Cracking the 4X Code: First Fun and RiverGame’s Billion-Dollar Strategy

Inside First Fun and RiverGame's billion-dollar strategy that's reimagining how mobile games are built and marketed.

The mobile 4X genre is experiencing a remarkable transformation, led by companies such as First Fun and RiverGame. These companies have achieved unprecedented success by fundamentally reimagining how these games are built and marketed. Their flagship title, Last War, generated over $1.1B in revenue in 2024, up from just $15M a year earlier.

In this analysis, we examine:

The strategic partnership between First Fun and RiverGame… is this legit?

Their innovative approach to balancing UA costs with player monetization

Their rapid product expansion strategy

Key challenges around player retention and rising UA costs

Implications for the future of mobile game development

Written by: Justin Yau

The strategic partnership between First Fun and RiverGame traces back to their founders’ shared roots as part of ELEX Technology, a successful mobile games developer known for its 4x games and global game distribution expertise. In 2014, ELEX was sold to a Chinese strategic for US$433M, and both founders eventually went their separate ways to build their own gaming studios.

However, the founders maintained strong ties (e.g., First Fun’s founder invested in RiverGame through his venture capital firm) and formalized their partnership in 2021, with First Fun acquiring a 42% stake in RiverGame.

In 2024, the flagship product that came from their partnership, Last War: Survival (“Last War”), experienced exponential growth, scaling from $15M in annual revenue in 2023 to over $1.1B in 2024 – placing the duo amongst the top mobile gaming developers of the year.

Source: AppMagic

Last War’s success comes from cleverly incorporating its “misleading” ad creatives into its gameplay to lead players into a deeper, hero-collector-based 4X game – introducing a much broader audience to the 4X genre. (In a prior issue, we dive into Last War’s “bait and switch” in more detail.)

Emboldened by their success with Last War, the duo has ramped up marketing spending behind other 4X titles developed using the same formula. This strategy has proven immensely successful, with the companies holding three top 10 grossing 4X games in January.

Source: AppMagic

In today’s article, we’ll dive into First Fun and RiverGame’s rapid product expansion and discuss whether their 4X formula is built to last.

Product eXpansion

First Fun and RiverGame’s recent success is built on decades of experience developing market-leading 4X games and scaling them internationally. The key difference between their current venture and their past games is the sweeping changes to the user acquisition landscape (ATT), which have significantly increased user acquisition costs for 4X games.

Their product strategy tackles this challenge head-on by taking established gameplay patterns with proven, attractive CPIs and “mashing” that gameplay with their high-spending, hero-collector-based 4X engine. Once they identify a promising pairing, they iterate on the concept to smooth the transition between the two gameplay loops, aiming for a mass-market scalable CPI-to-LTV equation.

A great example that exemplifies their approach to game development is the creation of Top Heroes. The gameplay in Top Heroes borrows heavily from Rumble Heroes, which was launched in late 2022 and showed promising download and retention stats.

Rumble Heroes Gameplay

Source: Link

A few months later, RiverGame published a game called Top Warriors, which looked suspiciously similar.

