📈 The Crowning of a New Mobile Heavyweight: First Fun

The history and success strategy of First Fun and the rise of Last War: Survival!

Hey Gamemakers,

This week, we welcome the debut of new newsletter contributor Justin Yau.

In this episode, Justin writes about the history and strategy of First Fun's success, the developers behind Last War: Survival! Read why the company's success is not surprising and about the surprising marketing strategy that helped the company succeed.

In this newsletter:

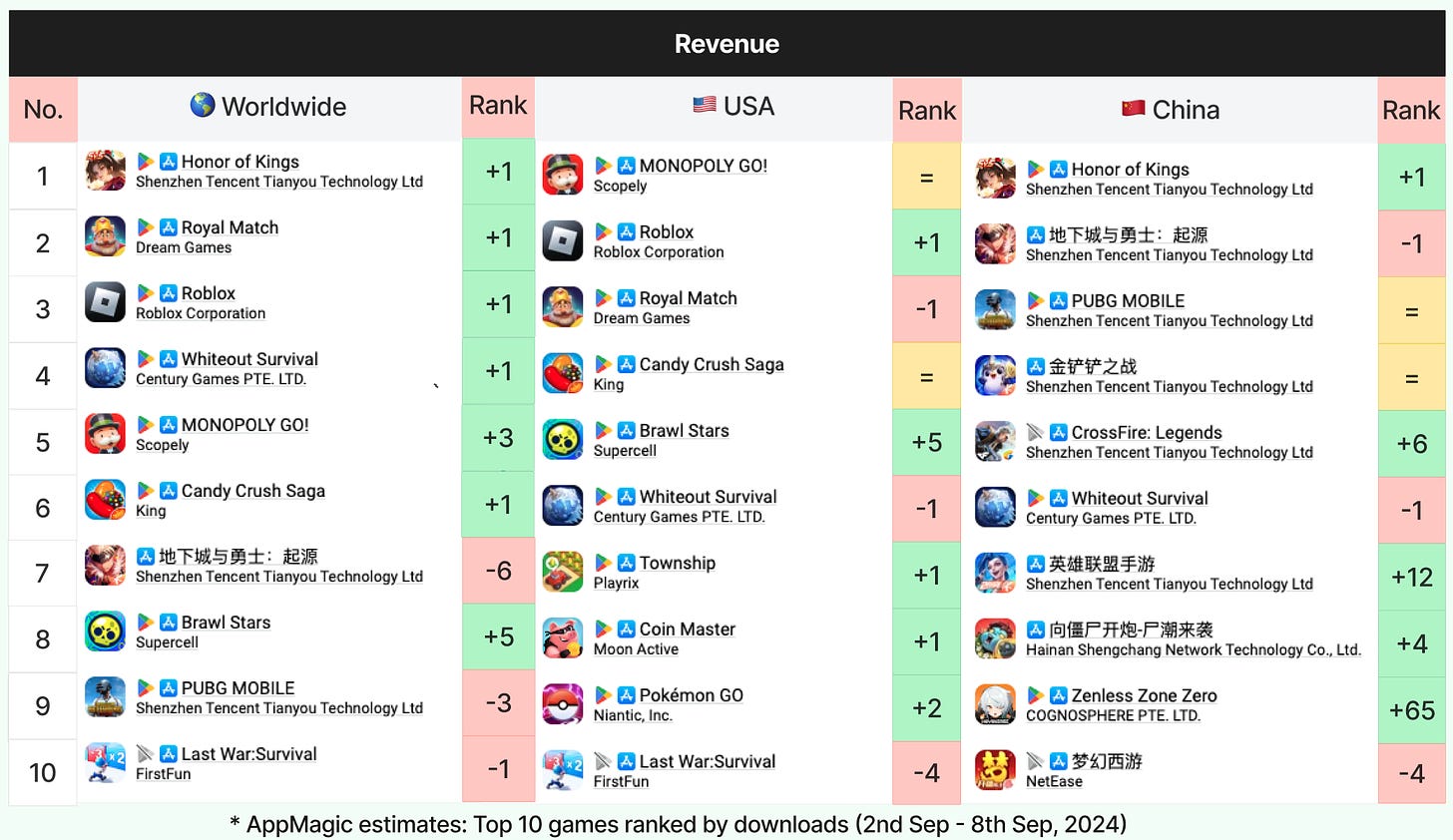

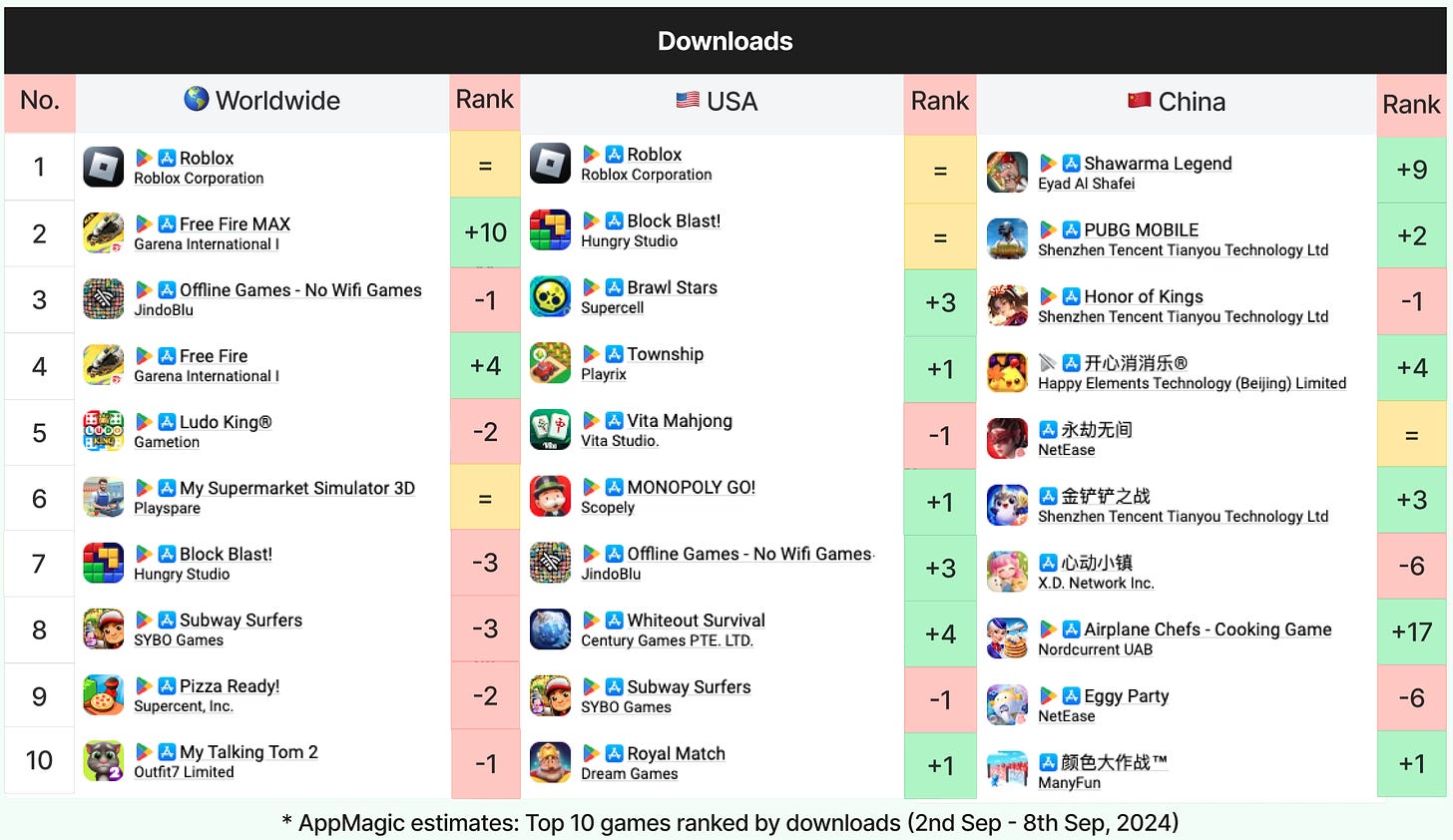

Top Revenue: Honor of Kings regains the #1 worldwide spot while Dungeon & Fighter: Origin drops to #7. Congrats to Brawl Stars for achieving #8 worldwide.

