Hey Folks,

Coming at you this week:

Macro: We dissect the massive $55 billion acquisition of Electronic Arts. I’ll take you beyond the headlines and offer an operator’s perspective. We’ll also deep dive into the likely buy-side and sell-side narratives that got this deal done.

Alpha: We’ll explore the alpha lessons from Grow a Garden, a Roblox game made by a 16-year-old that quietly became the biggest game in the world for a time—secret interview with a games industry insider.

Game Dev: I’ll share a powerful mental model called the “Alien’s Eye View” that will prompt you to examine whether your team’s actions truly align with its stated goals or intended purpose.

There’s a lot in the audio podcast that isn't covered in the newsletter; be sure to check it out.

→ Listen on Spotify, Apple (More Gamemakers content on YouTube)

Top 3 Most Significant Gaming News From Last Week

Saudi Arabia-Led Consortium Acquires EA for $55 Billion (Axios): Electronic Arts announced a historic $55 billion acquisition by a consortium including Saudi Arabia’s Public Investment Fund, Silver Lake, and Jared Kushner’s Affinity Partners in the largest leveraged buyout ever. The deal, announced September 30, will take EA private with $20 billion in debt financing from JPMorgan Chase, raising concerns about potential studio closures and layoffs to service the debt.

Xbox Game Pass Ultimate Price Increases 50% to $30/Month (CNBC): Microsoft raised Xbox Game Pass Ultimate pricing from $20 to $30 per month effective October 1, adding Ubisoft+ Classics and Fortnite Crew while upgrading cloud gaming to 1440p. The restructuring eliminates the Game Pass Core and Standard tiers in favor of Essential and Premium options, prompting widespread user backlash and leading to a surge in subscription cancellations.

Ubisoft and Tencent Launch Vantage Studios (TweakTown): Ubisoft has established Vantage Studios, a new Tencent-backed subsidiary with a $1.2 billion investment, to oversee the development of the Assassin’s Creed, Far Cry, and Rainbow Six franchises. Tencent owns 25% of the new entity.

1. Macro: EA’s $55B Acquisition - In-Depth Analysis from an Operator’s Perspective

This acquisition marks a somber ending for a company that began with a noble mission. In 1983, founder Trip Hawkins created Electronic Arts to empower a new class of entrepreneur: the “Software Artist.” That vision of championing creators feels worlds away from the EA of today—a scaled publisher of big IP, more focused on commercialism than artistry. In that light, the acquisition feels like a natural, if uninspired, fit.

Trip’s original vision for Electronic Arts:

So, why did the largest leveraged buyout in history happen now? It comes down to a collision of strategic imperatives and compelling financial narratives.

The Banker’s Pitch: Two Sides of a $55B Coin

Every major deal is built on two stories. Here’s the potential pitch that got this done.

The Buy-Side Story (Why the Saudi PIF Bought EA)

Strategic Fit: The deal is a cornerstone of Saudi Vision 2030, the country's plan to diversify its economy away from oil by investing in culture, sports, and entertainment. Gaming is a key pillar of the modern “attention economy,” and EA provides a dominant position.

Massive Upside “Potential”: The pitch from the bankers likely centered on four pillars of growth for the underperforming giant:

