Hi friend,

This week, I’m in Chennai, India, attending India’s largest game development conference, IGDC.

Five years ago, I cofounded a mobile gaming studio in India. People told me I was crazy then. And that the vision for what I wanted to try to do would be impossible.

Today, I’m asked how best to start a game studio in India. Furthermore, over the past five years, I have witnessed the growth of the local gaming player market, unlike anything I have ever experienced before.

Check out the data for yourself below!

In light of IGDC coming up, we talk about the two opportunity spheres associated with India in a two-part series:

The Indian Gaming Market (Part 1): The MASSIVE growth and opportunity presented by the booming local gaming market in India.

The Indian Game Studio Opportunity (Part 2): The opportunity for India to become the next China for game development, initially serving the burgeoning AA and eventually the AAA market for games.

The Massive Indian Gaming Market Opportunity - Part 1

Everyone saw India ban Real Money Gaming in August 2025. Almost nobody is tracking where $2 billion in annual gaming spend is about to flow.

While headlines focused on the massive impact on Dream11 and MPL (a collective loss of approximately $10 billion in market cap), a structural shift was happening underneath: 140 million paying gamers in India—20% of the total gaming population—suddenly lost their primary entertainment outlet. These weren’t casual players. They were users comfortable with UPI payments, habituated to daily gaming sessions, and proven to convert at rates Western publishers dream about.

The capital, the users, and the infrastructure don’t disappear when you ban a category. They redirect. And right now, they’re redirecting into free-to-play gaming at a scale that makes India the most underpriced gaming opportunity in global markets.

Where does the margin flow?

Executive Summary

India’s RMG ban eliminated billions in revenue but created a larger opportunity for F2P gaming. With 520 million gamers, 835 million internet users, a median age of 29, and ARPPU growing 9x since 2020, India’s digital gaming market is projected to more than double from $1.9 billion in FY25 to $4.3 billion by FY30. The combination of macro tailwinds—rising discretionary income, mobile-first infrastructure, and regulatory clarity—positions both global and local developers to capture users and spend fleeing the banned RMG category.

Do the current even further macro tailwinds drive the future potential of India’s gaming market even more?

India Didn’t Ban Gaming. It Banned One Business Model.

The August 2025 Promotion and Regulation of Online Gaming Act banned online money gaming nationwide, eliminating categories such as fantasy sports and skill-based card games, which accounted for 98% of India’s gaming revenue in FY23. The headlines treated this as a death blow to Indian gaming.

The data tells a different story.

