The Strategic Case for Microsoft Xbox Gaming Division Spin-Off and Epic Games Merger

A comprehensive analysis on the business case for Microsoft to spin out Xbox Gaming and to acquire Epic Games in a new stand-alone whup-ass company playing to win

A few weeks ago, I started hearing rumors about potential sales of Microsoft's game studios. The rumors were speculative at best, but they made me think a bit about one of my favorite game companies… Epic Games.

What if…?

What would it take for Epic Games to Play to Win? I believe that a combination of Epic and Blizzard would have massive synergy and help Epic win in so many ways.

This led to a bigger question, though: what exactly is Microsoft’s gaming strategy? Are they considering selling off their game studios? Are they gonna do a console? Really? The official word is yes, but it doesn’t seem to make sense given the current Game Pass strategy. Further, why is Microsoft still even going with what appears to be a pretty dead Game Pass subscription strategy?

What if…?

The bigger what if is what if Microsoft were to do the right thing. And that is to spin out Xbox and the other gaming assets into a standalone company.

What would that look like, and what would it take for that standalone company to Play to Win?

Thankfully, in this modern-day world of AI and with a few prompts from me, it’s pretty easy to build a high-level speculative picture (with some risk of hallucinations here and there) of what an Xbox standalone business might look like.

Check out the complete analysis below! 👇👇👇

The Strategic Case for Microsoft Xbox Gaming Division Spin-Off and Epic Games Merger

Written by: Perplexity with prompting by Joseph Kim

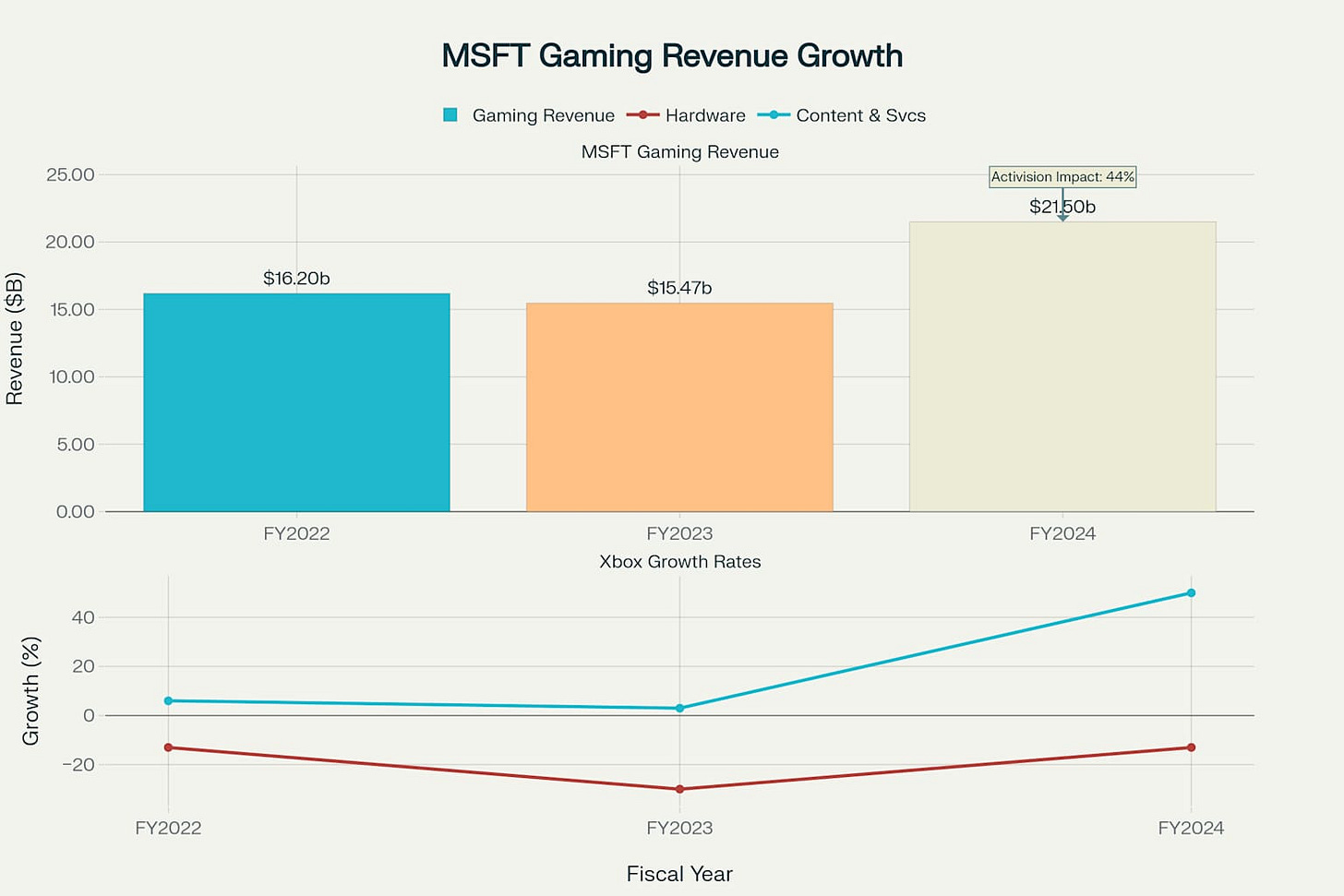

Microsoft's gaming division represents one of the world's largest interactive entertainment entities, generating $21.5 billion in annual revenue and operating across console, PC, and mobile platforms. However, despite significant investments, including the $68.7 billion Activision Blizzard acquisition, the Xbox business faces fundamental strategic challenges that prevent it from reaching its full potential within Microsoft's broader technology ecosystem.

This comprehensive analysis demonstrates that spinning off Xbox as an independent gaming company, combined with an Epic Games acquisition, would unlock substantial shareholder value while enabling focused strategic execution in the rapidly evolving gaming market.

