Market Wire | Jan 23, 2023

Netease + Blizzard DRAMA!, Quantum Tech Gaming M&A and Fundraising Report, Voodoo IDFV Crackdown, Playtika Attempts to Acquire Rovio, Blizzard Manager Employee Stack Rank Protest

Good evening. This new year is moving fast. Make sure you take a moment to enjoy the present. Have a great week everybody!

Also, we got some cool videos coming up so stay tuned!

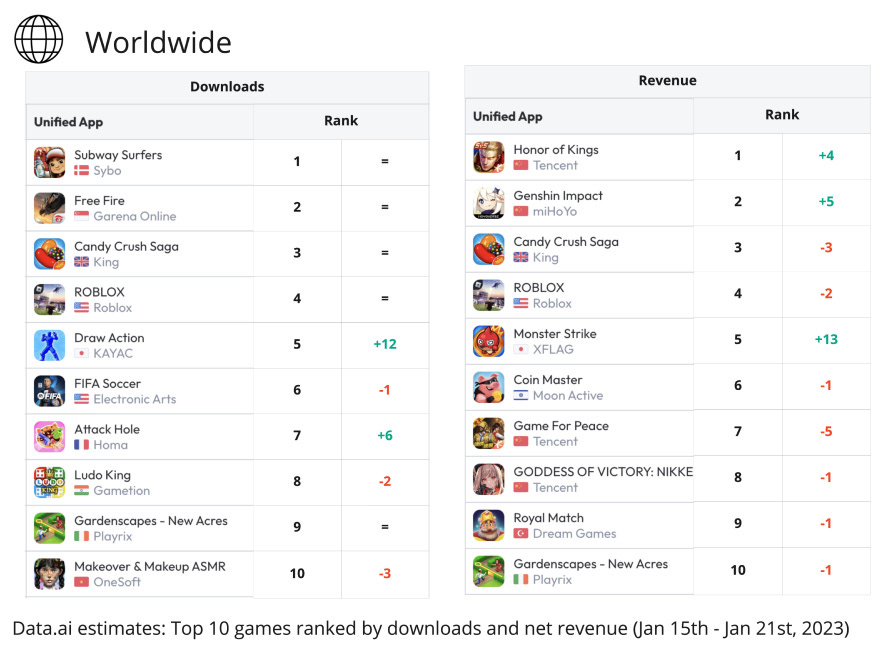

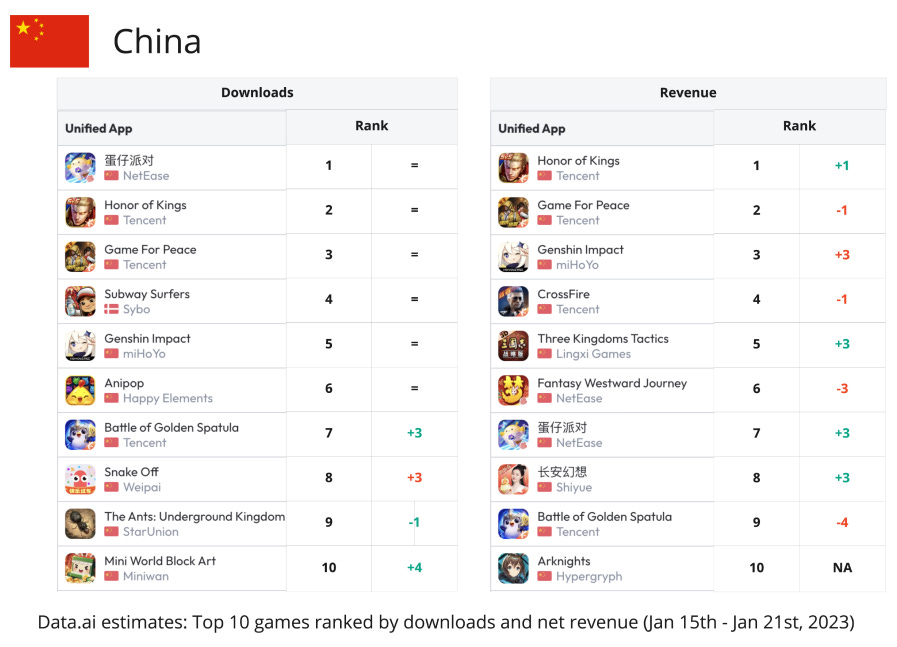

Market Data

Top 10 Charts

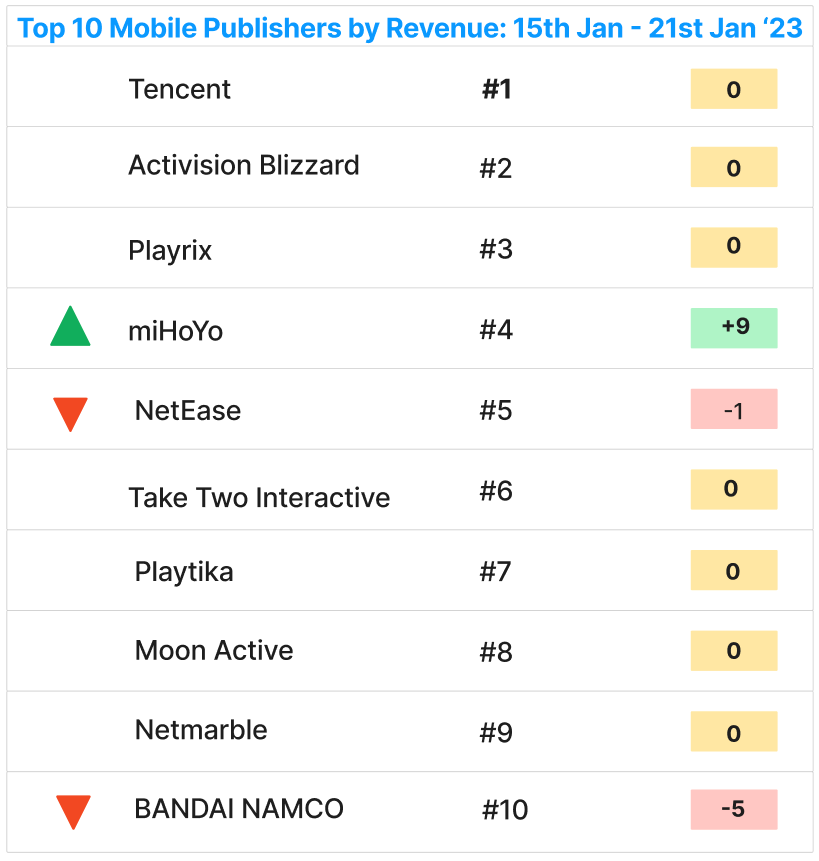

Top 10 Publishers by Rank

Welcome back to the top 10 miHoYo! Knocked Roblox out of the Top 10.

Top 5 Trending Downloads

Top 5 Trending Revenue

As usual biggest revenue movers are Japanese or Chinese.

Top 5 News

#1. Netease + Blizzard DRAMA! (Multiple Sources)

Wow, just… wow! We’ll get into it, but the drama behind the increasingly hostile relationship between Blizzard and Netease has now gone nuclear.

As most people in the gaming industry are already aware, Blizzard ended their relationship with Netease last year. We initially reported this last November in the very first Market Wire issue as follows:

Netease announced on November 17 that its relationship servicing Blizzard games in China is ending. Games impacted will include Overwatch 2, Diablo III, World of Warcraft, Starcraft, Hearthstone, and Heroes of the Storm. This ends an over 14-year relationship. WTF?

In that issue we also highlighted the very public comments Simon Zhu, Netease President, Global Investment and Partnership made condemning the move and calling out the “jerk” on the other side of the partnership (see that issue linked above for more details).

In a number of Twitter posts, it has come to light that more drama has unfolded.

First, it appears that Blizzard after cutting ties with Netease then approached Tencent for a deal but then was turned down as Tencent has already been working on a WOW clone:

Do you think Netease was mad about this? Uhmmm… let me say I suspect yes!:

Any more comments from Netease? Actually…

Wow, but wait a minute, just how pissed off could they be?

Ok, moving on. There couldn’t be any additional comments from Simon Zhu though could there?