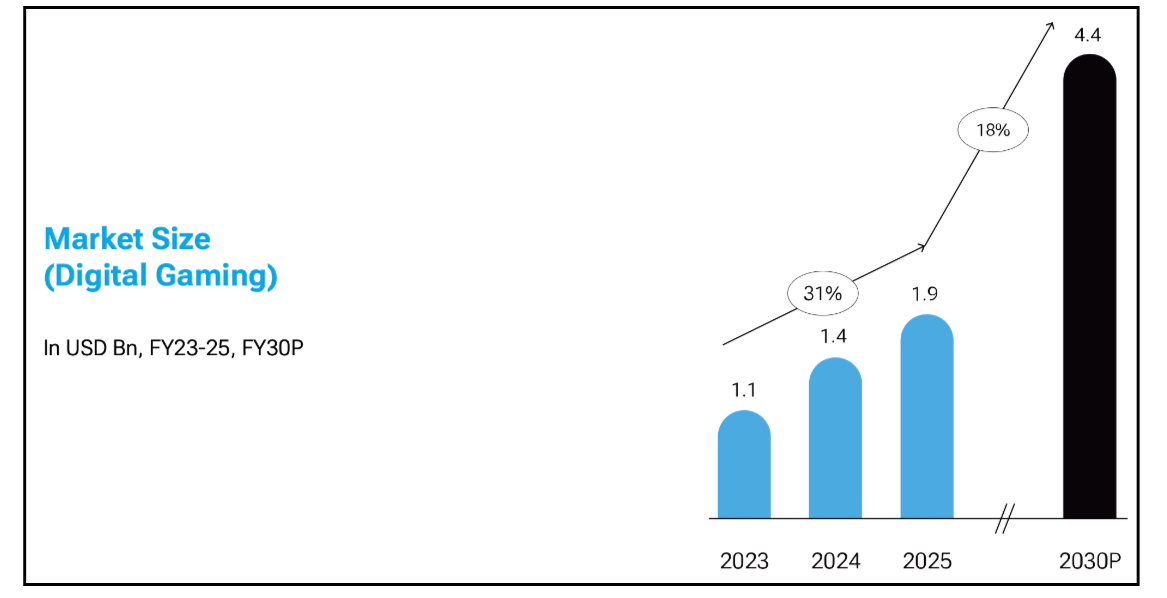

Digital gaming (excluding RMG) grew at 31% CAGR from FY23 to FY25 even before the ban. Post-ban, growth is expected to accelerate, with the digital gaming market projected to reach $4.3 billion by FY30—an 18% CAGR from FY25. Meanwhile, the total Gaming and Interactive Media market is expected to grow even faster at 26% CAGR, reaching $7.8 billion by FY30.

This isn’t speculative. The structural reset is already visible in user behavior. According to BITKRAFT and Redseer’s October 2025 report, the share of paying gamers in India increased from 80 million in FY21 to 140 million in FY25, and is projected to hit 230 million by FY30. These users aren’t leaving gaming—they’re switching categories.

Where RMG required users to deposit money upfront and accept financial risk, F2P games entertain first and provide wider monetization flexibility. For 140 million users accustomed to daily gaming habits and mobile payment rails, F2P represents a lower-friction, higher-entertainment alternative. The infrastructure they built—app installs, payment methods, gaming routines—transfers directly.

The Macro Tailwinds Are Unprecedented

India’s gaming boom isn’t happening in isolation. It’s supercharged by macroeconomic shifts that dwarf the RMG ban in significance.

Consumption is surging. According to the report, Private Final Consumption Expenditure (PFCE)—the share of GDP driven by household spending—now accounts for 61% of India’s GDP. This matches the United Kingdom (61%) and approaches levels seen in consumption-driven economies like the United States (68%) and Brazil (64%), while far exceeding other major emerging markets like China (40%), Indonesia (55%), Saudi Arabia (45%), and UAE (46%), based on IMF and World Bank data cited in the report.

Translation: India’s economy runs on consumer spending, not just exports or manufacturing. This creates a foundation for discretionary purchases, such as gaming.

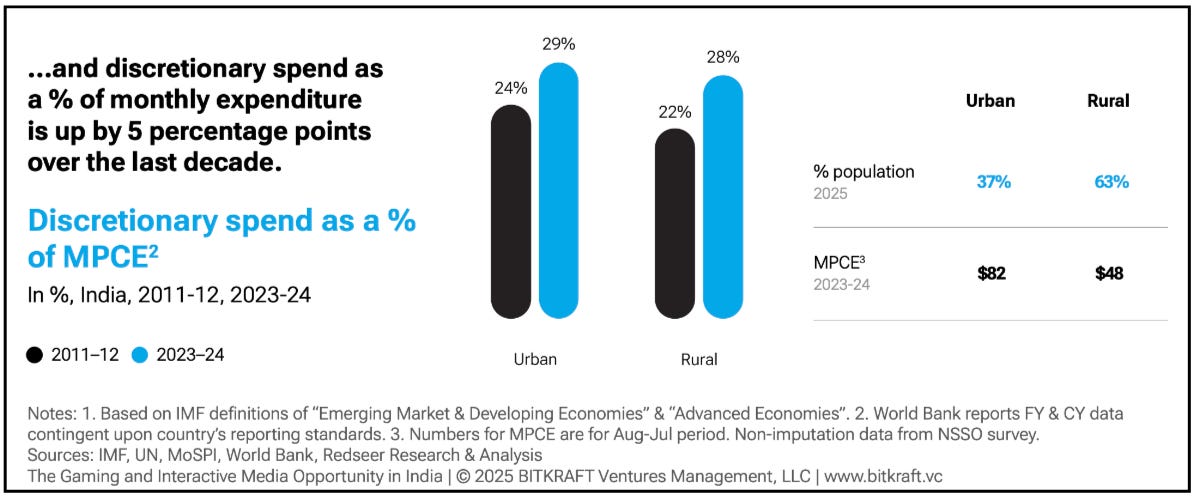

And that discretionary spending is accelerating. The report shows that discretionary spending as a percentage of monthly expenditure increased 5 percentage points over the past decade: from 24% to 29% in urban areas and from 22% to 28% in rural areas, based on India’s National Sample Survey Office (NSSO) data for 2011-12 and 2023-24.