Executive Summary

Situation: Xbox Gaming Within Microsoft's Empire

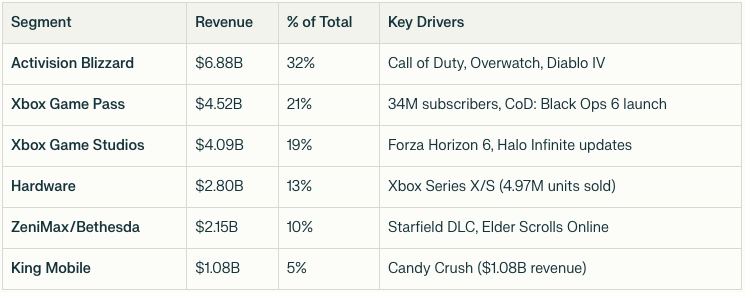

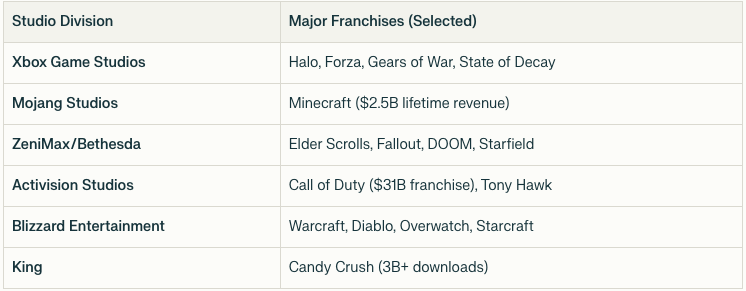

Microsoft's Xbox gaming division has evolved from a console challenger into a comprehensive entertainment ecosystem comprising over 32 development studios, Game Pass subscription service with 34 million subscribers, and Xbox console hardware maintaining only 14.0% market share compared to PlayStation's 52.5% and Nintendo's 34.0%. The division encompasses three primary asset categories: Xbox Game Studios, ZeniMax Media (acquired for $7.5 billion), and Activision Blizzard (acquired for $68.7 billion), collectively employing over 20,100 people globally.

The gaming business generates substantial revenue through a diversified portfolio, including Call of Duty, Halo, Minecraft, World of Warcraft, Diablo, and over 40 additional franchises. Revenue composition has shifted dramatically toward digital services, with Content & Services generating $18.6 billion (87%) compared to Hardware at $2.9 billion (13%) in fiscal 2024. Despite this scale and successful digital transformation, the gaming division operates as a subsidiary business within Microsoft's broader cloud and productivity technology focus.

Complication: Strategic Constraints and Value Destruction

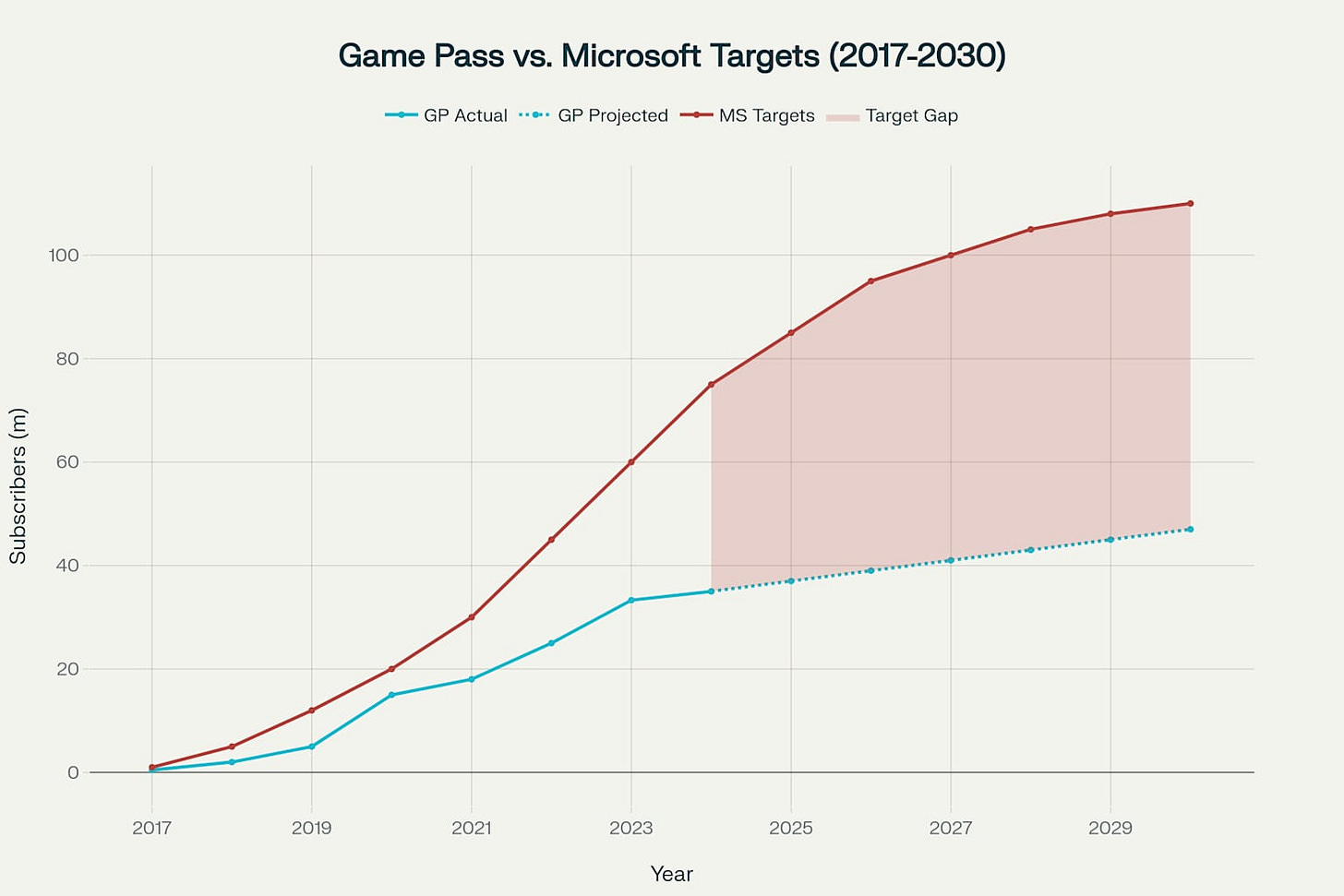

Xbox gaming faces multiple systemic challenges that constrain growth and value creation within Microsoft's current structure. Game Pass subscriber growth has dramatically decelerated, with the service reaching 34 million subscribers as of February 2024, representing minimal growth over recent periods. The service has consistently missed Microsoft's internal targets, falling far short of the company's ambitious goal of reaching over 100 million subscribers by 2030.

