📈 State of Mobile Gaming: Key Insights from 1H 2024 | AppMagic Data Analysis

Find out the current state of the mobile gaming market for 2024: Detailed data on the top games, genres, and new releases from AppMagic

Hey Gamemakers,

This week, we speak to Stan Minasov, VP of Product at AppMagic, to get a sense of the mobile gaming industry so far in the first half of 2024. Some surprising insights below.

In this newsletter:

Top Revenue: Dungeon & Fighter: Origin seems to have a death lock on #1 worldwide revenue. While Monopoly Go maintains #1 US revenue, it seems to be losing its war with Royal Match worldwide.

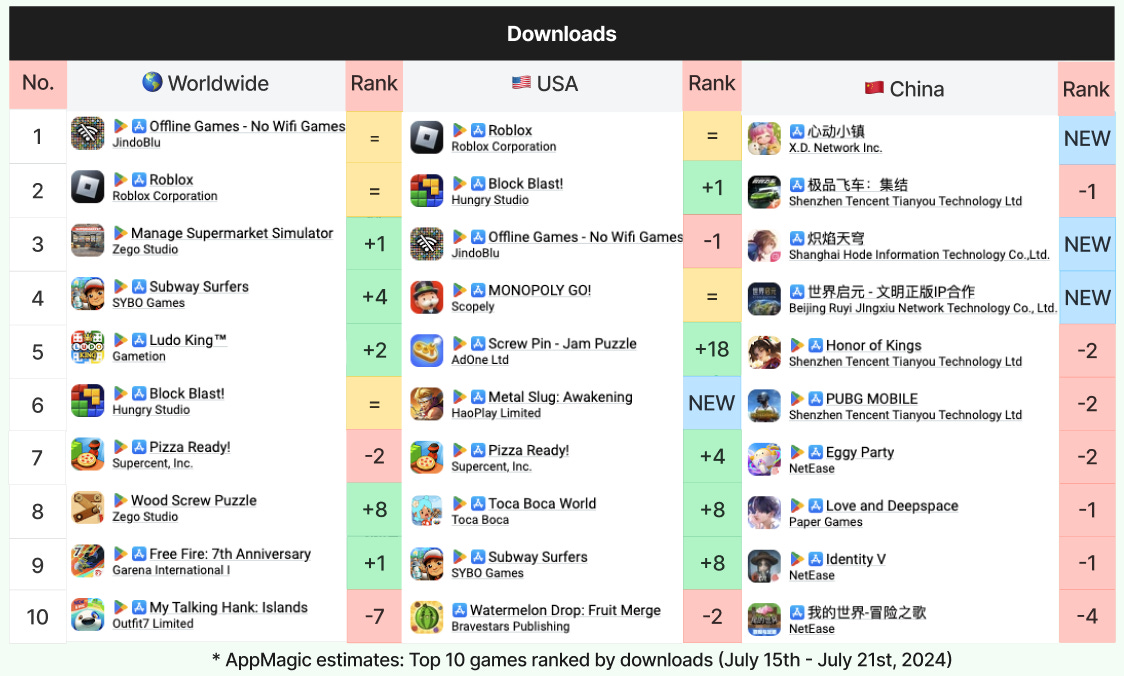

Top Downloads: Offline Games: No Wifi is dominating #1 worldwide downloads, while three new games crack China’s top 10 downloads.

