📈 Top 5 Insights from the State of Mobile Gaming Report by data.ai

Mobile gaming market milestones, emerging trends, and exclusive insights

Hello GameMakers,

This week, we cover the just-released report from data.ai on the State of Mobile Gaming 2024.

I highly recommend downloading and reviewing the report, but we’ll cover some key highlights in this edition. Scroll down for the full breakdown!

Also, we are hosting an exclusive, invitation-only GDC dinner reception (Tues March 19) on The Future of Gaming. If you would like to apply to attend, scroll down for more information.

Top 10 Charts

Garena’s Free Fire is the #1 worldwide downloaded game. It is also one of the earliest battle royale games to launch and is distinctly different from other mobile shooter games based on its accessibility (e.g., low-end device support). And yet, the overwhelming strategy of new mobile shooter games is to push to higher-end graphical fidelity, with almost everyone jumping from Unity to Unreal.

Watch for Netease’s new Blood Strike shooter game for mobile. It features a 100-person battle royale, 4v4 TDM, AND supports low-end devices with only 2GB of RAM.

菇勇者傳說, aka Legend of Mushroom, had a legendary day last week on Feb 14, making ~$3.6M that day according to data.ai estimates! Last week, the game made a big jump to reach #6 in top revenue worldwide.

Which games in the top 10 downloads are unlike the others? What does that say about their UA strategy for profitability? ROBLOX will also always have high organics.

I want to point out that Century Games’ Whiteout Survival continues to sit in the top 10 revenue without requiring as much UA as some of the other games in the top 10. If you want to learn more about how Century Games is performing so well, you should apply to the GameMakers GDC dinner, which is being co-sponsored by Century Games! See below to apply.

Revenue per download (RPD) for Game for Peace, according to data.ai, is over $14 on iOS vs. $6 or so for Call of Duty Mobile worldwide. I couldn’t pull Android data, but it strikes me as odd or something unique about the Chinese market that Game For Peace is in the top 4 downloads, yet Call of Duty: Mobile is in the top 10 revenue. There is something odd here. I’m not saying fishy; I’m saying there’s a nuance here I believe I’m missing.

Top 10 Mobile Publishers

Hypothetical scenario: What if Dream Games and Moon Active merged? The combined company “Dream Active” would be a top 3 publisher and potentially have interesting synergies given their games and competitors. You know what I’m saying… Lol.

Top 10 Steam Games

I’ve just been told by one of the best game designers I know that the social features in Helldivers should be studied very carefully and are aligned against one of the themes I’ve discussed a lot on podcasts and in this newsletter before: the shift since Covid towards cooperative gameplay models. This description of the theme is a simplification, and maybe I’ll write on this trend in the future, but I will certainly be buying and checking out Helldivers soon!

This is the report we are covering in our newsletter today. You should check it out.

See below for some of the key highlights.

Future of Gaming GDC Dinner Reception: Apply to Join!

GameMakers seeks doers and critical thinkers in the games industry with unique perspectives and key insights to our invitation-only and exclusive GDC dinner reception.

We prefer gathering those actively battling in the arena (not just superficial/high-level talking heads or high-level execs) who think deeply and critically about what’s happening in our industry and can discuss and debate differing perspectives.

Many thanks to our gold sponsors: Century Games and Sensor Tower!

Date: March 19, Tuesday

Time: 6:30 PM - 10 PM

Panels:

AI x Gaming: The biggest impact of AI to gaming!

Future of Gaming: Emerging Themes and Trends

If you would like an invitation, please comment on this post with a unique perspective on the game industry you believe is controversial. If you don’t want your perspective to be public, DM me.

Based on the responses received, I will select up to 3 people to invite.

🔦 Top 5 Insights from data.ai’s State of Mobile 2024 report

There are a number of additional details and insights I recommend you check out yourself:

Here are the top 5 insights you should be aware of:

#1. The mobile gaming market is very healthy!

If you account for COVID growth/craziness in 2020/2021, comparing 2020 and 2023 suggests the industry will continue to grow. This is despite two down years in consumer spend and a down year in downloads last year.

Having said that, word on the street suggests that if it weren’t for the COVID boost, a number of gaming studios would have gone out of business, and many shifted from losses to profitability because of the COVID boost.

Hence, while we’re rationalizing from the boost we saw, the overall market has been and continues to be healthy, and we should see continued growth.

data.ai’s comparison of 2020 to 2023 is the best visualization to see this trend.