Demographics favor digital entertainment. India’s median age is 29, with 51% of the population under the age of 30. Of 835 million internet users in FY25 (projected to reach 1.12 billion by FY30), 520 million play at least one game. That’s a 66% internet-to-gamer conversion rate—and it’s accelerating as Tier 2 and Tier 3 cities come online.

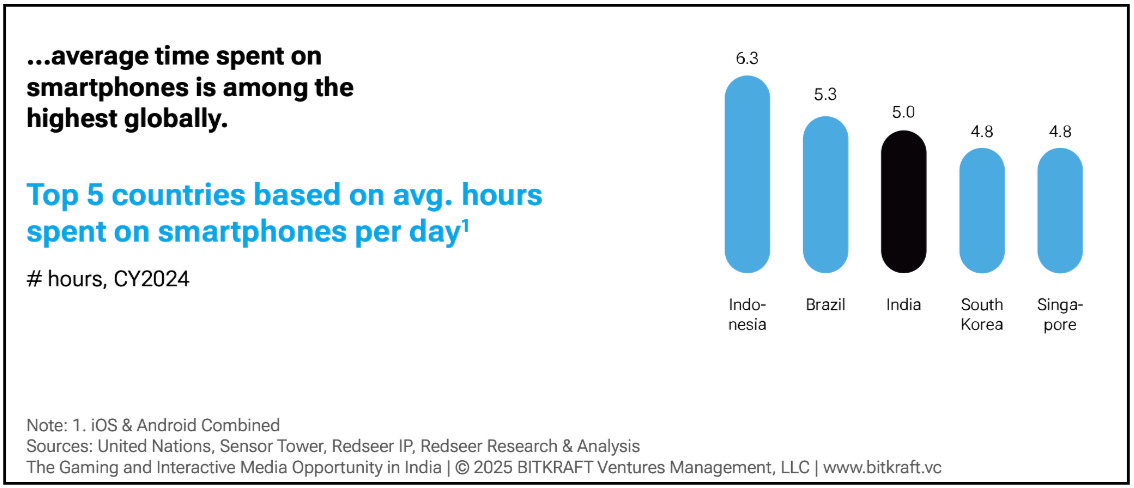

Infrastructure costs collapsed. India has the lowest mobile data costs globally at approximately $0.15 per GB—6.7x cheaper than the US and 12.7x cheaper than the UK. Smartphones in India cost roughly half the price of equivalent devices in the US and UK (which are both 1.9x more expensive). Meanwhile, Indians spend an average of 5 hours per day on smartphones—the third-highest globally behind Indonesia (6.3 hours) and Brazil (5.3 hours).

This combination—rising incomes, young demographics, cheap data, and high engagement—creates what BITKRAFT calls a “mobile-first ecosystem” where gaming becomes the default leisure activity for a generation coming of age entirely on smartphones.