Hardware economics remain deeply problematic, with Xbox reportedly losing between $100 and $ 200 per console sold, according to Microsoft Gaming CEO Phil Spencer. Most critically, Xbox console sales have reached historic lows, with only 4.97 million Xbox Series X|S units sold globally in 2024, compared to PlayStation 5's 18.65 million and Nintendo Switch's 12.05 million units. Platform restrictions fundamentally limit the potential for Game Pass expansion, as Sony and Nintendo will likely never allow Microsoft's subscription service on their platforms, thereby capping growth to Xbox and PC users only.

Resolution: Strategic Independence Through Spin-Off and Epic Games Merger

Microsoft should pursue Xbox gaming division spin-off combined with Epic Games acquisition to unlock $96.8-172 billion in shareholder value while creating the world's most comprehensive independent gaming company. The transaction would enable focused gaming strategy execution, allowing management to make critical decisions, including Game Pass restructuring and hardware optimization, that Microsoft's broader technology focus currently prevents.

A merger with Epic Games represents an optimal value-maximizing strategy, combining Xbox's content portfolio with Epic's Fortnite franchise, Epic Games Store platform, and Unreal Engine technology. Strategic independence would enable pursuit of game exclusivity strategies that could fundamentally reshape console market dynamics while generating superior shareholder returns through focused gaming execution.

Report Overview

This report evaluates a scenario in which Microsoft's Xbox and related gaming business are spun out into a new independent company. The analysis examines two critical strategic business decisions that would fundamentally shape the future direction and financial performance of the standalone Xbox gaming entity:

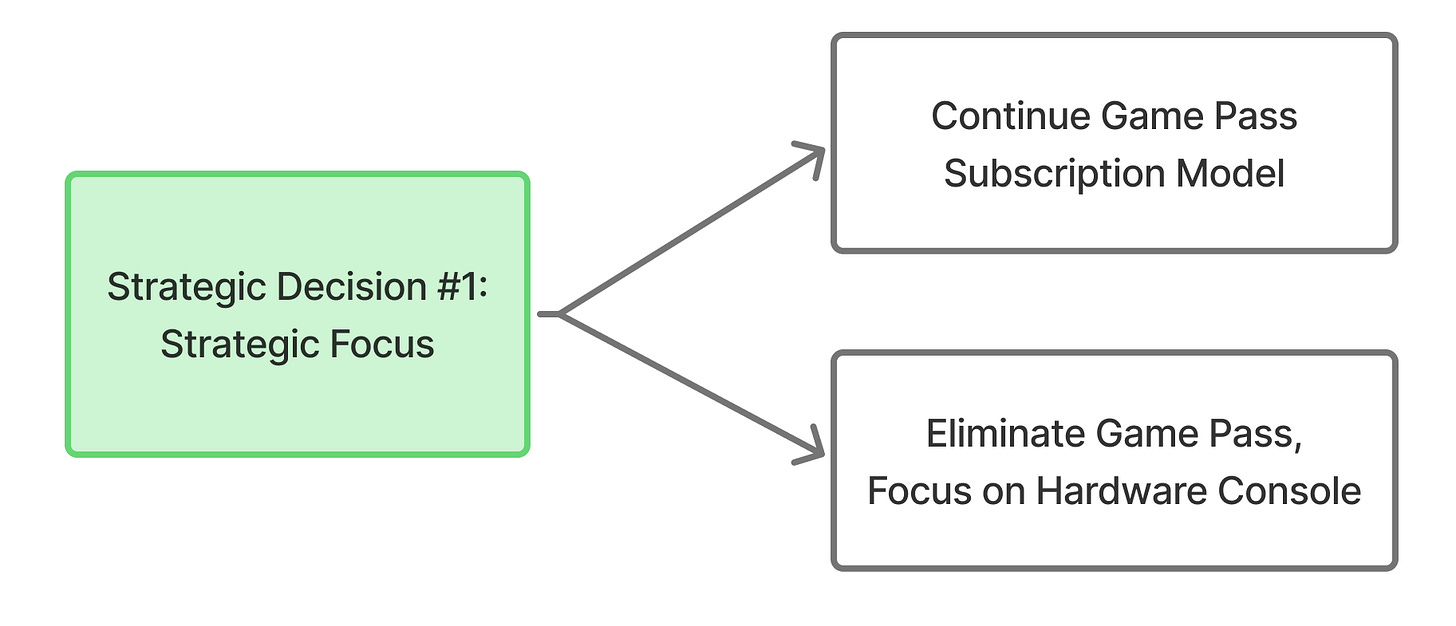

Strategic Focus Decision: Evaluating whether to continue the current dual approach with Game Pass subscription services or to eliminate Game Pass entirely and pursue an all-in hardware console business strategy focused on premium game sales and profitable console economics.

Strategic Growth Decision: Analyzing the potential merger and acquisition opportunity with Epic Games to realize significant business synergies, create market-leading exclusivity advantages, and establish comprehensive gaming ecosystem control across console, PC, and mobile platforms.

These strategic choices represent fundamentally different approaches to value creation, competitive positioning, and long-term market leadership in the rapidly evolving gaming industry. The corrected market share data reveals Xbox's precarious competitive position makes these strategic decisions even more critical for survival and growth.