Top Warriors Gameplay

Source: Link

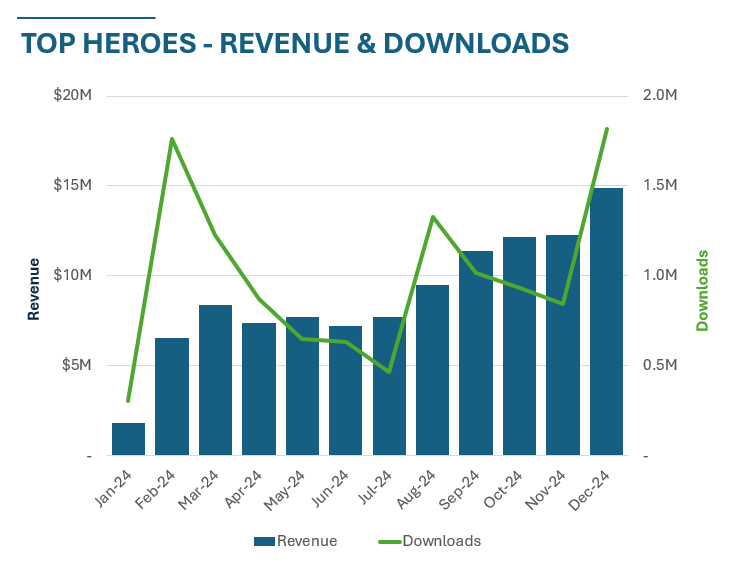

After establishing proof of concept, RiverGame polished the gameplay and deepened the integration with its 4X engine. In early 2024, the game was relaunched as Top Heroes and has since grossed over $120M in revenues. Fun Fact: RiverGame later tested a reskinned, higher-fidelity version of the game called Legends of Heroes (link to gameplay) to see if it could achieve better CPIs but ultimately stuck to scaling Top Heroes.

Source: AppMagic

Outside of Top Heroes, other promising 4X games in the duo’s portfolio include Dark War Survival (link to gameplay), which resembles Whiteout Survival but with zombies, and Last Z: Survival Shooter (link to gameplay), which is a higher fidelity version of Last War with a suggestive art style. They’ve also publicly tested at least ten other 4X concepts since launching Last War in late 2022 and have likely privately experimented with many more ideas.

Is First Fun’s 4X Formula Built to Last?

The driving force behind First Fun and RiverGame’s product expansion strategy is predominantly focused on growth. They’ve identified a winning formula with Last War, and more impressively, their formula is highly replicable and adaptable for different audiences – allowing them to quickly spin up additional 4X games without significant cannibalization.

However, the formula’s replicability is also its weakness, as imitators are bound to follow suit. As a result, the duo’s rapid pace of new product launches isn’t just about driving growth – it’s also a defensive maneuver to stay ahead of the impending gold rush. By being first to market, First Fun and RiverGame are effectively raising the table stakes by driving up CPIs and making it harder for competitors to follow.

Another impetus behind their product expansion strategy is the need for diversification. While Last War continues to chart new heights, 4X games are inherently prone to “boom and bust” cycles. The core loop in 4X games revolves around satisfying the desire to dominate – climbing the power rankings in your server and accruing resources to overpower other players. These games are designed to monetize this competitive drive, but these design choices often lead to player burnout. This sets off a vicious cycle, as players at the bottom of the food chain are usually the first to leave, worsening the experience for those higher on the food chain and potentially triggering a chain reaction of churn.

Source: AppMagic

There are early signs that this might become an issue with Last War as the game seems to struggle with long-term retention. As Oindrila points out in her excellent analysis for Naavik, Last War’s D30 retention is almost half that of its closest competitor, Whiteout Survival (D30 US iOS retention of 4% vs. 8% per Sensor Tower). The knock-on effect is that player cohorts aren’t stacking, and the DAU count has stayed relatively flat despite the company maintaining its user acquisition spending levels (implied through downloads).

Source: AppMagic

This leaves the company highly dependent on ongoing user acquisition efforts, which will only become more expensive over time as early adopters have already converted and competitors begin imitating the same strategy (e.g., Evony, the #3 grossing 4X game in January, has copied Last War’s math gates onboarding strategy). Solving this retention challenge will probably be the key task for First Fun and RiverGame if they want to create games that can continue growing for a long time.

Conclusion

2024 was a defining year for both First Fun and RiverGame. They successfully scaled their flagship title to over $1B in annual sales and launched two additional 4X games that could potentially become hundred-million (maybe even billion) dollar games.

While their rapid product expansion has positioned the company for strong near-term growth, the longer-term challenge of player retention remains a key issue. Fixing the retention issue will help the company reduce its dependence on user acquisition, which will only become expensive over time.

Despite potential headwinds, First Fun and RiverGame have a commanding head start in the market and a proven playbook for developing and scaling 4X games that are more accessible and engaging for the masses. They’ve planted their flag on a sizable share of the 4X market, raising the entry price for imitators looking to follow. If they can crack the code on retention and tighten their grip on the roughly $6B 4X market, they have the potential to lay the foundation for a potentially much larger gaming business.

