📈 Who Wins? Royal Match vs. Monopoly Go

We deep dive on the games, genres, performance, and future outlook for Royal Match vs. Monopoly Go!

Hey Gamemakers,

This week, we welcome the debut of a newsletter contribution from Shilpa Gaur, who wrote the highlight feature (Monopoly Go vs. Royal Match) with some editing, feedback, and conclusions from me (JK).

In this newsletter:

Top Revenue: Zenless Zone Zero (ZZZ) burst onto the scene last week, launching June 3 (Wed) and hitting #9 in worldwide revenue despite only being active for part of the week. It currently sits at #2 in worldwide revenue only under #1 Dungeon & Fighter: Origin.

Top Downloads: ZZZ hits #1 Worldwide, in the US and China.

Top Steam Revenue: First Descendant hits #1 in top revenue. Naraka Bladepoint jumped 68 spots to #7 in top revenue, driven by a new season (Season 12: Tenacity), which included a new map, Perdoria, and a new Justice Chamber system.

Highlight—Monopoly Go vs. Royal Match: Monopoly Go has continued to slide in downloads and revenue in 2024, finally giving up its #2 spot in worldwide revenue last month (according to AppMagic). Does June mark a critical inflection point for Royal Match to overtake Monopoly Go for good? We look closely at both games, their genre, and their historical performance to predict which game wins in the future!

Top 10 Mobile Charts (Worldwide, US, and China)

Top 10 Steam Games

🆚 Royal Match vs. Monopoly Go! Who wins in the long term?

Since its global launch on April 11, 2023, Monopoly Go has reportedly earned $2 billion in just 10 months. According to data from AppMagic, Monopoly Go consistently ranked as the #2 top worldwide revenue game every month from August 2023 until June 2024, when it dropped by four spots to #6. In June (last month), rival game Royal Match, Last War: Survival, Roblox, and the dominant new #1 worldwide game Dungeon & Fighter: Origin passed Monopoly Go.

Does June mark a turning point for Monopoly Go?

Since its launch, Monopoly Go seemed to be in a high-stakes rivalry for a higher worldwide revenue position with Dream Games’ Royal Match. Royal Match was among the top 5 worldwide revenue games during the same period as Monopoly Go.

Both games have achieved phenomenal success, becoming the best in their respective genres. However, some experts questioned Monopoly Go’s viability in sustaining its top position (including one of the authors of this newsletter). Further, there was debate regarding which game had more attractive economics and profitability.

Which game has higher long-term potential, Monopoly Go or Royal Match?

In this post, we will:

Genre Comparison: Examine the AppMagic-defined genres of Match-3 (Royal Match) and Casual Casino (Monopoly Go).

Performance Analysis: Compare the performance of these games within their respective genres.

Future Outlook: Forecast the future top-revenue position leader between Monopoly Go and Royal Match.

Genre Comparison: Match-3 vs. Casual Casino

Match-3 Genre

Revenue History

Since Candy Crush Saga was introduced in 2012, the match-3 genre has been a very attractive market as measured by revenue and growth. Since 2015, the match-3 genre has grown revenue at a CAGR of ~16 % over the past nine years.

Genre Market Share

Candy Crush Saga's success led to increased competition for the match-3 genre. The biggest competitor was Playrix, which launched its "Scape" series of games, most notably Gardenscapes in 2016 and Homescapes in 2017. These new games from Playrix innovated the match-3 genre by adding meta-game features to add additional progression to the games and through innovative marketing.

These two strategies helped Playrix Scapes games gain market share. From the launch of Gardenscapes in 2016, Playrix and King combined to dominate the match-3 genre, growing from 62% to 74% of the market (market defined as revenue from Top 100 match-3 games) between 2016 and 2020.

During this time frame (2016-2020), the match-3 genre consolidated around the 3 biggest games: Homescapes, Gardenscapes, and Candy Crush Saga.

The chart below shows the cannibalization of other match-3 games with the introduction of Scapes games by Playrix.

Introducing Dream Games’ Royal Match

In 2021, Dream Games launched Royal Match, bringing product innovation to the match-3 game genre.

The picture below shows how Royal Match found the perfect spot between Candy Crush Saga and the Scapes games.

Royal Match entered the market with the following differentiators:

Gameplay: Largely unchanged. Small innovations were introduced, such as optimizing and making gameplay slightly better

Meta: Made the metagame lighter, more focused, and with less friction (e.g., eliminating story).

Theme: Leaned into a broadly appealing Kingdom-focused theme with a heavy focus on “saving the King” scenarios, which seemed to test extremely well in ads.

Royal Match’s biggest differentiator was delivering a "light meta" game experience. Hence, while the meta has extra features like the ability to decorate furniture, it doesn’t have as many additional elements as Gardenscape, such as a deeper storyline. Even in decoration, players have a single default option for decoration compared to multiple options in Gardenscape.

Royal Match bet on players wanting a simplified, faster, and more frictionless meta-game design. With a simpler meta, this approach focused players on the main match-3 gameplay experience.