Strategic Decision 1: Game Pass Limitations vs Hardware-Focused Strategy

Game Pass Growth Collapse and Financial Reality

Game Pass faces insurmountable structural barriers that prevent it from achieving sustainable growth within Microsoft's current strategy. Microsoft Gaming CEO Phil Spencer acknowledged that console growth had slowed because "at some point you've reached everybody on console that wants to subscribe". Current Game Pass revenue is estimated at $5.5 billion in 2025, based on 34 million subscribers, with limited expansion potential due to structural market limitations.

Platform restrictions create insurmountable growth constraints, as PlayStation and Nintendo platforms remain permanently inaccessible for Game Pass expansion. With PlayStation commanding a 52.5% market share and Nintendo holding 34.0%, Xbox's 14.0% position severely limits the addressable market for Game Pass growth. Publishers are increasingly resisting service inclusion due to concerns about cannibalization, with industry executives describing the service as "value destructive."

All-In Console Strategy with FPS Focus and Game Pass Elimination

An all-in console strategy represents a fundamental shift toward a high-performance FPS gaming powerhouse approach, prioritizing superior graphical fidelity and performance specifically optimized for first-person shooter games. Rather than pursuing immediate hardware profitability, as Nintendo's model does, this strategy targets a maximum hardware loss of $50 per unit while maintaining competitive technical specifications for FPS gaming excellence.

The console strategy involves:

High-end graphical performance optimized specifically for FPS gaming at 120+ frames per second

FPS-exclusive content strategy featuring Call of Duty, Overwatch, Fortnite, and additional acquired FPS franchises

Targeted hardware loss of $50 per unit (improved from current $100-200 losses)

Complete Game Pass discontinuation by 2027-2028 to eliminate revenue cannibalization

Digital-only design to reduce manufacturing costs while maintaining premium specifications

Platform-exclusive content strategy to drive console adoption and ecosystem lock-in

The global FPS gaming market presents substantial opportunity, valued at $21.6 billion in 2024 and projected to reach $32.6 billion by 2033. This market segment represents one of the most lucrative gaming categories, with key franchises such as Call of Duty, Fortnite, and Overwatch generating billions of dollars in annual revenue.

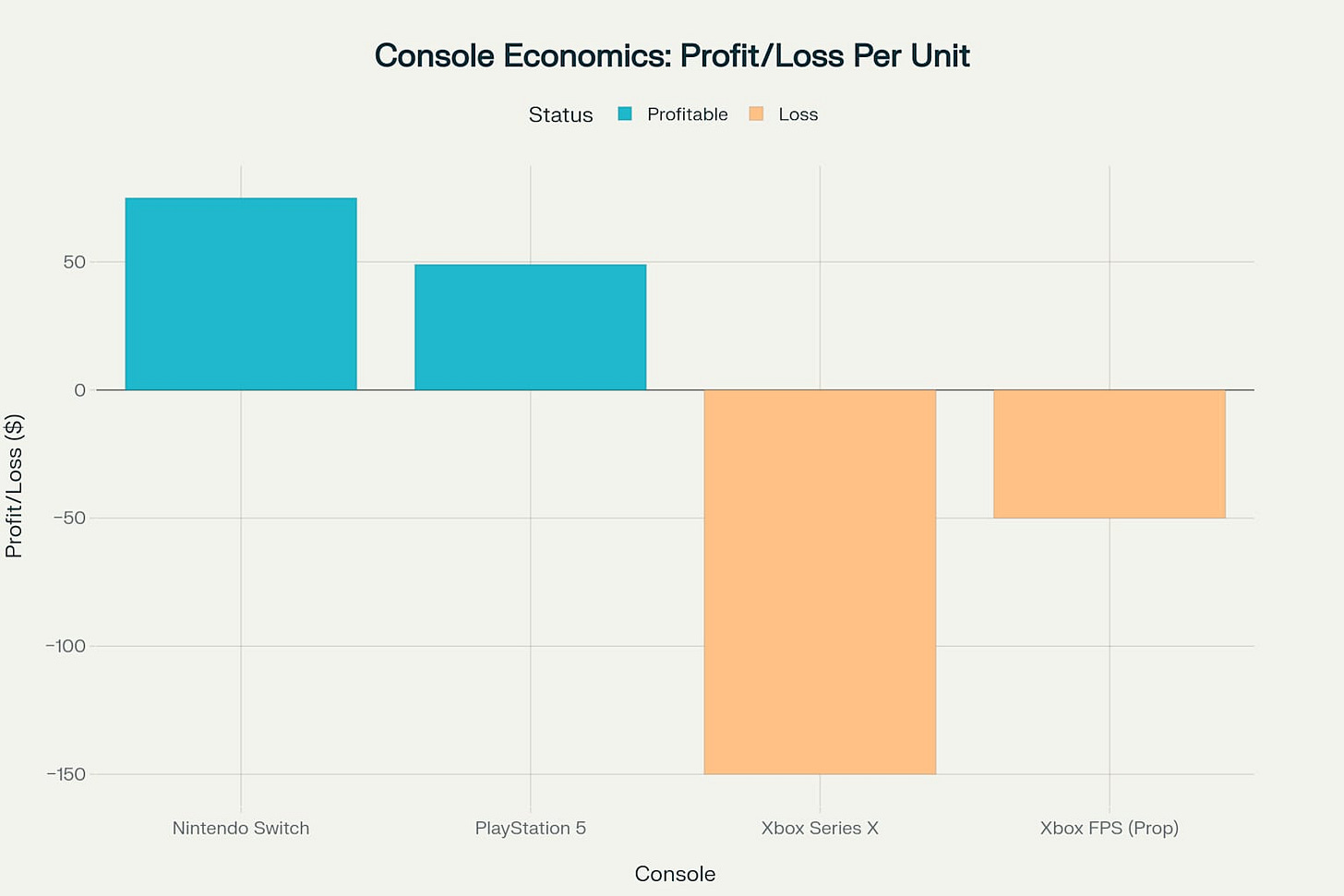

Current console economics reveal dramatic differences between manufacturers, with Nintendo generating substantial profits from each Switch unit sold, while Xbox loses between $100 and $ 200 per console, according to Phil Spencer. Nintendo's hardware business model demonstrates that profitable console economics are achievable, with the Switch generating an estimated $65 to $ 85 profit per unit in recent years.