Top Downloads: Roblox is #1, while Free Fire MAX hits #2 worldwide. At #1 in China, Shawarma Legend is a cooking and restaurant simulation allowing players to manage their own shawarma restaurant.

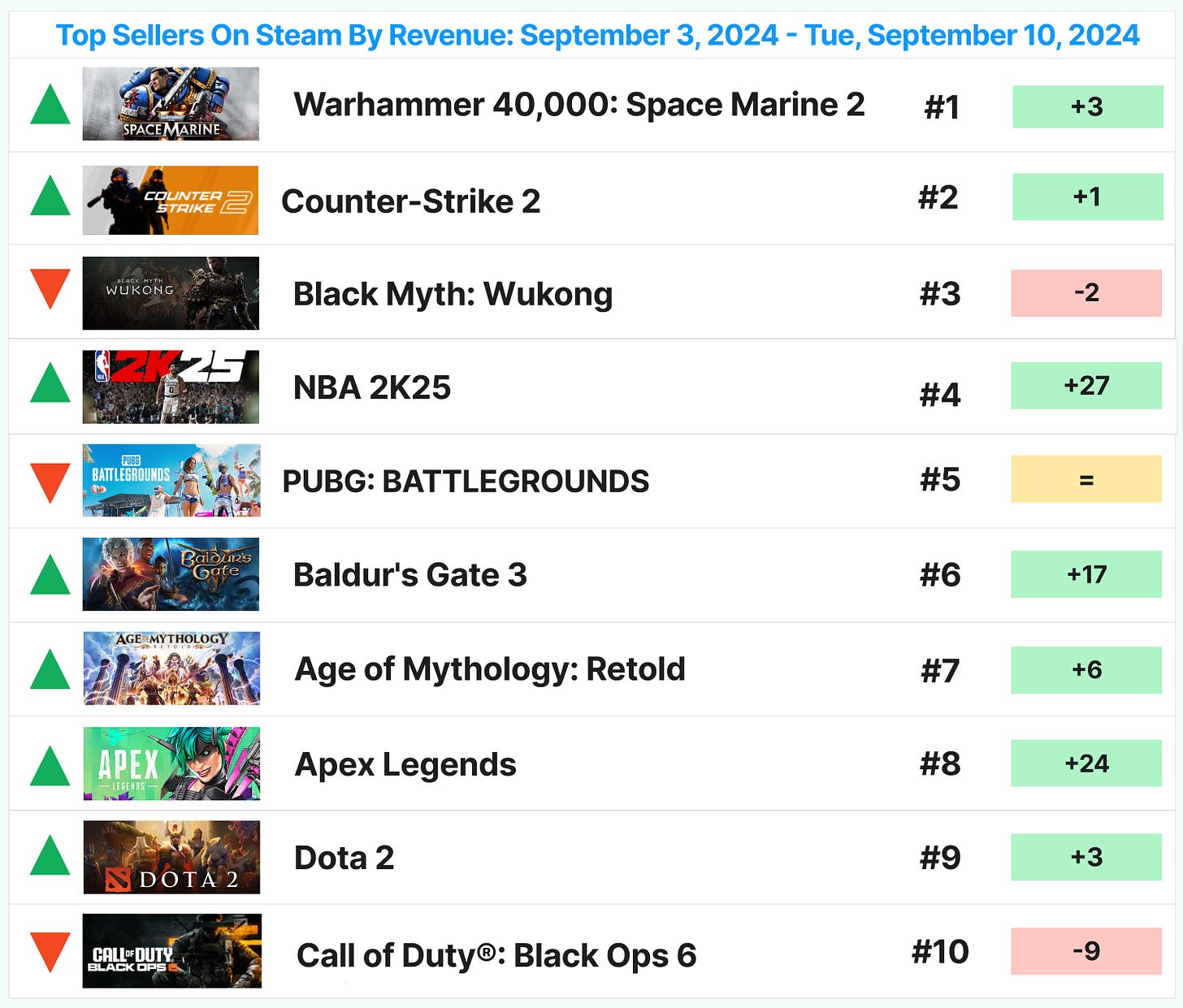

Top Steam Revenue: Warhammer 40,000: Space Marines 2 hits #1 in top revenue while Black Myth: Wukong drops 2 spots to #3. NBA 2K25 jumps 27 spots to #3.

Highlight—The Rise of First Fun Developers of “Last War: Survival”: Read how First Fun rose to success and the origins of consistently top 10 worldwide revenue mobile game Last War: Survival!

Top 10 Mobile Charts (Worldwide, US, and China)

Honor of Kings regains the #1 worldwide spot while Dungeon & Fighter: Origin drops to #7.

Congrats to Brawl Stars for achieving #8 worldwide.

It's great to see Zoneless Zone Zero reach the top 10 in China at #9.

Free Fire MAX hits #2 worldwide.

At #1 in China, Shawarma Legend is a cooking and restaurant simulation allowing players to manage their own shawarma restaurant.