Blizzard China issued an updated statement today (January 17, 2023) stating that during this period Blizzard has initiated a search for a new partner. For unknowable reasons, last week Blizzard re-sought NetEase with an offer of a so-called six-month extension of the game service and other conditions, and made it clear that it would not stop continuing negotiations with other potential partners during this extension. And as far as we know, Blizzard's negotiations with other companies during the same period were all based on a three-year contract period. Considering the non-reciprocity, unfairness and other strict conditions attached to the cooperation, the parties could not reach an agreement in the end.

In our view, Blizzard's proposal - including today's sudden announcement - is rude and unreasonable, inappropriate and commercially illogical. Its overconfidence does not take into account where players and NetEase have been placed by this kind behavior of making endless exorbitant demand, taking free ride, and taking all the advantages without responsibilities.

Second, the media reported that "NetEase wants to control the IP" statement.

We are concerned that some media have received rumors that NetEase wants to control Blizzard’s IP. We would like to formal correction that in the past 14 years of long-term cooperation, as a business partner NetEase has used and licensed all Blizzard’s IP in accordance with the terms of the contract, and has always obtained Blizzard's consent and approval. All NetEase’s IP cooperation with other partners is also based on this principle.

Well folks. If you like drama, Netease and Blizzard certainly have a lot going on right now.

In all seriousness though, I don’t think there are any winners here and definitely not the Chinese players who would love to have access to these really great games. Let’s hope for some de-escalation and resolution for both companies and players.