Battle Royale Dominance Signals, Not Limits, the Opportunity

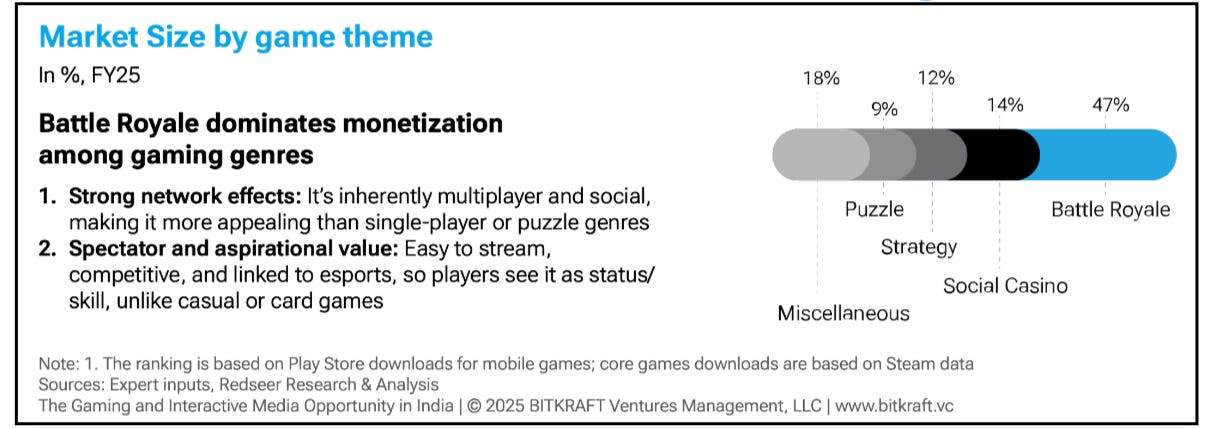

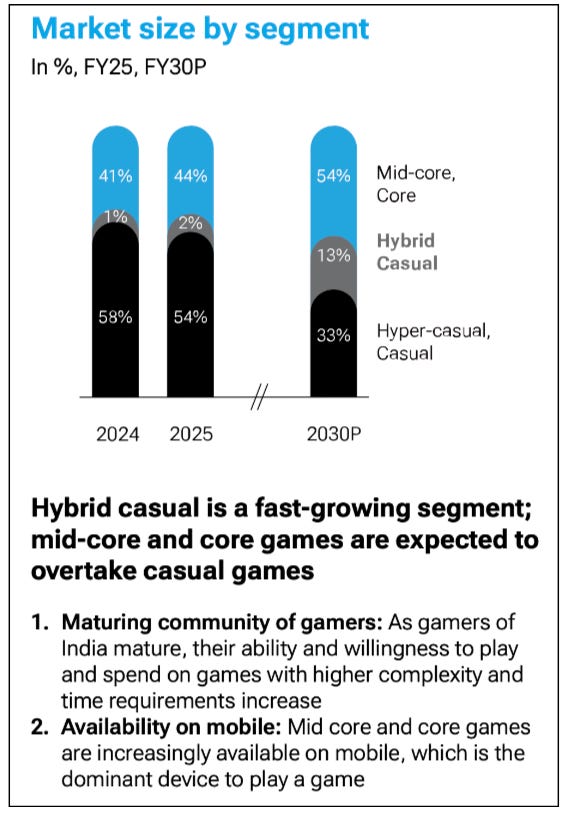

The Indian gaming market today looks highly concentrated. Battle Royale games—primarily BGMI (Battlegrounds Mobile India) and Free Fire—account for 47% of total gaming revenue in FY25. Simulation games dominate downloads at 22% of the top charts. Casual and hyper-casual games make up 54% of market share by segment.

This concentration isn’t a weakness. It’s a leading indicator of massive untapped diversification potential.

When one genre captures nearly half of all revenue in a market projected to double in five years, it signals that user demand is ahead of supply-side innovation. Battle Royale succeeded because it solved for India’s two dominant gaming motivations: socializing (cited by 40-50% of mobile gamers) and familiarity (50% of gamers in FY24 preferred local games with regional content).

As the market matures, developers who address other motivations—such as competition, progression, status, and creativity—will unlock new segments. The early signs are visible: hybrid casual games, which blend casual mechanics with mid-core progression systems, are the fastest-growing segment. Mid-core and core games are expected to grow from 41% of the market in FY24 to 54% by FY30.

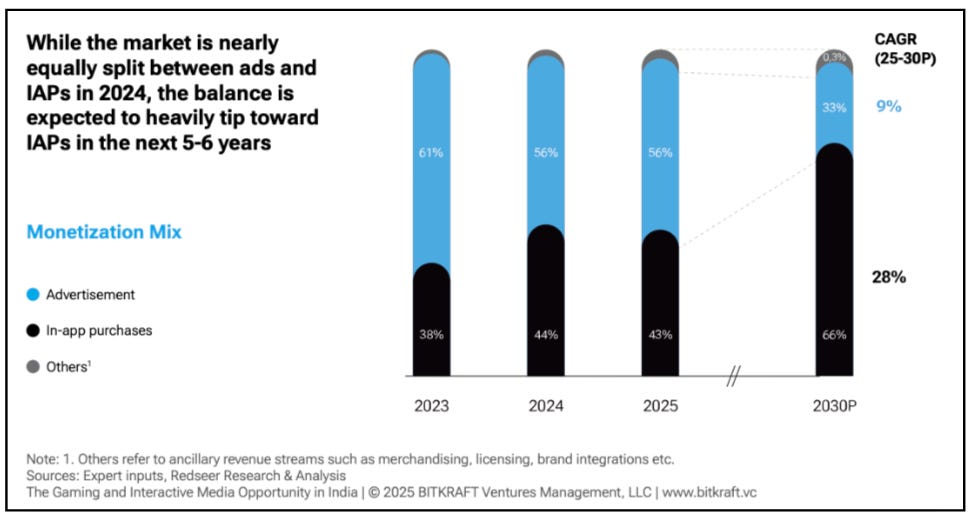

Genre diversification historically follows monetization maturity. In India, ARPPU increased 9x from $3 in FY20 to $27 in FY25. In-app purchases (IAPs), which accounted for 38% of revenue in FY23, are projected to reach 66% by FY30, overtaking advertising as the primary monetization lever.