At #8 in China, coincidentally similar to Shawarma Legend, Airplane Chefs - Cooking Game. This is a time-management cooking game taking place on airplanes while traveling to famous cities across the world.

Top 10 Steam Charts

Congrats to Space Marine 2 for reaching #1 on Steam.

Although Black Myth: Wukong dropped a couple of spots, anecdotally, it’s #1 in how many of my friends are playing the game and talking about it in various slack groups.

Big jumps for NBA 2K25 and Apex Legends.

🔑 Keys to First Fun’s Huge Success with Last War: Survival

Written by: Justin Yau

Note: Revenue and download estimates from AppMagic; Revenue figures reflect IAP reduced by platform fees and taxes (excludes China, advertising, and web store revenues).

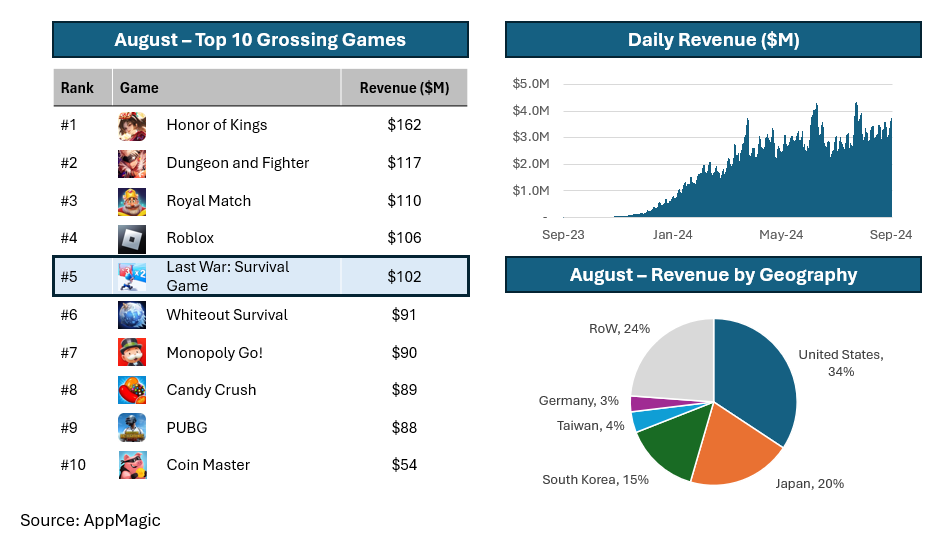

First Fun’s Last War: Survival Game (“Last War”) has been on an absolute tear since the beginning of the year. According to AppMagic, in August, Last War was the fifth highest-grossing game based on store revenue ($102M) and among the 40 most downloaded games (6M downloads).