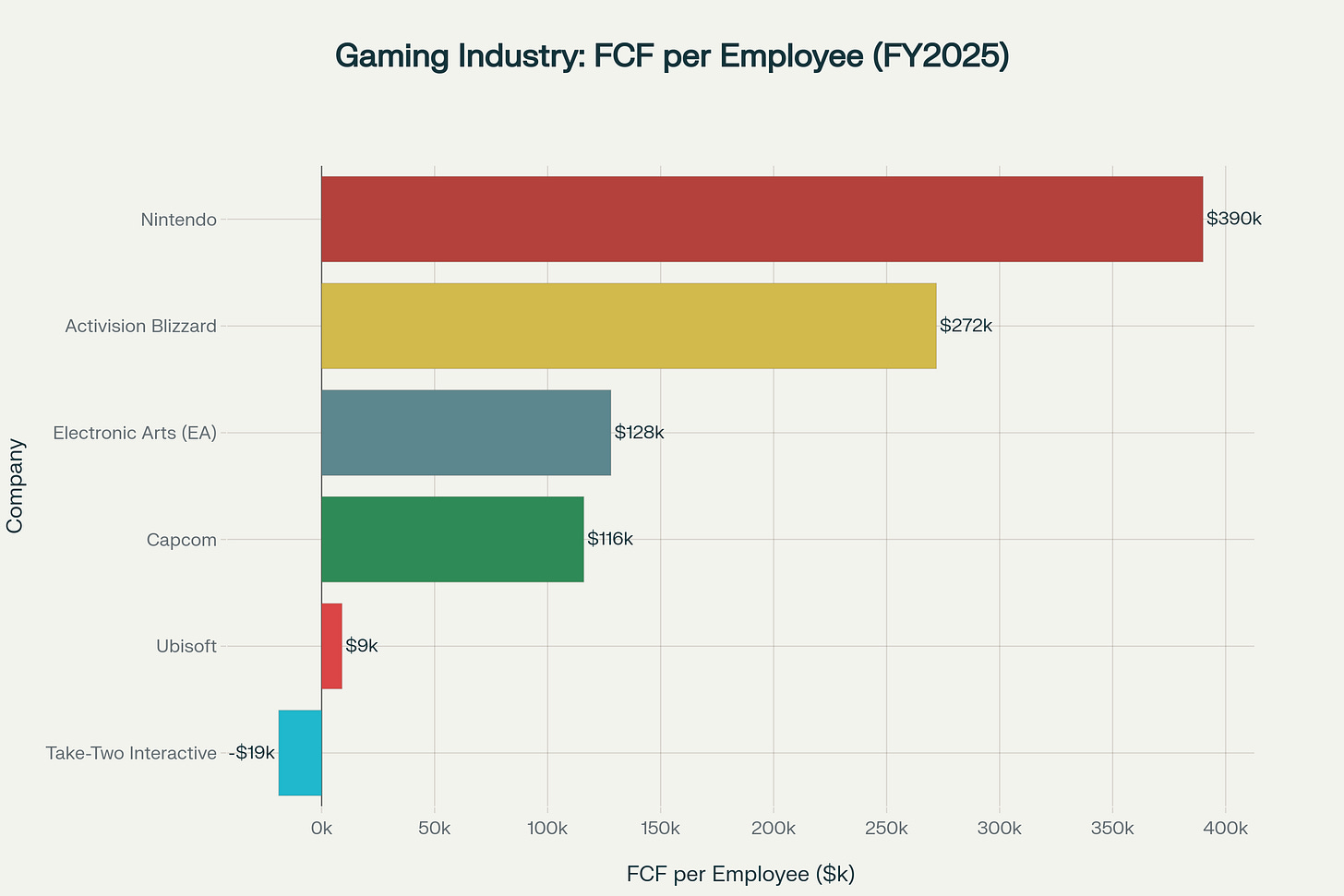

Operational Efficiency: EA generates just $128k in free cash flow per employee, compared to Activision’s $270k and Nintendo’s $390k. With operational specialists from Silver Lake involved, expect significant cost-cutting measures.

Mobile Growth: EA’s mobile revenue is stagnant at ~16% of total bookings. The plan is likely to inject liveops DNA from other PIF investments (like Scopely) and 2-3x this business.

Asia Expansion: The APAC region accounts for 50% of the global games market, yet it generates less than 15% of EA’s revenue. Fixing this historical weakness is likely a core part of the thesis.

Transmedia & AI: EA’s IP (Mass Effect, Dragon Age) is significantly underleveraged in film and TV. AI is also framed as a call option for massive future cost reduction and revenue growth.

The Sell-Side Story (Why EA’s Board Sold)

Stalled Growth & Franchise Fatigue: The on-the-ground reality at EA is challenging. The company posted -1% top-line growth in fiscal ‘25, and live services growth has stalled at 1%. Key franchises are showing their age, with Dragon Age: The Veilguard missing sales targets significantly after nine years in development.

Concentration Risk: Over 50% of EA’s revenue comes from just four franchises. The biggest, Ultimate Team (~$2.2B), relies on loot box mechanics that face serious regulatory risk.

The Competitive Threat: China is producing massive, high-quality original IPs (Genshin Impact, Wuthering Waves) that are leaving Western development behind. EA’s historical advantages in retail distribution are now meaningless. From this perspective, EA looks more like a dinosaur than an insurgent, making a sale at a 25% premium a smart move.