Further, the game’s theme and ad concepts around “Saving the King” seemed to help the game attract a bigger audience through better-performing ads. We believe that Candy and Kingdom concepts are more broadly appealing than Gardens, enabling both Candy Crush Saga and Royal Match to better scale marketing/UA.

Since its launch in 2021, the game has grown exponentially. So far this year (first half), it has achieved a 25% market share in its genre for 2024.

Impact of Competition

Perhaps the most interesting phenomenon after the introduction of Royal Match was the competitive impact on the match-3 market.

See the chart below:

Royal Match impacted the match-3 genre market in the following ways:

Market Growth: Royal Match helped grow the overall size of the match-3 market.

Market Split: The competitive rivalry between Royal Match and Candy Crush Saga elevated the performance of both games and split the market. While the two market leaders increased their genre market share, other top games declined.

Royal Match Wins: After three years, Royal Match became the market leader in July 2023.

Monetization Comparison: Match-3 Leaders

The chart above shows that Royal Match has the highest RPD in the genre, reaching a peak of $8 per player and currently standing at $7.51 per player. This compares to an RPD of less than $6 for all the other top games in the genre.

While all of the leading match-3 games continue to grow RPD (revenue per download), interestingly, Gardenscapes had a major spike in 2018 before declining significantly. This may suggest that the game had a limited demographic appeal compared to other games with broader appeal. One theory explaining the decline in Gardenscapes' RPD in 2018 suggests that ramping marketing scale with a less broadly appealing theme caused the decline.

As we will see in the Monopoly Go study below, theme matters. In today’s mobile gaming market, game success depends on product, liveops, and marketability.

Casual Casino Genre

Revenue History

The casual casino genre (by AppMagic taxonomy) is defined by games that combine casino slot machine mechanics with light meta progression and asynchronous social battles. According to Appmagic’s data estimates, this genre became significant (>$100 Million) starting in 2018 when the Coin Master game grew significantly, expanding the entire genre.

The Casual Casino game market grew at a CAGR of about 70% per year from 2015 to 2023.

Genre Market Share

Given the significant genre growth, we should have expected much more robust competition. Surprisingly, until the launch of Monopoly Go, Coin Master dominated the genre.

As shown in the chart below, Coin Master grew its genre market share significantly from 2017 - 2022 before the launch of Monopoly Go.

Introducing Scopely’s Monopoly Go!

Monopoly Go launched in April 2023 into the casual casino genre previously monopolized by Coin Master. The game reportedly achieved $1B in revenue in just 7 months, one of the fastest in mobile games history.

In contrast to Royal Match, Monopoly Go did not bring significant product innovation into their game; instead, they differentiated with a greater focus on the popular Monopoly IP and adapted gameplay to fit the theme.

The picture below shows how Monopoly Go compares with Coin Master.

In summary, Monopoly Go entered the market with the following differentiators:

Gameplay: Adapting casual casino gameplay to the Monopoly board game.

Meta: Largely similar, except Coin Master has a pet system offset by a slightly deeper property upgrade system for Monopoly Go.

Theme: Focus on Monopoly IP, one of the world's most popular and iconic brands

While small differences in gameplay and meta were introduced to adapt to the Monopoly board game theme, the key to Monopoly Go’s success was primarily driven by the theme and IP. Hence, unlike Royal Match, Monopoly Go’s biggest differentiator focused on the theme.

Finally, one of the more significant impacts of the Monopoly IP is the focus on the US, given Monopoly’s popularity in the US compared to globally. Note the dramatically higher concentration in the US for Monopoly Go relative to Coin Master, which has more global appeal.

Since its launch in April 2023, Monopoly Go has gained ~40% market share within its launch year and currently sits at 57% market share for the first half of 2024. This growth makes the game one of the fastest-growing mobile games in history.