Despite Last War’s huge success, its creator, First Fun, still flies under most people’s radars. In today’s newsletter, we’ll shed some light on the developer behind the hit game and how First Fun combined misleading user acquisition (“UA”) and genre-mashing to create one of today’s top-grossing mobile games. Let’s dive right into it.

A special shoutout to the folks at two & a half gamers who spotted this game early. This article builds on their excellent analysis of the game.

Who is First Fun?

A quick Google search of First Fun will lead you to a basic website with scant details on the company. At first glance, the website gives off the misleading impression that First Fun is an obscure Chinese mobile developer.

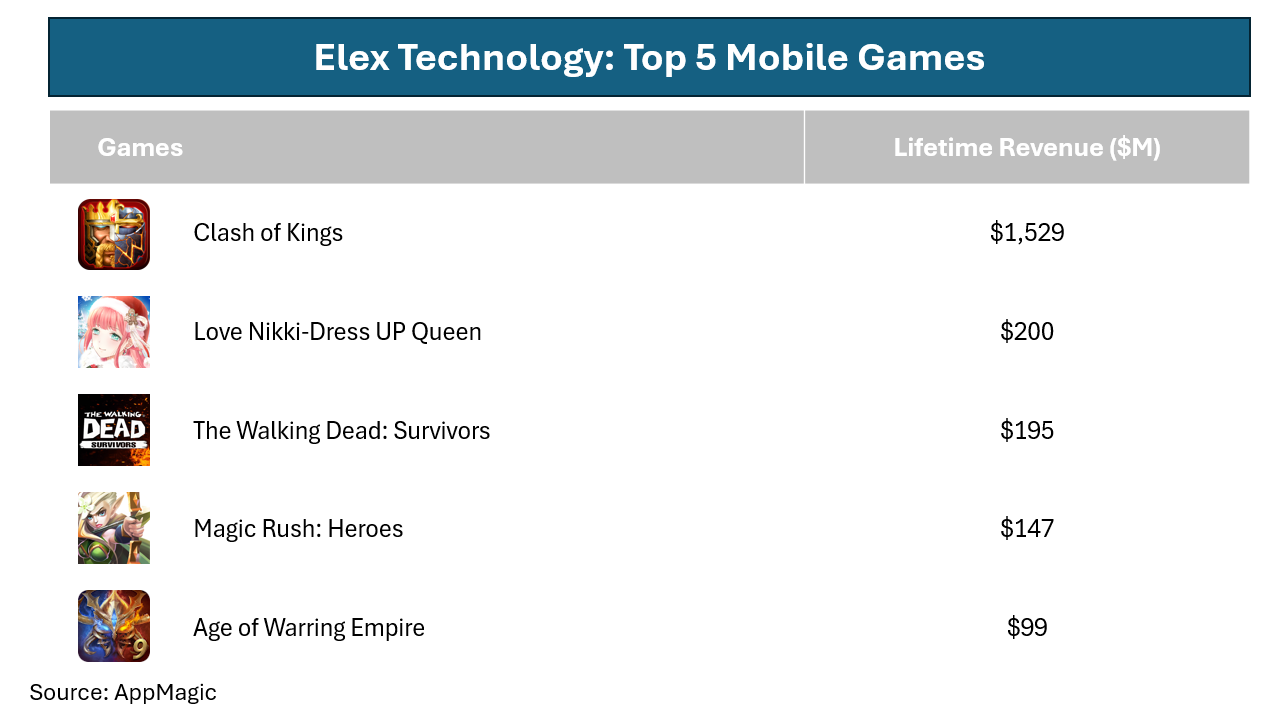

Dig deeper, and you’ll find that’s far from the truth. First, the company’s founder, Xie Xian Lin (谢贤林), was the founding CTO of Elex Technology (智明星通), a Tencent-backed game developer that was acquired by a Chinese strategic for ~$430M in 2014. Games developed by Elex Technology include the billion-dollar grossing 4x title, Clash of Kings, among many other successful games.