Translation: Indian gamers are increasingly willing to pay for progression, customization, and competitive advantage—the monetization mechanics that drive mid-core and core games globally. As developers layer these systems onto locally relevant IP and themes, the revenue per user will expand, and the genre mix will diversify.

Local vs. Global: Two Different Opportunities, Same Tailwind

The India opportunity bifurcates into two distinct plays:

For global developers, India represents a massive, undermonetized audience with proven payment behavior. The 520 million gamers in FY25 already exceed the entire US population. The 140 million paying gamers match the paying user base of many mature Western markets, but at 1/10th the ARPPU. As purchasing power increases and payment friction decreases (UPI adoption is near-universal), the ARPU gap will compress. Developers who localize for India now—local language interfaces, regionally relevant content, social features optimized for voice chat—will capture a disproportionate market share as the category scales.

For local Indian developers, the opportunity is even larger. According to BITKRAFT/Redseer analysis of Play Store download data, five of the top 10 games in India by downloads in FY24-25 were from Indian publishers: Ludo King (1 billion+ downloads), Zupee Ludo, Indian Bikes Driving 3D, WinZO Ludo, and Cricket League. These games succeeded by solving for cultural familiarity. Ludo King’s premise—a digitized version of a board game that every Indian household owns—required zero explanation. The social features (voice chat, multiplayer lobbies) mapped directly to how Indian families and friends already interacted.

[INSERT GRAPH: Top Games by Downloads and Revenue, Page 25 of report]

But here’s the underappreciated insight: over 80% of Indian game developers’ revenue comes from overseas markets. Studios like Gameberry Labs (Ludo Star), Moonfrog Labs (Ludo Club), and Nazara (CATS: Crash Arena Turbo Stars) generate the majority of their revenue outside India. They’ve proven they can compete globally on game design, live ops, and monetization.

The RMG ban removes the distraction. For five years, Indian gaming talent was pulled into building skill-based gambling mechanics optimized for user acquisition and retention on a 30-day timescale. Now that capital and talent can redirect toward building IP-driven, progression-based games with multi-year retention curves. The 500+ gaming studios founded in India over the past five years—many staffed by developers trained at global publishers—are now competing for the same user base that RMG vacated.

The result: a Cambrian explosion in supply-side experimentation, with both global and local developers racing to serve the same 520 million users.

Takeaways

The RMG ban didn’t destroy demand—it redirected it. Approximately 140 million paying gamers, accustomed to daily gaming sessions and mobile payments, are transitioning from skill-based gambling to free-to-play (F2P) entertainment. Digital gaming is projected to grow from $1.9 billion (FY25) to $4.3 billion (FY30) at an 18% CAGR.

Macro tailwinds are unprecedented. Discretionary spending has increased by 5 percentage points over the past decade. PFCE accounts for 61% of GDP, and India has 835 million internet users with a median age of 29. Data costs are the lowest globally, and smartphone usage averages 5 hours per day.

Battle Royale’s 47% revenue share signals opportunity, not saturation. When one genre dominates revenue in a market projected to double, it reveals that user demand is ahead of supply-side innovation. As ARPPU grows 9x (from $3 in 2020 to $27 in 2025) and IAPs overtake ads by FY30, genre diversification into mid-core and core will accelerate.

Local developers have a home-field advantage but global ambitions. Five of India’s top 10 games by downloads are from local publishers, but 80% of Indian developers’ revenue comes from overseas. Post-RMG, that talent is redirecting toward IP-driven, progression-based games that can compete both locally and globally.

Localization is non-negotiable for global developers. 50% of Indian gamers prefer local games with regional content. Voice chat usage in BGMI is higher in India than in any other country. Developers who solve for cultural relevance, localized UI, and social features optimized for Indian behavior will capture outsized market share.

Next in Part 2: Why India could become a world-class game development hub similar to China—the rise of the White Tiger.

Sources: BITKRAFT Ventures & Redseer Strategy Consultants, “The Gaming and Interactive Media Opportunity in India,” October 2025.