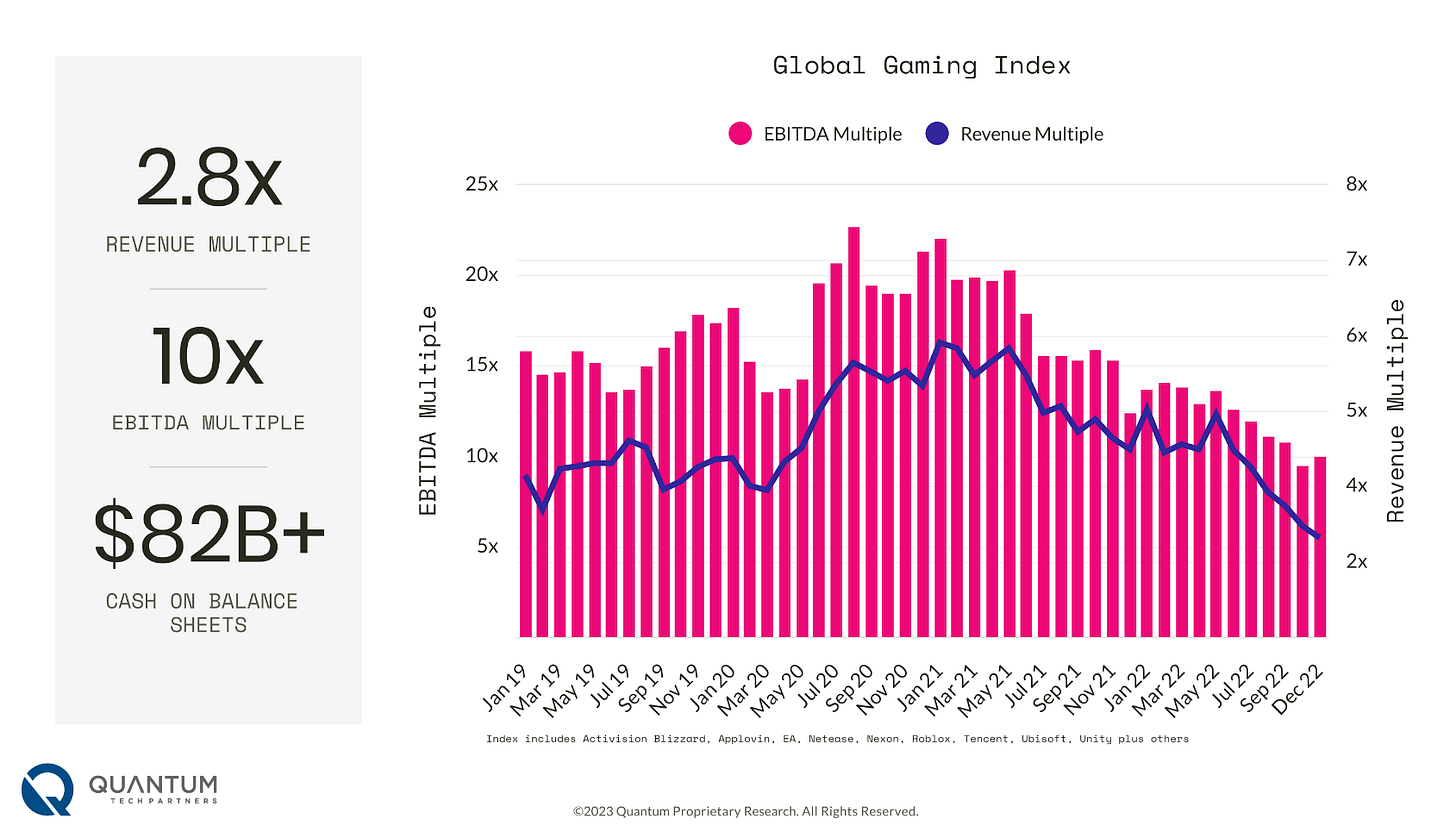

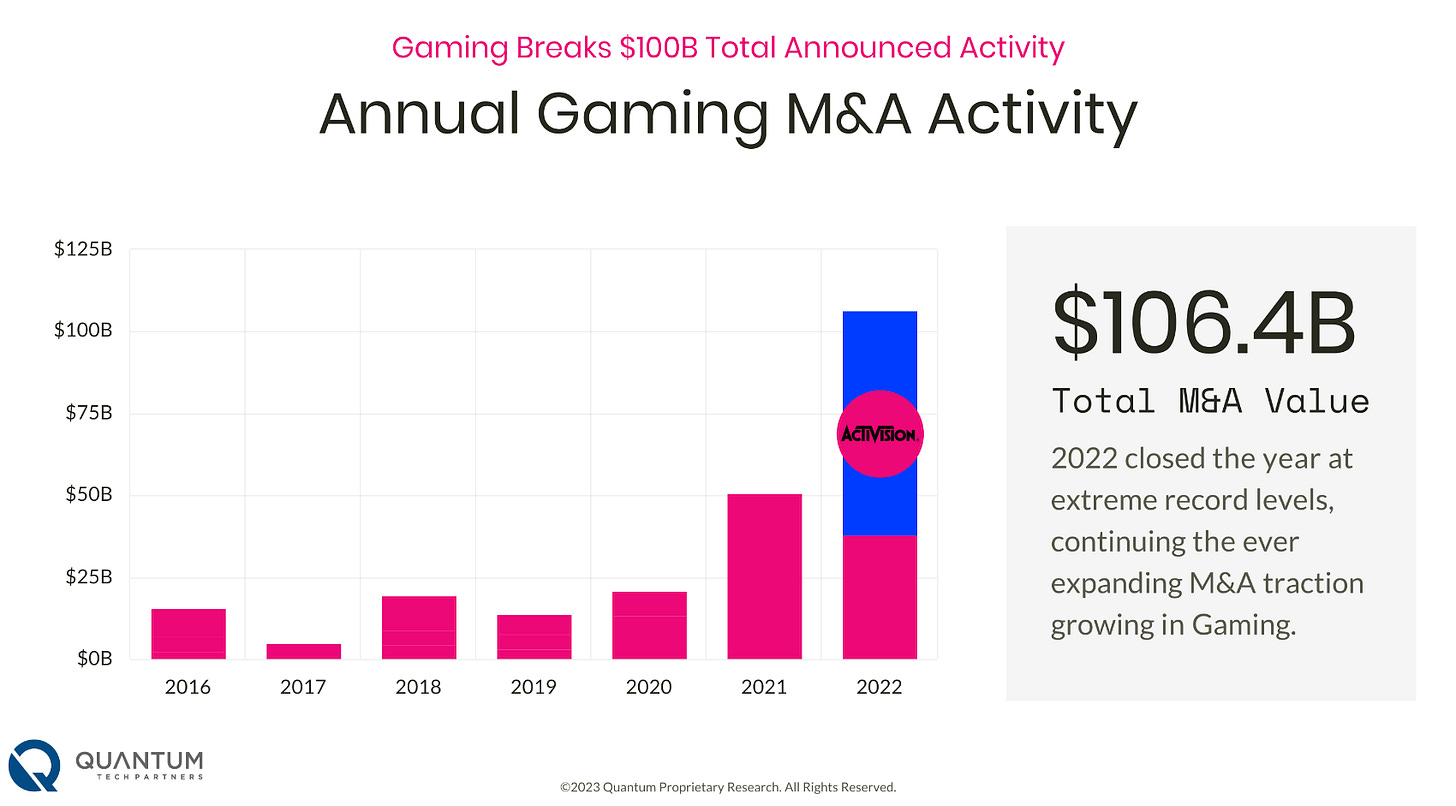

#2. 2023 Industry Report: Gaming M&A and Fundraising (Quantum Tech Partners)

Quantum Tech Partners a self described “Global Gaming M&A Advisory” has recently published a report on the state of gaming M&A and fundraising with a few interesting data points as per below.

Valuations have been steadily declining since the beginning of 2021:

Although Quantum is seeing the trends as proof of continued expansion, I’ll take the opposite view here. We may be on the cusp of a decline in annual gaming M&A activity. How many big players are left out there and what happens if you were to take Activision out?:

M&A activity clearly heading down:

Note the biggest transactions of 2022, and also note there aren’t that many big players left (and maybe Rovio is next, see next news item below):

If only some of this M&A activity was predictable… lol, like back in June of 2021, when I wrote in The Warning | Game Companies Face Structural Transition in 2021:

“All of the public game companies will be super hungry for growth. The key implications you should take away from this as the M&A market continues to tap out:

#1. M&A will move to bigger (as I predicted on the Glu acquisition) and smaller (pre-product with high earn-out structures) targets

#2. Game companies will continue to vertically (e.g., ad-tech) and horizontally (e.g., cross-platform) integrate seeking growth

#3. As public game company execs run out of ideas, they will make some really dumb moves (and hopefully a few smart ones) or throw their hands up and just increase share buybacks.”

Anyway, nice report by the Quantum Tech guys. You should definitely check out the rest of their report: https://www.quantumtechpartners.com/news

#3. What are the real motives behind Playtika's $813 million offer to buy Rovio?(CTECH)