Second, First Fun has incredibly deep ties across the Chinese mobile gaming ecosystem. After selling Elex Technology in 2014, Elex Technology’s CEO and Xie Xian Lin co-founded Challenjers Capital, a venture capital firm with over $1B assets under management. They made many investments in the gaming industry, including providing seed funding for Moonton, which was acquired by Bytedance for $4B in 2021. Another promising studio they backed was River Game, the developer behind Top War – a 4x game that has grossed over a billion dollars to date according to AppMagic. In 2021, First Fun took on a significant minority ownership stake in River Game and worked together to launch Last War.

Last but not least, it should be no surprise that Tencent backs First Fun. When Xie Xian Lin founded First Fun in 2020, Tencent jumped at the opportunity and acquired a 10% stake in the startup.

While it’s undisputable that the First Fun team is highly talented and well-resourced, their first big hit didn’t happen overnight. In its early days, the company launched multiple RPGs and idle games that failed to find product-market fit, and they ultimately decided to refocus on their 4x roots. Their first internally developed shot on goal, Build Master: Bridge Race (“Build Master”), was launched in 2022, and the game made use of a simple puzzle mechanic to lead players into a deep strategy game (~$3M of monthly store revenue according to AppMagic estimates).

Source for images: Apps Walkthrough

They then took the lessons from Build Master to rework Top War with the hypercasual “gates” mechanic and launched the game as a separate product. This game was Last War: Survival Game.

Source for images: Medieval Fun

Last War: Survival Game – The Perfectly Executed “Bait and Switch”

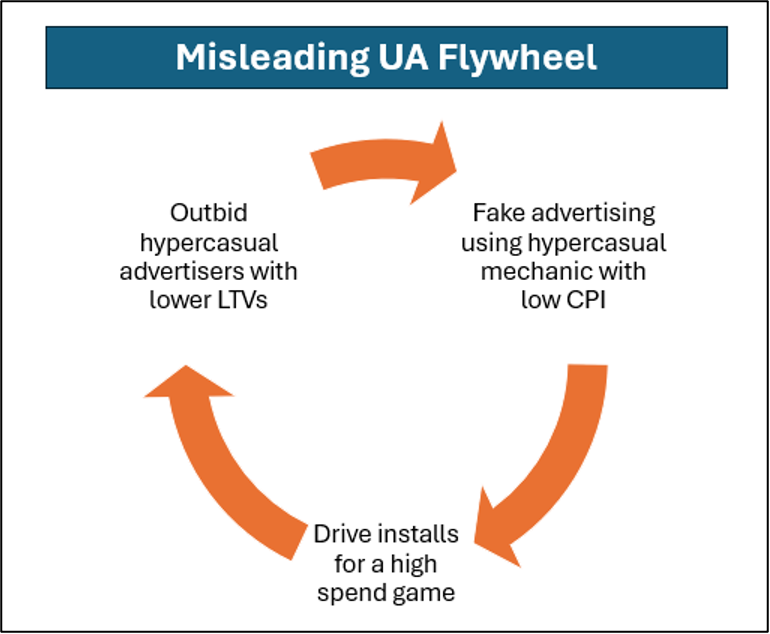

Misleading advertising is nothing new in mobile gaming, though the introduction of ATT has undoubtedly increased adoption. Last War: Survival Game is one of many games that have adopted this strategy.

However, the game distinguishes itself in a crowded market by fully leaning into “fake advertising” and cleverly incorporating the advertised mechanics into its gameplay. It then uses that hook to transition players into a much deeper core gameplay experience.

Source: Medieval Fun

The first-time user experience. When players first enter the game, the initial play sessions align with the advertising but with two subtle twists. First, around the 5-minute mark, players are introduced to the base-building mechanics, with clearing stages tied to base expansion. Second, around 10 minutes into the game, the random units brought into clearing stages are replaced by collectible heroes. Still, the gameplay remains heavily focused on the advertised hypercasual mechanic, while the drastically simplified base-building and hero-collecting elements feel like sideshows.