PlayStation 5 has achieved break-even to slight profitability, with Sony's overall PlayStation business generating a 9.5% profit margin across the ecosystem. In contrast, Xbox's current loss-leader model represents one of the least efficient approaches in the gaming industry, as it loses substantial amounts on each unit sold without corresponding market share gains.

The proposed Xbox FPS-oriented console targets a maximum loss of $50 per unit, representing a significant improvement over current economics while delivering superior FPS gaming performance.

Digital-only console design offers immediate cost savings of approximately $47 per unit through the elimination of disc drives, component integration, and simplified manufacturing processes. Additional cost optimizations through strategic component selection, custom silicon design, and supply chain improvements enable the target $50 loss while maintaining high-end graphics capabilities essential for FPS gaming dominance.

Strategic Decision 2: Epic Games Merger as Core Strategy

Epic Games Strategic Assets and Market Position

Epic Games represents a transformational acquisition target with an estimated $5.82 billion in revenue for 2024, driven primarily by Fortnite's $3.5 billion contribution. The Epic Games Store achieved $1.09 billion in total spending during 2024, with 295 million PC users, though third-party sales declined 18% year-over-year. Unreal Engine contributes approximately $275 million annually through licensing fees while powering 31% of all Steam game sales.

Epic's ongoing legal battles with Apple and Google position the company to capitalize on alternative mobile app store opportunities enabled by regulatory changes. The combination would create unprecedented vertical integration across console hardware, PC distribution, mobile platforms, and game engine technology, establishing comprehensive competitive moats against Sony and Valve.

UEFN Margin Impact and Strategic Integration Problem

Epic Games' UEFN initiative has created substantial financial pressures through its Creator Economy 2.0 program, paying out $352 million to creators in 2024 while allocating 40% of Fortnite's net revenue to creators based on engagement metrics. This margin compression contributed directly to Epic's financial crisis that led to 830 employee layoffs in September 2023. While UEFN generates 36.5% of total Fortnite playtime and substantial user engagement, its economics create acquisition complications requiring strategic restructuring.

Rather than shutting down UEFN and risking the loss of creator content engagement, the merged Xbox-Epic entity should restructure the program's economics. This could include reducing the 40% revenue sharing percentage, implementing tiered payout structures based on performance thresholds, or integrating Xbox franchise content as alternative creator compensation mechanisms.

Xbox-Epic Merger Synergies and Value Creation

Comprehensive Synergy Analysis

The Xbox-Epic merger is expected to generate $27.4 billion in cumulative synergies over five years through strategic exclusivity, platform consolidation, and cross-platform optimization. These synergies stem from five distinct value-creation mechanisms that address Xbox's current competitive disadvantages while leveraging Epic's strategic assets.

Console Hardware Exclusivity ($20.9B): Strategic game exclusivity could transform Xbox's market position from its current 14.0% to potential market leadership, driving a 40% increase in hardware sales through exclusive access to the Fortnite and Call of Duty franchises. Making Fortnite, Call of Duty, and Blizzard games exclusive to Xbox consoles would leverage Fortnite's 650 million registered players and Call of Duty's billion-dollar annual revenue potential to create unprecedented console-selling power.

Cross-Platform Revenue Optimization ($8.08B): Integrated monetization strategies across console, PC, and mobile platforms maximize revenue per user while eliminating platform holder fees that currently reduce margins. The merger enables sophisticated cross-platform monetization strategies that eliminate platform dependencies and create direct customer relationships across all gaming touchpoints.

PC Distribution Platform Transformation ($4.8B): Epic Games Store market share growth from 3% to projected 25% of Steam's revenue by 2030 through exclusive content access and developer-friendly 12% revenue sharing. Consolidating Epic Games Store with Xbox's PC efforts while making major franchises exclusive would accelerate market share growth against Steam's dominance.

Mobile Platform Development ($5.5B): The combined entity leverages Epic's legal battles with Apple and Google to develop alternative mobile distribution channels, capitalizing on regulatory changes like the EU's Digital Markets Act. This strategy particularly benefits from Epic's established relationships with mobile developers and technical capabilities in cross-platform development.

Unreal Engine Technology Integration ($0.87B): Enhanced integration with Xbox's development studios and Epic Games Store exclusivity accelerates engine adoption and licensing revenue growth. Unreal Engine's growth from 19% to 31% of Steam game sales demonstrates momentum that would accelerate further with Xbox's extensive developer network and guaranteed distribution.

Technology Integration and Competitive Advantages

The merged entity would possess the gaming industry's leading engine technology powering 31% of new game sales, combined with the largest alternative PC distribution platform and rapidly growing mobile capabilities. This technology foundation enables superior development capabilities, reduced licensing costs for internal projects, and strategic control over game distribution that competitors cannot replicate.

Enhanced integration of Unreal Engine with Xbox's 32+ development studios would accelerate development efficiency while improving game quality and time-to-market across the combined portfolio. The integration also provides leverage in negotiations with mobile platform holders and supports alternative distribution strategies that Epic has pioneered through its legal challenges.