Deal Mechanics & Industry Implications

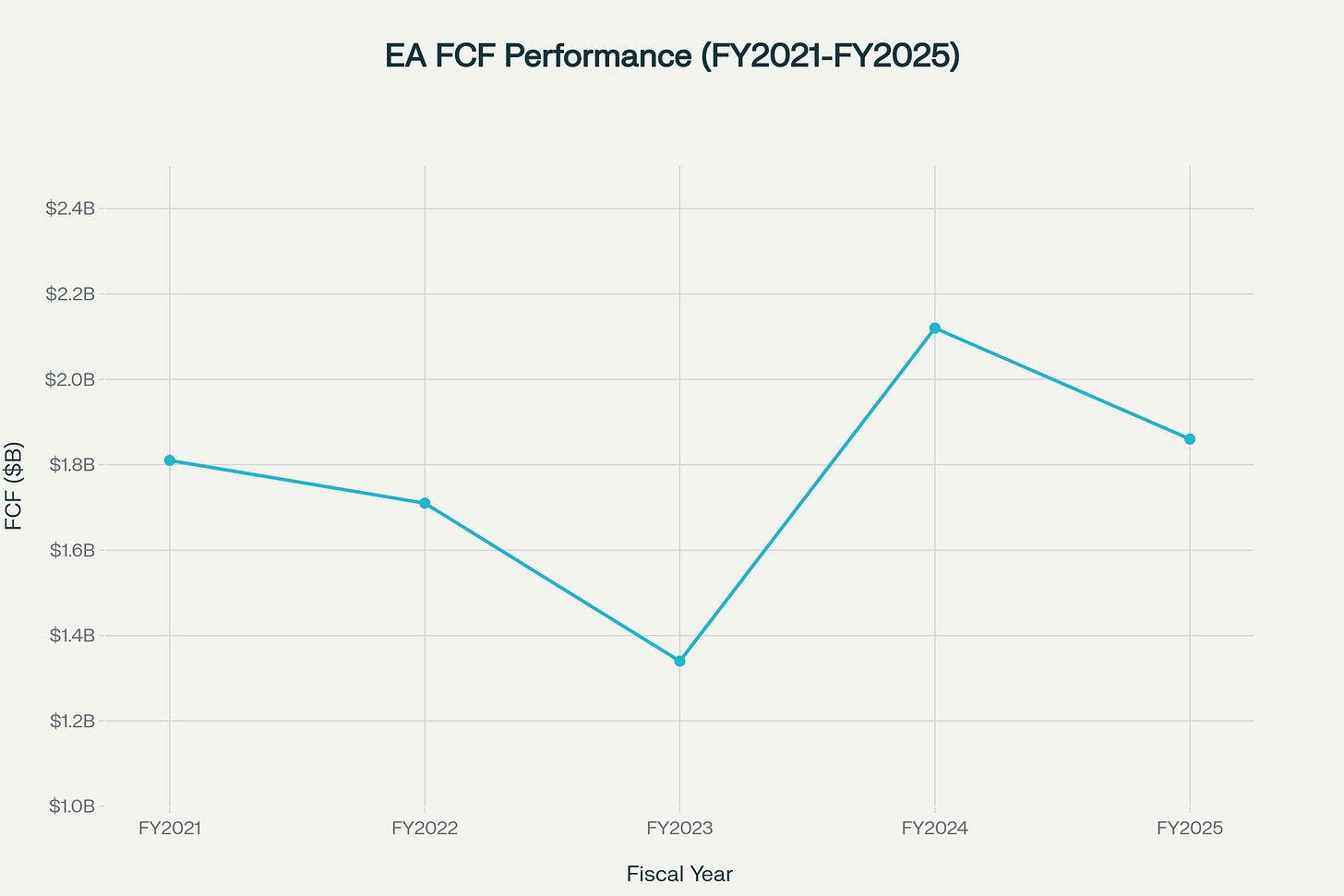

High Leverage, High Risk: The deal involves roughly $20 billion in debt. This requires ~$1.8B in annual debt service, which is roughly equal to EA’s average free cash flow. This represents a high level of leverage (9.8x debt-to-EBITDA, compared to an LBO average of 5.2x). While Saudi’s deep pockets can cover any shortfalls, execution is not guaranteed.

Industry Impact:

More Big Deals: The banks made nearly a billion dollars in fees here. You can be sure they are already pitching similar LBOs for companies like Ubisoft and CD Projekt.