Source for images: Medieval Fun

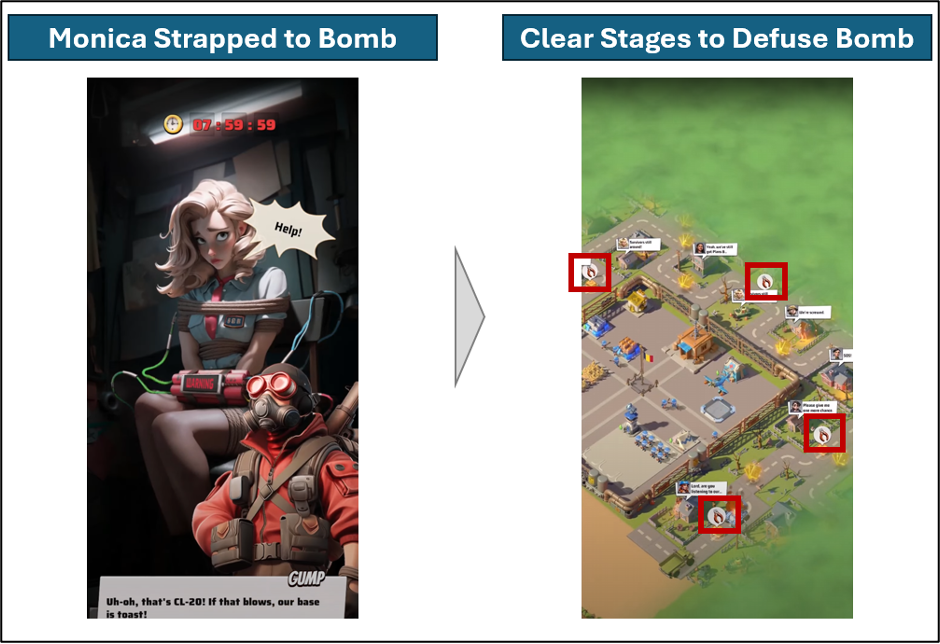

Once the basics are introduced, the developers have one final trick up their sleeves to push players through the onboarding journey. They play a cutscene where one of the collectible heroes, Monica, is tied up with a bomb at the player’s town hall.

The player is given a false sense of urgency to defuse the bomb before it detonates in eight hours. The deliberately vague consequences drive players to push through stages of the hypercasual gameplay to collect wirecutters. At the same time, players are gradually eased into the more complex layers of the game, such as the idle resource production system needed for leveling up heroes and the shard system for increasing hero tiers – both needed for clearing additional stages. Ultimately, players who let the timer run out will realize it is simply a ruse that will reset upon expiration.

Transitioning players into the core gameplay. After players complete onboarding, the game starts restricting the hypercasual gameplay based on base and hero progression. It also gradually introduces players to various daily tasks and events tied to the core gameplay and showers players with generous rewards to incentivize participation. Over time, between the daily tasks and events and idle resource generation, players start building a habit of checking on the game regularly throughout the day. Unwittingly, players are taught to play a 4x game, and the hypercasual gameplay fades away.