Financial Scenario Analysis: Status Quo vs Transformation

Comprehensive Performance Comparison

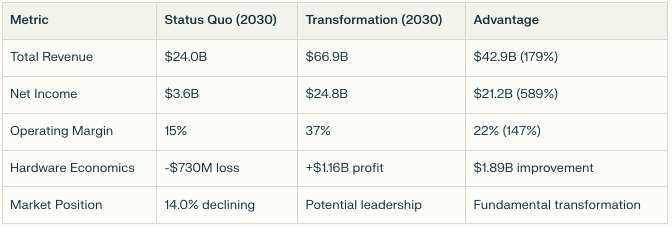

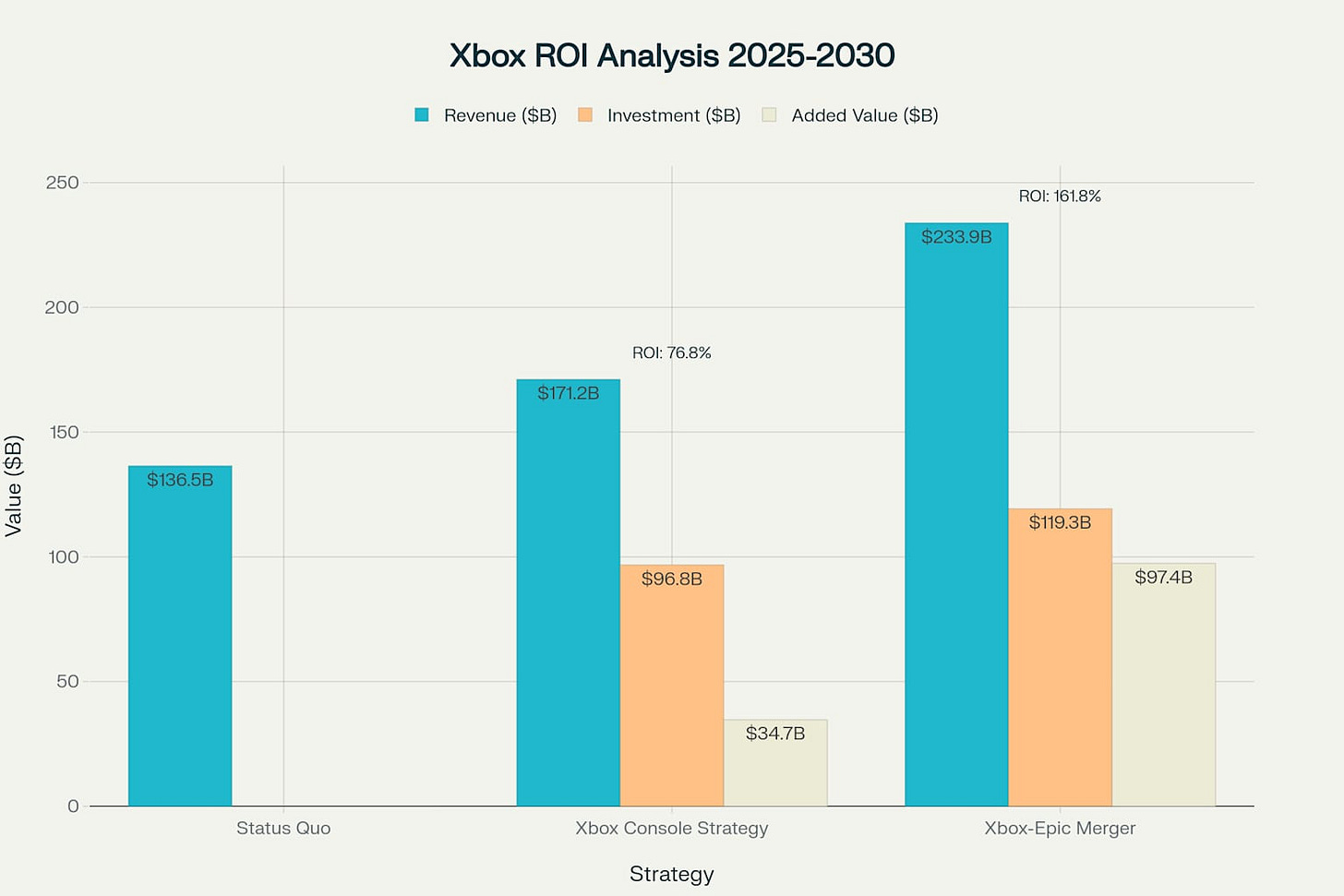

The financial analysis reveals a stark contrast between maintaining Microsoft's current Xbox strategy versus pursuing the transformational spin-off and Epic Games acquisition, with Xbox's weak 14.0% market position making transformation even more urgent:

Strategic Options Revenue Comparison

The financial analysis reveals dramatic performance differences between strategic approaches:

Status Quo (Dual Game Pass + Hardware):

2025-2030 Revenue Growth: 12% ($21.5B to $24.0B)

Continued Game Pass stagnation and hardware losses

Limited strategic flexibility within Microsoft structure

Weak competitive position with only 14.0% market share

Standalone Xbox Console Strategy:

2025-2030 Revenue Growth: 62% ($12.8B to $38.5B)

Eliminates Game Pass cannibalization effects

Implements profitable console economics with FPS focus

Still faces competitive disadvantage against dominant PlayStation and Nintendo

Xbox-Epic Merger Strategy:

2025-2030 Revenue Growth: 423% ($12.8B to $66.9B)

