Marketing Analysis: PUBG New State vs. Garena Free Fire Max

SocialPeta analyzed the marketing activities between the two games and Matej Lancaric and Nebo Radovic give their expert opinions!

To game industry execs and marketers:

Ad Marketing Intelligence platform SocialPeta suggests a dramatic performance difference from the two latest top shooter games launched in 2021: Garena Free Fire Max and PUBG New State.

Their analysis suggests a blended ARPI gap between the two games of $0.74 for Garena Free Fire MAX vs. $0.09 for PUBG: New State:

PUBG New State has incredible technology and, in my opinion, plays incredibly well. In fact, better than MAX. It’s surprising by core gameplay (e.g., hit accuracy, movement, gunplay, guns, etc.) to understand the performance of the game relative to MAX.

While a product-specific and market-focused analysis would tell us why there is such a significant gap in relative performance, I was more curious about any potential differences in the user acquisition strategies for the two games.

While speaking to SocialPeta a few months back, I asked them to evaluate the user acquisition strategies of the two games. After some research and evaluation, SocialPeta sent over a presentation examining:

An overview of the top 3 mobile shooter games in the market: PUBG Mobile, Call of Duty Mobile, and Garena Free Fire.

A comparison of Garena Free Fire MAX vs. PUBG: New State.

What follows is a conversation covering the analysis in the presentation with two of the top mobile marketing experts in the games industry:

🎧 Listen on Spotify, Apple Podcasts, or Anchor

Speakers:

Joseph Kim, CEO at LILA Games

Matej Lancaric, UA Consultant at Lancaric.me

Nebo Radovic, Director of User Acquisition, Zynga

The Global Top Mobile Shooter Games of 2021

To open the analysis, SocialPeta first examined the top three games in the market for 2021:

SocialPeta’s download and revenue estimates:

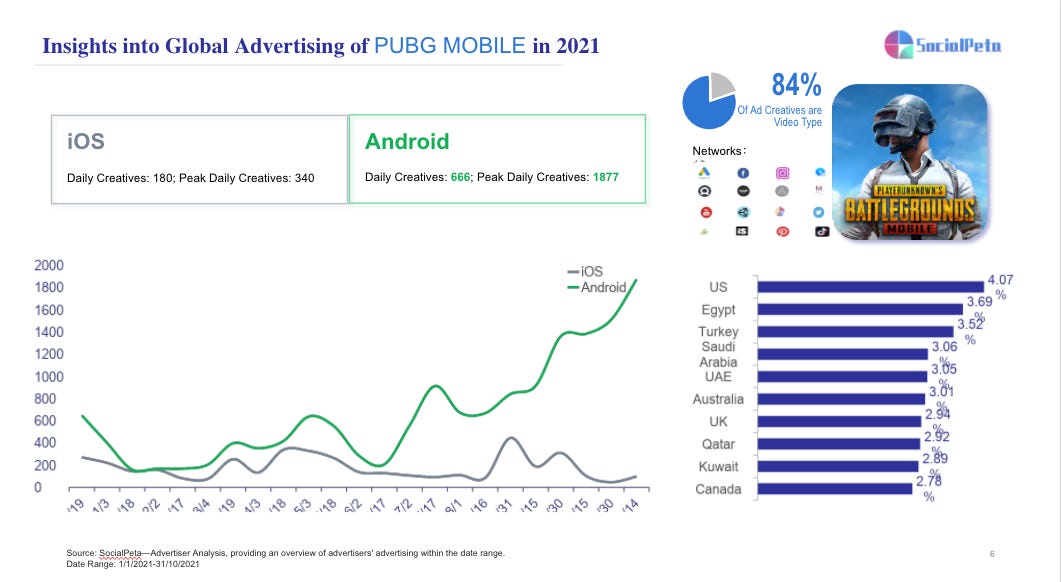

Their analysis included #1. an overview of the number of creatives generated by platform and geography, #2. distribution of ads by ad network, and #3. popular creatives.

Here’s PUBG Mobile as an example below.

#1. Number of creatives by platform and geography:

#2. Distribution of ads by network:

#3. Popular creatives:

Interestingly, SocialPeta also claimed that the use of tournaments and eSports serves as a driver for “expanding the audience” for these games:

Garena Free Fire MAX vs. PUBG: New State

The focus of the presentation then shifted to MAX vs. New State:

The most exciting aspect of the strategy of KRAFTON and Garena came into focus when examining the marketing strategies for both of these games.

Note the early focus on iOS by Garena’s Free Fire MAX:

On the other hand, KRAFTON’s PUBG New State initially targeted Android and focused there:

The user acquisition strategy suggests a strategic flanking attack of each other’s markets of strength. Garena Free Fire has typically been dominant on lower-end devices and Android. Further in emerging markets like Southeast Asia and Latin America. Conversely, PUBG has been relatively stronger on iOS and in Western markets.

Many thanks to Nebo and Matej for joining me and giving us their expert opinions.

Finally, shout-out to SocialPeta for the research and analysis.