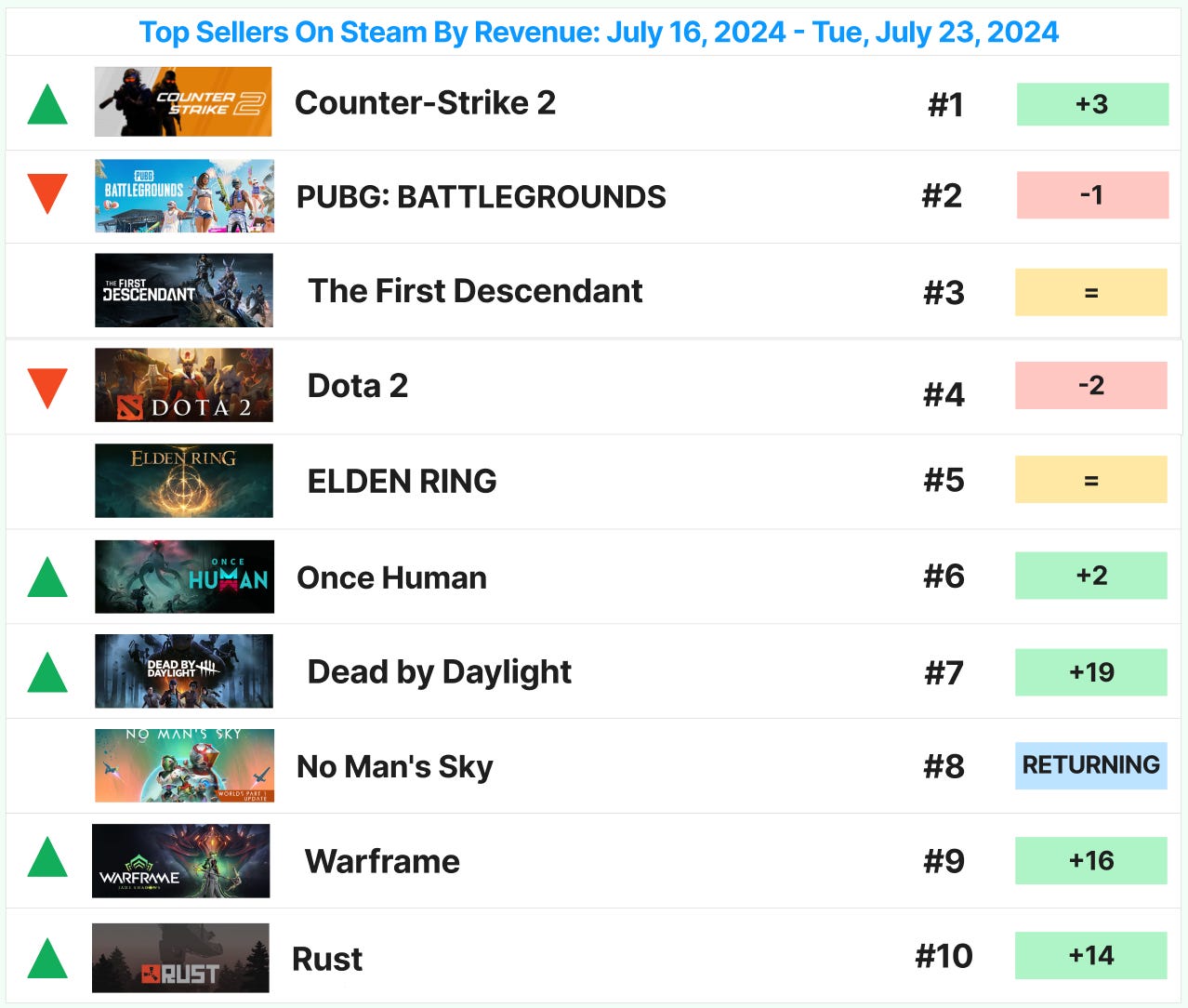

Top Steam Revenue: Counter-strike 2 is back at #1, while some older games have returned to the top 10: Dead by Daylight, No Man’s Sky, Warframe, and Rust.

Highlight—Mobile Gaming Report 1H 2024: We deep dive this week into the current state of the mobile gaming industry so far in 2024, featuring an overview from AppMagic’s Stan Minasov.

Top 10 Mobile Charts (Worldwide, US, and China)

The revenue grudge matches continue: 1. Dungeon & Fighter Origin vs. Honor of Kings, 2. Royal Match vs. Monopoly Go, and 3. Last War: Survival vs. Whiteout Survival.

There is very little movement worldwide and in the US revenue positions, but China continues to have a volatile revenue leaderboard.