Leverages strategic game exclusivity to overcome market share disadvantage

Creates comprehensive gaming ecosystem to compete with industry leaders

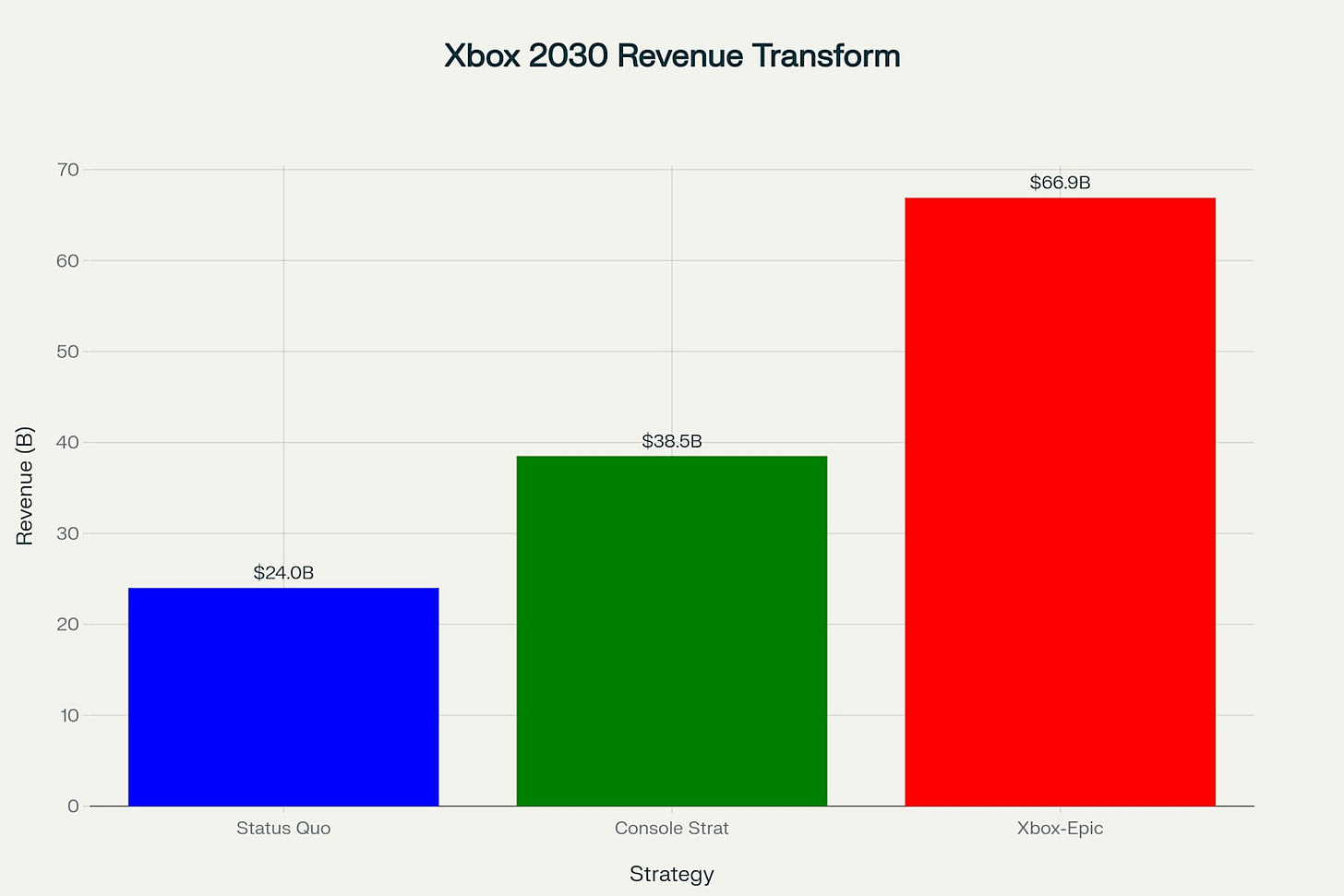

Five-Year Cumulative Performance

Revenue Performance:

Status Quo: $136.5 billion cumulative revenue

Transformation: $233.9 billion cumulative revenue

Advantage: $97.4 billion additional revenue (71% improvement)

Profitability Performance:

Status Quo: $23.4 billion cumulative net income

Transformation: $77.4 billion cumulative net income

Advantage: $54.0 billion additional profit (231% improvement)

Investment Returns and Value Creation

The transformation strategy requires a total investment of $119.3 billion, including the $22.5 billion Epic Games acquisition and $96.8 billion Xbox spinout valuation. The projected 2030 enterprise value using conservative 4.5x revenue multiples reaches $301.1 billion for the transformation strategy versus $108.0 billion for the status quo approach.

This analysis demonstrates $193.1 billion in additional value creation, representing a 161.8% five-year return on investment that substantially exceeds typical gaming industry M&A returns and validates the strategic transformation approach. Long-term strategic positioning creates sustainable competitive advantages as traditional gaming boundaries blur and new distribution models emerge from regulatory and technological changes.

Strategic Recommendation and Conclusion

The comprehensive financial analysis, reinforced by the market share data revealing Xbox's precarious 14.0% position, unequivocally supports the transformation strategy as the only viable path forward for Xbox gaming. The combination of Xbox spinout, Game Pass elimination, hardware optimization with FPS focus, and Epic Games acquisition creates a comprehensive solution that addresses every major challenge facing the current Xbox business model while establishing sustainable competitive advantages.

Key Value Drivers:

$193.1 billion in additional enterprise value creation

161.8% five-year return on investment

Potential transformation from 14.0% market laggard to industry leader

Comprehensive gaming ecosystem control across all platforms

Elimination of structural constraints limiting current growth

Recent market data reveal that Xbox's actual competitive position is weak and deteriorating, making the transformation strategy not only optimal but also essential for survival. With only a 14.0% market share compared to PlayStation's 52.5% dominance and Nintendo's profitable 34.0% position, Xbox faces an existential crisis that requires dramatic strategic action.

The status quo approach offers only continued decline within a market structure where Xbox has already lost the "console wars" and trails significantly behind both major competitors. The transformation strategy provides the only realistic path to competitive relevance through strategic exclusivity, comprehensive platform control, and the scale necessary to challenge the market dominance of PlayStation and Nintendo.

The Epic Games merger represents not merely an opportunity but a strategic imperative for Xbox's survival and growth in an increasingly competitive gaming landscape where market share leadership determines long-term viability. The FPS-focused console strategy, combined with Epic's strategic assets, creates the only viable path for Xbox to achieve market leadership and generate superior shareholder returns.