🎙️ The Future of 4X Games: The Evolution of UA-Led Game Design

🎧 Listen on Spotify, Apple Podcasts, or Anchor ← Subscribe now!

📺 Subscribe to GameMakers on YouTube

Speakers:

Matej Lancaric.

Joseph Kim. CEO at Lila Games.

Jakub Remiar.

Justin Yau. Contributing Writer at GameMakers & Naavik. MBA Candidate Wharton.

🤝🏻 Gamemakers x 2.5Gamers Collaboration

Based on Justin’s post above, we decided to record a collaborative podcast with Matej and Jakub from the 2.5 Gamers crew to dig into more depth on the 4X market. Make sure to check them out!

Here’s what we talked about:

0:00 - Introduction & Speaker Backgrounds

5:01 - The History of First Fun & RiverGame: From ELEX to Today

Origins at ELEX Technology

Path to partnership

Evolution of their strategy

13:42 - Modern 4X Game Server Economics

Server management strategies

Player retention mechanics

Economics of maintaining healthy servers

UA cost structures

20:01 - The Evolution of 4X Game Design

Integration of hypercasual elements

Multiple gameplay cores

From reskins to innovative design

31:30 - UA Innovation & Creative Production

AI-generated content

Scale of creative teams

Volume of creative production

Creative iteration strategies

41:15 - Case Study: Top Girl & Genre Innovation

Reimagining 4X mechanics

Hidden 4X elements

New audience targeting

51:43 - Future of 4X Games: Non-Consensus Views

Integration into other genres

Core gameplay innovation possibilities

Industry expert predictions

Market evolution predictions

57:22 - Closing Thoughts & Industry Implications

🔑 Top 10 Takeaways

Here are 10 key insights and compelling quotes from the discussion:

"They're actually trying to integrate the game loops to be more deep and to keep that illusion for longer... For Top Heroes, there was more reason for me to re-engage with that core loop. There was like bosses that I had to kill every single day for loot drop... So there was more integration." - Justin Yau. Offers a player-perspective analysis of how newer 4X games are evolving their retention mechanics through deeper gameplay integration.

"When you have the 4X core, then why reinvent the wheel? ...It's not reskinning anymore." - Matej Lancaric. Highlights how the genre has evolved from simple reskins to sophisticated hybrid game design.

"If you join an alliance very early, the LTV profile of the players that joined like on day one or very early were dramatically higher... Today, when you look at the way the gameplay behavior of so many people, especially after COVID is in groups and teams and people playing together." - Joseph Kim. A unique insight into social mechanics and their impact on monetization, suggesting untapped potential in early social integration.

"Nobody cares about fingerprinting and privacy changes... You build games now around UA and around the algorithms." - Matej Lancaric. A stark reminder of how UA requirements are fundamentally reshaping game design.

"It's mandatory now to build the game around the onboarding... that's the key." - Matej Lancaric. The shift from treating onboarding as a feature to making it a core strategic element.

"After day 30, usually the whole server is just paying players because everybody else just gets stomped to the ground." - Jakub Remiar. A critical insight into 4X server dynamics and monetization patterns.

"If you pay $300 for CPA, it's not sustainable and you need to end up like Rise of Kingdoms. If you don't innovate, you go down." - Jakub Remiar. The existential pressure driving innovation in the space.

"It literally means the difference between success and failure... Whiteout Survival was actually initially a failed game, right? ...that literally made the difference between success and failure." - Joseph Kim On the importance of seemingly small design and UA changes.

"4X is two steps ahead than everybody else. So everything we see in Forex, it's going to come to the other part of the industry." - Matej Lancaric. Positioning 4X as the leading edge of mobile game innovation.

"Even if you will never do 4X in your whole life, you should still study 4X." - Jakub Remiar. Perhaps the most compelling call-to-action for the broader industry.