Why is it urgent for a company that has just laid off hundreds of employees, closed games, and spent $600 million on buying back its own shares, to embark on an expensive all-cash adventure?

Good question!

Deal summary:

Playtika currently trying to acquire Rovio, who created the Angry Birds franchise, for $813M USD.

This offer is an improved offer that reflects a 55% premium over closing price as of Jan 18

Last November, Playtika submitted an initial offer of 8.5 Euros per share (current price is at 9.05 Euros per share)

Playtika shares rose 7% on the announcement valuing the company at $3.7B

Some odd points about the deal:

“One of the unusual things in Playtika's proposal is its desire to pay the entire amount in cash, even though in transactions of this magnitude, made between two public companies, it is customary to pay at least part of the amount in shares.”

“Playtika already has experience in acquisitions of Finnish game development companies, acquiring ReverX, the company behind the popular interior design application Redecor, in September 2021 for $600 million. In that transaction, Playtika agreed to pay $400 million in the first stage and $200 million in accordance with the acquired company meeting certain goals.”

“Playtika already has experience in acquisitions of Finnish game development companies, acquiring ReverX, the company behind the popular interior design application Redecor, in September 2021 for $600 million. In that transaction, Playtika agreed to pay $400 million in the first stage and $200 million in accordance with the acquired company meeting certain goals.”

One interesting point raised by the author of this post, is her conspiracy theory surrounding the rationale behind the acquisition.

The past acquisitions by Playtika of Finnish companies clearly showed a distinct cultural gap in work ethic and approach between Playtika and their acquisitions of Finnish companies Seriously and ReverX. Hence, why would they try to acquire another Finnish company?