References

Statista. "Microsoft annual gaming revenue 2024." https://www.statista.com/statistics/963263/microsoft-annual-gaming-revenue/

Microsoft Corporation. "FY24 Q4 - More Personal Computing Performance - Investor Relations." https://www.microsoft.com/en-us/investor/earnings/fy-2024-q4/more-personal-computing-performance

Microsoft Corporation. "Microsoft 2024 Annual Report." https://www.microsoft.com/investor/reports/ar24/index.html

Microsoft Corporation. "FY24 Q1 - More Personal Computing Performance - Investor Relations." https://www.microsoft.com/en-us/investor/earnings/fy-2024-q1/more-personal-computing-performance

GameHub. "Microsoft: Q3 gaming revenue rises 51% due to Activision Blizzard." https://www.gameshub.com/news/news/microsoft-q3-2024-financial-results-2639597/

The Verge. "Microsoft's Xbox Game Pass service grows to 34 million subscribers." https://www.theverge.com/2024/2/15/23570040/microsoft-xbox-game-pass-subscriber-numbers-34-million

VGChartz. "PS5 vs Xbox Series X|S vs Switch 2024 Worldwide Sales Comparison Charts Through May." https://www.vgchartz.com/article/461693/ps5-vs-xbox-series-xs-vs-switch-2024-worldwide-sales-comparison-charts-through-may/

VGChartz. "PS5 vs Xbox Series X|S vs Switch 2024 Americas Sales Comparison Charts Through November." https://www.vgchartz.com/article/463447/ps5-vs-xbox-series-xs-vs-switch-2024-americas-sales-comparison-charts-through-november/

VGChartz. "PS5 vs Xbox Series X|S vs Switch 2024 Worldwide Sales Comparison Charts Through December." https://www.vgchartz.com/article/463777/ps5-vs-xbox-series-xs-vs-switch-2024-worldwide-sales-comparison-charts-through-december/

Reddit Gaming. "PS5 Was The Best Selling Console Of 2024, Nintendo Switch Was Second, Xbox Series X|S Third." https://www.reddit.com/r/gaming/comments/1i87mta/ps5_was_the_best_selling_console_of_2024_nintendo/

Market.us News. "Gaming Console Statistics and Facts (2025)." https://www.news.market.us/gaming-console-statistics/

VGChartz. "PS5 vs Xbox Series X|S vs Switch 2024 Americas Sales Comparison Charts Through September." https://www.vgchartz.com/article/462848/ps5-vs-xbox-series-xs-vs-switch-2024-americas-sales-comparison-charts-through-september/

Indie Kings. "How Much Does Epic Games Make from Fortnite in 2024?" https://www.indiekings.com/2024/09/how-much-does-epic-games-make-from.html

Engadget. "Teardown suggests Xbox One manufacturing cost of $471." https://www.engadget.com/2013-11-26-teardown-suggests-xbox-one-manufacturing-cost-of-471.html

Statista. "Global market share of console operating systems 2024." https://www.statista.com/statistics/1044925/market-share-of-console-operating-systems-worldwide/

Esports Insider. "Fortnite reveals $352m was paid to creators in 2024." https://esportsinsider.com/2025/01/fortnite-352m-creator-revenue-payments-maps

Digital Music News. "A Peek At Fortnite's Creator Economy in 2024." https://www.digitalmusicnews.com/2025/01/24/a-peek-at-fortnites-creator-economy-in-2024/

MitchCactus. "Rise of Fortnite Creators: $352 Million Paid in 2024 Alone." https://mitchcactus.co/blog/fortnite/rise-of-fortnite-creators-352-million-paid-in-2024-alone/

PocketGamer.biz. "Epic Games paid $352 million to Fortnite creators in 2024." https://www.pocketgamer.biz/epic-games-paid-352-million-to-fortnite-creators-in-2024/

Verified Market Reports. "First-person Shooting Game Market Size, SWOT, Research & Forecast 2033." https://www.verifiedmarketreports.com/product/first-person-shooting-game-market/

33rd Square. "How Much Money Does Nintendo Make on Each Switch? A Detailed Look at the Profit Margins." https://www.33rdsquare.com/how-much-money-does-nintendo-make-on-each-switch/

LinkedIn - Market TrendXplore. "FPS Game Market." https://www.linkedin.com/pulse/fps-game-market-market-trendxplore-bnzif/

LinkedIn - David Taylor. "Epic Games announced today that they have paid $479 million to creators in the last 18 months." https://www.linkedin.com/posts/jdavetaylor_epic-games-announced-today-that-they-have-activity-7246989526684876801-JUw2

GameSpot. "Xbox Loses As Much As $200 On Every Xbox It Sells, Phil Spencer Says." https://www.gamespot.com/articles/xbox-loses-as-much-as-200-on-every-xbox-it-sells-phil-spencer-says/1100-6508748/

Hot Hardware. "Xbox Boss Spencer Claims Microsoft Loses Up To $200 For Each Game Console It Sells." https://hothardware.com/news/xbox-boss-claims-microsoft-loses-up-to-200-for-each-game-console-it-sells

VGChartz. "Phil Spencer: 'We Lost the Worst Generation to Lose in the Xbox One Generation'." https://www.vgchartz.com/article/457086/phil-spencer-we-lost-the-worst-generation-to-lose-in-the-xbox-one-generation/

Game Rant. "Phil Spencer Reveals How Much Xbox Loses With Each Console Sold." https://gamerant.com/xbox-console-sales-losses/

TweakTown. "PS5 made $136 billion sales in five years, Sony's gen 9 ecosystem has 5% profit margin." https://www.tweaktown.com/news/105779/ps5-made-136-billion-sales-in-five-years-sonys-gen-9-ecosystem-has-5-profit-margin/index.html

Video Games Chronicle. "Xbox Game Pass growth is 'slowing down' on console, claims Phil Spencer." https://www.videogameschronicle.com/news/xbox-game-pass-growth-is-slowing-down-on-console-claims-phil-spencer/

Tech Times. "Microsoft Suffers a $200 Loss For Each Xbox Sold, According to Phil Spencer." https://www.techtimes.com/articles/282752/20221102/xbox-ceo-phil-spencer-lose-between-100-200-whenever-sell.htm

Nintendo Everything. "Nintendo financial results - May 2024 - Switch at 141.32 million units." https://nintendoeverything.com/nintendo-financial-results-may-2024-switch-at-141-32-million-units/

If I missed any AI hallucinations, let me know!