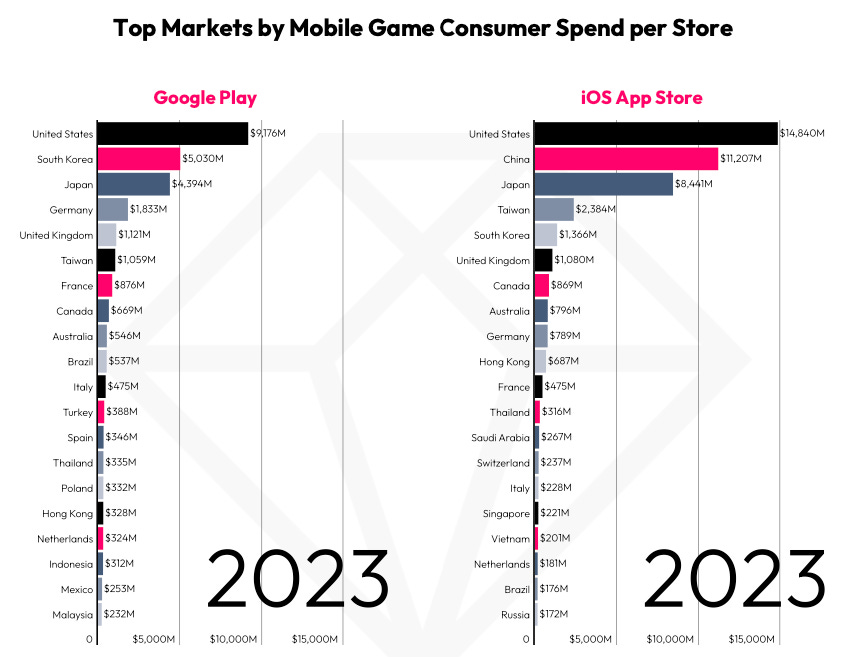

#2. The top mobile markets by country

Understanding the biggest markets by download and revenue is a great view to understand where you can focus your future games to maximize success.

For example, the sheer volume of downloads for the top markets on Google Play represents a great perspective on where the puck is headed. And, where the market is today, if you can figure out lower-end device support and monetization relative to operating costs.

Companies that can figure out India, Brazil, and Indonesia can have a bright future.

While many developers will be blocked out of China, the US continues to represent the most attractive market in the world by a wide margin.

Also, remember that China here is under-represented as the data intelligence services don’t track alternative app store data.

#3. Global Mobile Ad Spend continues to increase!

Wait a minute. Consumer mobile spending and downloads are down post-COVID, but global mobile ad spend has continued to increase.

What about IDFA deprecation and its impact on ad targeting? Shouldn’t this have decreased ad spend? Aren’t a bunch of game studios suggesting their ad budgets are down?

If only someone recorded a podcast that explains what’s going on with mobile ad measurement and the future of mobile ads. Lol, stay tuned. We got a banger coming up for you soon…

In the meantime, while we had slower growth, data.ai’s chart clearly shows overall spending did not reduce, and marketers continued to spend through IDFA deprecation.

#4. New releases are getting whacked, and Hypercasual is no longer hyper-downloaded

The chart below shows the number of new games released per year. The number of new releases dropped significantly in 2022 and 2023.

Further, most of the decline shown disproportionately impacted hypercasual titles in 2021 - 2023.

Also, the chart on the bottom shows that while the average downloads by new releases dropped in the past few years, it finally started increasing again in 2023. Hopefully, this is the turning point to longer-term download growth for new releases.

#5. Player demographics by genre

The French philosopher Auguste Comte is famous for saying: “Demography is destiny.”

What does the demographic skew towards specific game subgenres suggest to you? What are the implications for your game strategy for success?

Unsurprisingly, old-timers prefer solitaire, Match-3, and Slots (Casino). Young players prefer Battle Royale, Arcade Racing, and Team Battle RPGs.

The gender differences are also somewhat unsurprising but similarly potentially useful to understand.

Prediction: The mobile market will continue to stall in its growth, but the new successful titles will continue to break individual revenue records - i.e., we will have fewer successes, but larger ones.

We will see roughy to what happened to the movie industry in the 1970s with the release of Jaws. After the release of Jaws, most of the budgets and creative talent started to be sucked in into fewer big-budget projects (blockbusters). Jaws also ditched the "limited release" cycle of movie at that time (e.g., even Godfather initially launched at 5 theaters), and went straight to "wide release" after a large marketing campaign. The "limited release" of movies is the analogue of "soft launches" in mobile gaming, so hence we will likely see more big-splash releases without soft launching. A good example would be Honkai: Star Rail

Would love to take part in the dinner!

Hi there, I'd love take part in the future of games dinner! My "controversial" opinion is that the definition of a "game" will evolve considerably at a societal level, which will be confusing for traditional players in the industry, but ultimately good for "players" (who may just be thought of as "users" in some contexts). Multiplayer game development in particular is important to this and it will be further normalized & simplified with a lower barrier of entry for devs thanks to more middleware-type entities and tech providing foundational tools (think UEFN, Roblox, etc but more bespoke and white label). This coinciding with the arrival of new AI-assisted or powered content tools will not only fuel a surge in game development but also ensure these games are vastly different in design and engagement from today's chart-toppers. This transition may be bewildering for traditionalists but, by integrating gaming with diverse aspects of our digital & physical lives, we stand on the brink of a creative gaming renaissance.