The conspiracy theory:

“Looking for a growth engine is one explanation but not one that will suffice. Rovio is indeed growing more than Playtika, but not at a phenomenal rate that will be significantly felt on the scale of the merged company. It is possible that the explanation for the current course of action can be found in the ownership structure of the company itself.”

“[Playtika] has changed hands several times already and over 25% of its shares were supposed to be sold to the Chinese Joffre Capital fund at a valuation of $8.5 billion last year. The deal blew up last December, and it may be that Playtika sees the purchase of Rovio as a kind of "poison pill" that can deter potential takeovers. After all, who wants to buy a company that is trying to spend all its cash or take on debt to fight for the purchase of a company that probably doesn't really want to be sold.”

#4. Mobile games: the CNIL fined VOODOO 3 million euros (CNIL)

There was a time IDFA deprecation, and the introduction of IDFV in its place, made some in the industry believe that mobile game industry consolidation would be inevitable.

When a publisher offers an application on the App Store, APPLE provides it with a technical identifier “IDentifier For Vendors” (or IDFV), allowing this publisher to track the use that is made of its applications by the users. An IDFV is assigned to every user and is identical for all the applications distributed by one publisher.

Hence within the boundaries of a single publisher, an IDFV could be used like IDFA amongst the apps of that publisher by Apple’s rules.

France’s consumer data protection agency CNIL, however, doesn’t see it that way. In fact:

“On 29 December 2022, the CNIL imposed a fine of 3 million euros on the company VOODOO, which publishes video games for smartphones, for using an essentially technical identifier for advertising without the user's consent.”

CNIL have found that using IDFV based on a negative ATT request response is in violation of the “French Data Protection Act.”:

“When opening a video game application, a first window designed by the company APPLE (App Tracking Transparency or ATT) is presented to the users in order to collect their consent for the tracking of their activities on applications downloaded on their smartphones.”

“When a user refuses the ‘ATT request’, a second window is displayed by the company VOODOO explaining that the advertising tracking has been deactivated and specifying that non-personalized ads will still be offered.”

“During its investigations, the CNIL however observed that when a user refuses the advertising tracking, the company VOODOO reads the technical identifier associated to this user (IDFV) anyway and still processes the information linked to the browsing habits for advertising purposes, therefore without consent and in contradiction with what it indicates in the information screen it displays.”

Some of the justification by companies such as Zynga to acquire hyper-casual companies like Rollic were presumably based on the premise of IDFV.

#5. Blizzard's 'Workplace Ranking' For Employees Sounds Like Hell [Update] (Kotaku)

From the original Bloomberg article:

In 2021, Blizzard, a unit of Activision Blizzard Inc., implemented a process called stack ranking, in which employees are ranked on a bell curve and managers must give low ratings to a certain percentage of staff, according to people familiar with the change who asked not to be named discussing a private matter. Managers were expected to give a poor “developing” status to roughly 5% of employees on their teams, which would lower their profit-sharing bonus money and could hamper them from receiving raises or promotions in the near future

I was a little surprised this article would touch a nerve with folks. We definitely had a bit of a discussion and debate within one of the private gaming communities I’m a part of about this issue.

Bloomberg further reported:

When team leads asked why we had to do this, World of Warcraft directors explained that while they did not agree, the reasons given by executive leadership were that it was important to squeeze the bottom-most performers as a way to make sure everybody continues to grow. This sort of policy encourages competition between employees, sabotage of one another’s work, a desire for people to find low-performing teams that they can be the best-performing worker on, and ultimately erodes trust and destroys creativity.

Clearly this issue touched a nerve with Kotaku as well:

“What the fuck? You’re telling me this company has implemented a system where 5% of its workforce, even if they’re doing just fine, even if they’re going a great job, will be targeted—and suffer financially—just to meet a quota?”

The “manager” in question is Brian Birmingham who later posted on Twitter:

In my private slack group, we have folks on both sides of this issue and there’s a lot of nuance behind this that may be worthy of some further discussion and debate in the future.

But what do you think?

Written by Joseph Kim and Ryan Wilson.