Information Blackout: With fewer public companies, we lose valuable business data from public disclosures.

Saudi’s Push to Be #1: The PIF seems intent on being the top player in gaming. Expect them to push their portfolio to create #1 hits, which will have significant ripple effects on the competitive landscape.

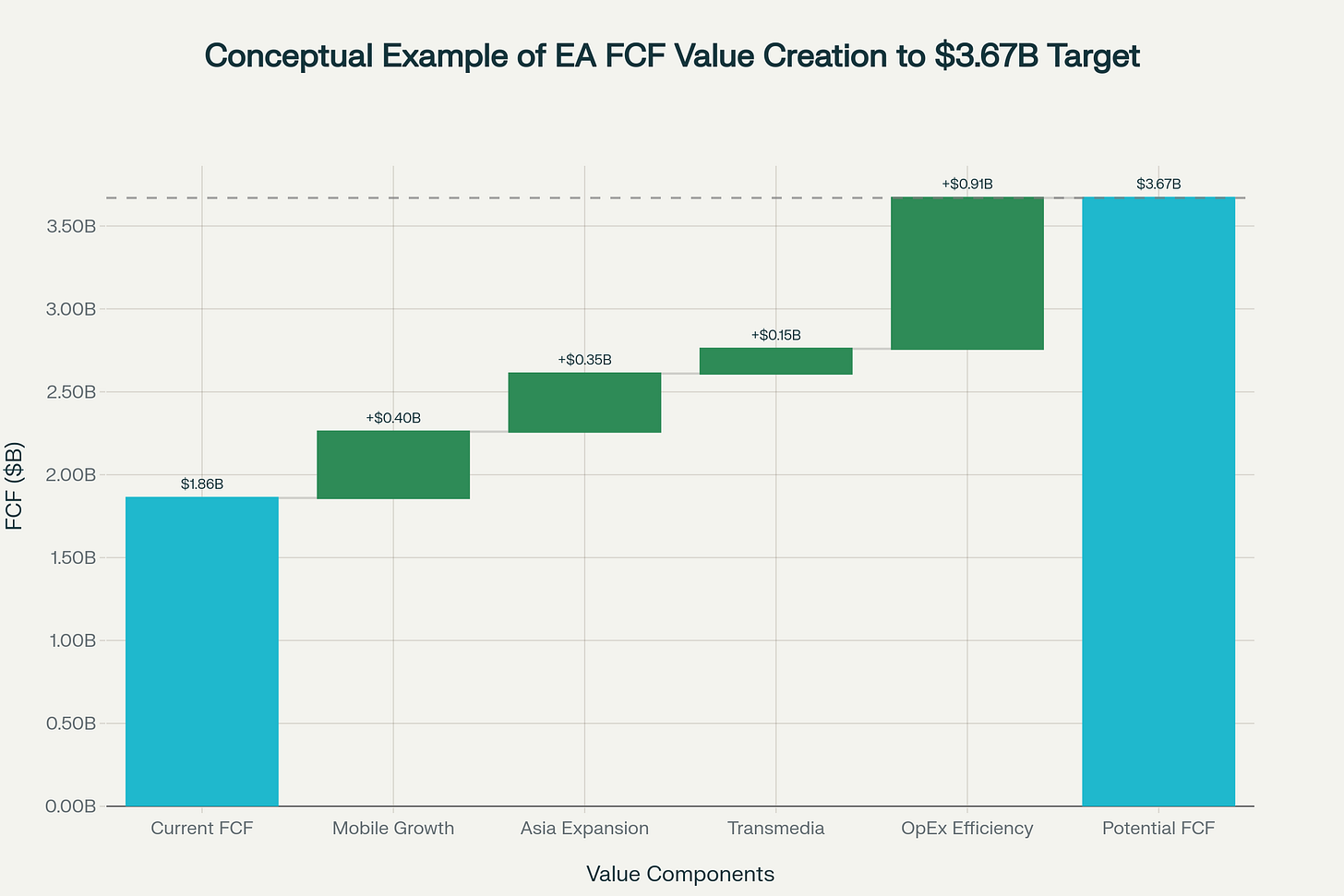

How will EA do under new ownership? Well, that’s a big question. I’m skeptical, but you can do your own analysis. Here’s a hypothetical example illustrating how you can draw your own conclusions by focusing on the impact of the various theses on FCF:

^^ This is obviously a conceptual example.