Monetization Comparison: Casual Casino Leaders

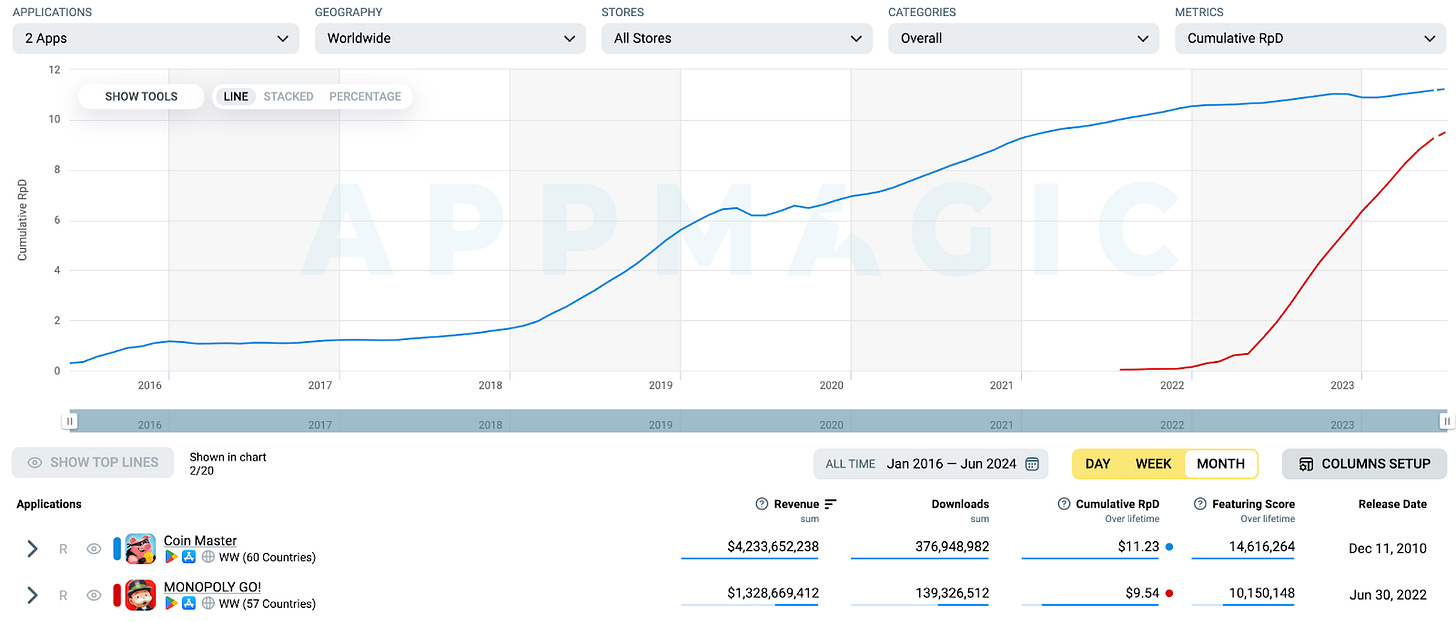

As it currently stands, Coin Master still maintains an RPD advantage relative to Monopoly Go:

However, while it took Coin Master 9 years to achieve its current RPD, Monopoly Go grew its RPD significantly in only 2 years.

Following the trendlines in the RPD chart above, we would normally expect Monopoly Go to overtake Coin Master in RPD. However, we would caution that RPD is a function of product quality and user acquisition quality + scale. Further, Monopoly Go lihas lower margins to work with to contribute to UA, given that they must pay royalties to Hasbro (probably 10-15% of revenue), but that could be somewhat offset by lower UA costs for Monopoly Go assuming that the Monopoly IP helps reduce player cost per install (CPI).

At the publisher level, Scopely has many more games like Stumble Guys that could potentially be used to drive traffic to Monopoly Go. In contrast, Dream Games cannot take advantage of a wider portfolio of games for cross-promotion.

All this is to say that the future RPD picture for Monopoly Go is complicated and not easy to forecast without inside data/knowledge.

So, Who Wins?

Since August 2023, Monopoly Go’s focus has shifted from winning its genre to winning in the worldwide revenue charts. Up until this past June, Monopoly Go had dominated Royal Match.

The big question is whether we have reached an inflection point in Monopoly Go’s performance where Royal Match will dominate the battle moving forward.

Which game wins in the long term?

RPD Analysis

On an RPD basis, Monopoly Go, on the surface, seems to have a distinct advantage over Royal Match. A comparison of $9.64 (Monopoly Go) vs. $7.53 (Royal Match).

A few points of reminder:

US vs. Global Concentration: Monopoly Go has a significantly higher US concentration, naturally implying higher RPD vs. Royal Match with a greater global focus. Ultimately, worldwide revenue will be a function of global downloads and RPD.

Hasbro Royalty: Monopoly Go must pay a royalty (probably 10-15%) to Hasbro, unlike Royal Match, which used royalty-free original IP somewhat ambiguously similar to Supercell Clash IP.

Coin Master Upper Bound: Based on our genre analysis, Monopoly Go RPD will likely not grow much more. And while Monopoly Go could achieve higher RPD relative to Coin Master via US concentration, it’s unlikely to go much higher than Coin Master if it does surpass at all.

Performance Trends

Let’s examine the performance of both Monopoly Go and Royal Match over the past 1.5 years, from December 2022 - June 2024.

Monopoly Go:

Downloads: Fell from a high of 13.9M in August 2023 to 4.8M in June 2024, a 65% drop.

Revenue: Fell from a high of $132M in March 2024 to $91M in June 2024, a 31% drop.

Royal Match:

Downloads: Fell from a high of 18.4M in January 2023 to 8.1M in June 2024, a 56% drop.

Revenue: It has not substantially decreased, with June 2024 revenue hitting $101M, slightly less than $103M in March 2024.

On a historical performance basis, trends seem to favor Royal Match.

Conclusion: Royal Match Wins!

In conclusion, how do we determine who will most likely succeed long-term?

Let’s examine various factors that could impact future performance:

Of the factors mentioned, the most current and potentially impactful is UA Scale.

Focusing on the single most important factor, UA Scale, Royal Match will likely win in the long term if there is a continued UA scale/download disparity between the games.

Even further…

Based on all the major contributing factors contemplated, we believe Royal Match beats Monopoly Go in the long term!