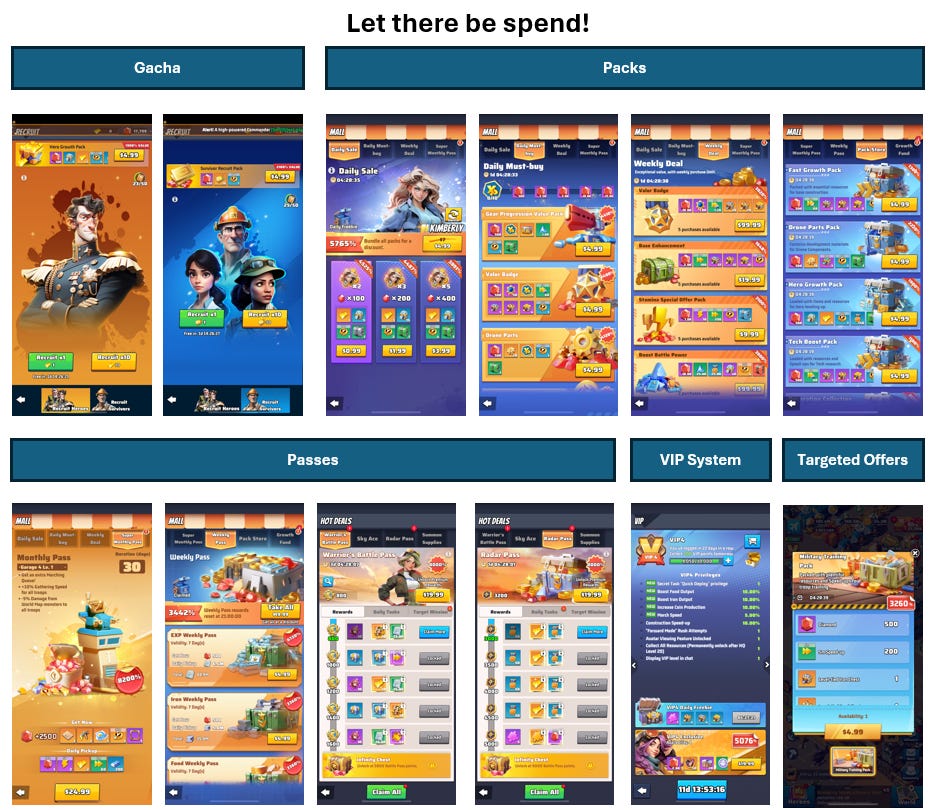

Spend depth. Once players are ensnared, the game starts revealing its true colors. First, players are bombarded with cheap offers (e.g., $0.99 for the best tank hero in the game; $1.99 for another builder) that deliver incredible value, giving them a chance to whet their appetite.

As players get deeper into the game, they realize it is as much a hero-collector as a 4x game. Heroes become the core determinant of player power by being deployed in a team-battler setting in the 4x PVE and PVP gameplay. Unlocking and upgrading heroes are tied to a gacha system, but players can bypass that by spending on targeted bundles and hero-specific battle passes.

Beyond the above-mentioned elements, those inclined to spend have many options available. Almost every part of the gameplay can be sped up or expanded. The game also offers a variety of high-value daily packs at US$4.99, which are perfect for impulse purchases to get a player through any hump. There’s also a separate gacha system for survivors, who players can deploy across their base to improve resource production. And, of course, there’s a VIP system that provides generous rewards for spenders and incentivizes repeat purchases.

As someone 30+ days in the game, I feel like I’ve barely scratched the surface for spending (only $3 spent so far). Spending also has a huge social element (e.g., your whole alliance is rewarded when you spend), which continues to grow as players are introduced to deeper 4x mechanics (e.g., battles go from between alliances to server-wide to across servers).

Conclusion

The emergence of Last War: Survival Game is the latest proof that misleading user acquisition combined with genre-mashing can be a recipe for success. First Fun successfully executed this by establishing a tight loop between advertising and product – smoothly guiding players from the advertised hypercasual mechanic into the core game.

Given the competitive nature of the mobile gaming industry, imitators will undoubtedly follow suit. I believe there is a first-mover advantage, especially if the game has sufficient scale and spending depth, as competitors can be priced out of the UA game.

The broader takeaway is that in a world where targeting becomes increasingly challenging, misleading user acquisition and genre mashing can come together to unlock pockets of growth within “red ocean” markets. I predict that we will see many more interesting genre-mashing combinations outside of 4x in the near future.

Once again, hats off to the folks at First Fun, who spotted this insight early and successfully executed on it to create one of today’s top mobile games. I’m excited to see what else they have in store.

R u guys still hiring?

Hi