I delved deeply into all of these issues and more in the podcast. Be sure to check it out!

2. Alpha: Lessons from the Biggest Game in the World—Grow A Garden

Grow Garden hit 22.3 million concurrent players on Roblox—more than Fortnite’s all-time peak. The secret? It’s just Farmville with a modern coat of paint.

This week, we have a Q&A with a secret game industry insider who has specific expertise in Roblox games and Farmville.

Here’s what I asked:

From your perspective, how did Grow a Garden become so successful?

To some degree, Grow a Garden is just a modern-day FarmVille. What are the similarities between the two games?

What are the differences between FarmVille and Grow a Garden that enabled the game to achieve so much success on Roblox? What are the platform-specific drivers?

Grow a Garden was built by a young dev… but then a deal was struck with a team. What did that deal look like, and what did that team do to help drive the game to so much success?

How do you view the opportunity of looking at older games and reviving them for a modern audience on a platform like Roblox, similar to Grow a Garden?

Lesson 1: The Innovation Framework That Still Works

Our secret gaming insider reveals the formula popularized by Mark Pincus/Zynga:

The Zynga Framework:

1/3 Proven mechanics (farming gameplay)

1/3 Better execution (3D, real-time multiplayer)

1/3 New elements (viral TikTok-worthy plants, PvP stealing)

Lesson 2: What Farmville Got Wrong That Grow Garden Fixed

The Core Loop Evolution:

Farmville: Plow → Plant → Harvest (PPH)

Grow Garden: Plant → Harvest (simplified)

Result: Lower friction, faster dopamine hits

The Audience Adaptation:

Removed crop withering (killed Farmville’s casual audience)

Added stealing mechanics (Gen Z loves competitive elements)

Made plants “over the top” for social sharing

Real-time multiplayer vs asynchronous Facebook requests

Lesson 3: The Publisher Playbook

BMW Lux built it in 3 days, but Splitting Point Studios scaled it:

The Growth Hacker Model:

Scout for diamonds in the rough

Invest/acquire promising games

Professionalize the operation (UI/UX, LiveOps, monetization)

Move fast, pivot faster

Current team: ~30 people managing multiple games

Key insight: We’re seeing 9-figure deals for single Roblox games. Dave Baszucki wants billion-dollar Roblox studios, and it’s going to happen sooner than you think.

Lesson 4: The Broader Opportunity

Don’t just port old games—adapt and refresh:

Zynga couldn’t even port Farmville successfully to mobile

Supercell won with Hay Day by rebuilding from scratch

The winners understand platform-native design

The formula for success:

Find proven mechanics from 10+ years ago

Adapt for modern platforms and audiences

Add viral/social elements native to the platform

Iterate fast based on player behavior

Make sure to check out the podcast for a lot of really great insights!

3. GameDev: Actions vs. Intent, The Alien’s Eye View

For this week’s GameDev lesson, I want to share a powerful mental model that exposes the gap between what your team says it values and what its actions prove it values.

Chris Williamson’s concept of “The Alien’s Eye View” exposes the brutal truth about what we say and what we actually do:

“Imagine an alien watching you work. It knows nothing about your motivations or intentions—it can only see what you do. What would it think you value?”

You might say the biggest priority is fixing the core loop.

But the alien, watching your team spend 80% of its time on a new vanity cosmetic system, would conclude that cosmetics are what you truly value.

The insight is profound: Action eats intention for breakfast. We often say our biggest problem is X, but our weekly tasks are focused on Y and Z.

How to Align Action with Intent

At my studio, we’ve restructured our weekly product meetings to combat this drift and force alignment:

Monday Sprint Review: We kick off the week by verifying that our planned tasks align with our top-priority goals for the sprint.

Midweek Check-in: We discuss progress and brainstorm solutions, always through the lens of our primary goal.

End-of-Week Retro: We assess what we accomplished and ask the hard question: “Did our actions actually move the needle against our stated intention?”

This simple structure forces you to confront the Alien’s Eye View. It ensures your team is vector-aligned—with all its energy pointed in the same direction—rather than vector-neutral, where effort is scattered and velocity is lost. I highly recommend integrating this thinking into your sprint planning and retros. It’s one of the simplest ways to maximize your team’s effectiveness.