Offline Games - No Wifi Games holds the #1 worldwide downloads position.

Metal Slug: Awakening cracks top 10 US.

At #1, 心动小镇 (aka Heartwarming Town) is a city-building and life simulation game.

At #3, 炽焰天穹 (aka Blazing Skies) is an anime ARPG.

At #4, 世界启元 - 文明正版IP合作 (aka World Genesis) is an officially licensed Civilization IP game.

Top 10 Steam Charts

Keep an eye on The First Descendant, holding at #3. The game reached an all-time peak of over 260K concurrent users, and people seem to love the gameplay. However, it currently has a mixed review score of around 50%.

🌎 1H 2024 Mobile Gaming Market Review with AppMagic

🎧 Listen on Spotify, Apple Podcasts, or Anchor

Hosts:

Joseph Kim. CEO at Lila Games.

Stan Minasov. VP of Product at AppMagic.

The mobile gaming industry has seen significant changes and trends in the first half of 2024. I spoke with Stan Minasov from AppMagic to discuss the state of the market, highlighting important developments and opportunities. Here are the key takeaways:

Market Overview:

The mobile gaming market is stabilizing after a post-COVID decline

Revenue numbers are similar to the first half of 2023, indicating a plateau

Downloads have shown a slight growth (1-2%) compared to 1H 2023

Tier 1 West markets show 7% revenue growth, outperforming other regions

Genre-specific Insights:

Monopoly Go has significantly grown the overall market

The genre more than doubled in revenue compared to 1H 2023

There's potential for innovation in mid-late game core gameplay

The genre shows steady growth despite being a "red ocean"

Downloads have decreased, indicating a focus on monetizing existing players

Royal Match and Dream House Adventures continue to perform well

Piggy Kingdom, a newcomer, surprisingly entered the top 10

The genre is still growing, with revenue quadrupling since 2022

Travel Town dethroned Merge Mansion as the top game

The niche remains open for new developers and innovative ideas

Showing explosive growth, with revenue increasing almost 10 times since 2022

Match Factory leads the category with significant revenue growth

The genre is not saturated yet, offering opportunities for developers

The genre is declining, with a 10% drop in both revenue and downloads

Considered oversaturated with less interest from players and developers

Key Trends:

Increased focus on live operations (LiveOps) and events to boost engagement and revenue

Shift towards operating existing titles rather than launching new games

The success of games using "misleading" ad creatives (e.g., Last War Survival, Match Makeover ASMR)

Asian RPGs dominating among top new releases

Notable Games and Developments:

Dungeon and Fighter Origin achieved massive success in China (iOS only)

Brawl Stars made a significant comeback through improved LiveOps

Supercell's Squadbusters showed strong initial downloads but faces retention challenges

New Releases:

Top Grossing New Releases:

Dungeon and Fighter Origin (DNF Mobile): This game dominated the revenue charts, generating nearly $300 million. It is particularly notable for being produced only on iOS and exclusively in China.

Asian RPGs: Various Asian RPGs have performed exceptionally well, demonstrating strong RPD (revenue per download) numbers and dominating the top-grossing new releases.

Top Downloaded New Releases:

Magic Dress: A hyper-casual dress-up game where players choose between clothing items, featuring simple graphics and appealing to a broad audience, including kids.

Squadbusters: Benefited from cross-promotion in Supercell games and a substantial marketing boost, although its metrics dropped significantly after initial growth.

Industry Lessons:

LiveOps and events are crucial for long-term success and revenue growth

There's still room for innovation in established genres (e.g., casual casino, match-3)

Cross-promotion and marketing boosts can significantly impact initial game performance

The Chinese market remains a powerful force in mobile gaming

In conclusion, while the mobile gaming market has stabilized, there are still opportunities for growth and innovation across various genres. Developers should focus on enhancing LiveOps, exploring untapped niches, and carefully considering their monetization and user acquisition strategies to succeed in this evolving landscape.

DOWNLOAD THE SLIDES: