In today’s newsletter, we’re diving deep into three critical topics that are shaping the industry right now.

Macro: We’ll break down how Delta Force on mobile managed to outperform the legendary PUBG by a staggering 75% on recent revenue peaks. How did they do it, and what does it mean for the shooter genre?

Alpha: An intriguing report from Investgame claims a “Take-Two Mafia” is succeeding in mobile. We’ll examine this thesis, show why I disagree, and uncover where I believe the real alpha is hiding.

Game Dev: I’ll share a lesson that’s very close to my heart—why recruiting is often broken and how applying a product management framework from Tony Fadell’s book Build can create a massive competitive advantage.

Let’s get into it. 👇👇👇

→ Listen on Spotify, Apple (More Gamemakers content on YouTube)

Top 3 News

EA in Advanced Talks for $50 Billion Buyout (PocketGamer.biz): Electronic Arts is reportedly in advanced discussions with investors, including Saudi Arabia’s Public Investment Fund (PIF), for a potential buyout valuing the company at $50 billion. If completed, it would be one of the largest acquisitions in video game industry history.

The Take-Two Diaspora: Why Alumni Win Big in Mobile, Not AAA (investgame, Anton Gorodtesky): A report by InvestGame and GDEV suggests startups from Take-Two alumni have secured $3.7 billion in deals since 2020. The analysis shows this success is concentrated in the mobile sector, led by veterans from subsidiaries like Peak Games, contrasting with Take-Two’s AAA focus.

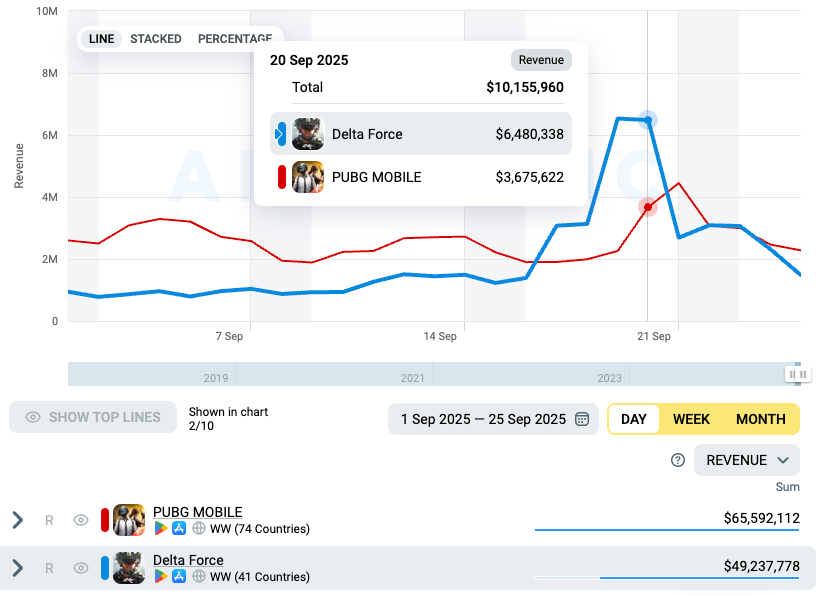

Delta Force Overtakes PUBG Mobile in Historic Revenue Milestone (AppMagic): Delta Force achieved an unprecedented 75% revenue outperformance over PUBG Mobile on September 20, generating $6.48M versus PUBG’s $3.68M, marking the first time any mobile shooter has significantly challenged PUBG’s dominance.

1. Macro: How Did Delta Force Outperform a Titan?

We just saw a truly unprecedented event in the mobile shooter space. Our partners at AppMagic flagged that Delta Force had a monster run, outperforming PUBG Mobile by 75% on certain days. While Garena Free Fire has occasionally topped PUBG, it has never been with this magnitude or sustained over several days.

This raises some huge questions. Is a new king being crowned? And how did a relatively new game pull this off? Let’s look at the data.

First, some context on the giant they’re challenging.

PUBG Mobile: Launched in April 2018, this game is one of the most successful of all time. It has generated over $9.2 billion in lifetime net revenue and boasts over 1.2 billion downloads. It’s a cash machine, averaging about $3.4 million in daily net revenue.

Now for the challenger.

Delta Force on Mobile: Launched in September 2023, with a global release in April 2024. To date, it has generated $224 million in lifetime net revenue from 47 million downloads, averaging around $1.1 million daily since its global launch.

The Surprising Story in the Data

When you compare their launches, PUBG had dramatically higher downloads and daily active users. That’s not a surprise, as hitting massive scale was easier back in 2018.

However, the revenue story is shocking. Despite a massive gap in users, Delta Force generated significantly higher revenue at launch than PUBG did. This suggests its per-user monetization is on another level, likely driven by superior design and LiveOps.

The real explosion happened around September 20th. Delta Force’s average daily revenue of $1.1 million spiked to over $6.5 million on September 20th—a 6x increase.

So, what caused this massive surge?

Esports Integration: The spike was driven by the game’s first-ever esports world championship, the Delta Force Invitational, which had a $500k prize pool.

Sophisticated LiveOps: The event was supported by a “Pick’em Challenge” letting players wager on matches, a massive server-vs-server competition, and a dedicated tournament store. This shows how much LiveOps and esports integration have evolved into powerful monetization engines.

Key Takeaways:

The China Factor is Huge: Both games earn the majority of their revenue from China, but the skew for Delta Force is extreme. About 97% of its lifetime revenue ($217M of $224M) comes from China. For Western studios, this highlights both the immense opportunity and the challenge of being effectively locked out of the market without a local partner.

LiveOps & Esports Drive Revenue: In today’s attention-constrained economy, generating more revenue from existing players is critical. The scale and complexity of the Delta Force event is a masterclass in how to drive monetization spikes far beyond baseline levels.

Watch the “Splinternet”: We’re already seeing a digital world fractured along national lines, especially with China. Recent regulatory moves, like the forced sale of TikTok’s U.S. business, show a real risk of regulation dramatically altering the competitive landscape. This is something every global gaming company needs to keep on its radar.

2. ALPHA: The Real Mobile Gaming Mafia Isn’t Take-Two—It’s Peak Games

A recent report from market intelligence firm Investgame made a bold claim: “when [Take-Two’s] veterans launch their own studios, a surprising pattern emerges: the most significant wins come not from replicating AAA glory, but from mobile studios.”

Investgame’s thesis suggests that Take-Two confers “mafia” effects to their alumni that leads to winning in mobile vs. AAA.

This immediately struck me as odd. Take-Two is a publisher with a portfolio of studios that, by all accounts, operate as independent city-states. How could a holding company imprint a unified “mafia effect” on its alumni?

While I applaud the effort and line of investigation, I believe the report’s conclusion is a stretch. But in digging into it, we can find some real alpha.

The Flaw in the Thesis

The report’s logic seems to be built on the massive success of one company: Dream Games. The analysis suffers from a few critical issues:

The Publisher vs. Studio Problem: Game-making DNA—the culture, processes, and talent that drive success—resides in the studio, not the publisher. It’s hard to see how a “Take-Two effect” could exist across its independent studios.

The Single Data Point Problem: The conclusion is almost entirely driven by the outlier success of Dream Games.

The Timeline Problem: Dream Games was founded in 2019 by alumni from Peak Games. Zynga acquired Peak Games in 2020. Take-Two acquired Zynga in 2022. The organizational overlap never happened. The success of Dream Games is a Peak Games story, not a Take-Two story.

If you remove the Dream Games and other Peak Games alumni data, the thesis flips. The organic Take-Two alumni network actually favors console and PC development.

Finding the Real Alpha

So, I believe the report’s conclusion is wrong, but the line of thinking is valuable. Here are the key lessons:

The Peak Games Mafia is Real: There absolutely appears to be a “mafia effect” at play here, but it originates from Peak Games. This is the real alpha. We should be studying Peak to understand what in their DNA enabled such repeatable success. Was it their people, their practices, their culture?

There Are No Infallible Experts: We often look to market intelligence firms or legendary studios as if they have all the answers. But everyone makes mistakes—I make them constantly. In an industry as dynamic as gaming, our goal should be to question assumptions and seek the truth together.

JK Note: I’ve offered to collaborate with Investgame on a future study of Peak.

3. Game Dev: Your Most Important Product is Your Recruiting Pipeline

I believe the success of any game or company comes down to one thing: the people. The difference between a great team member and a mediocre one isn’t 10% or 20%—it’s 10x or more. Steve Jobs famously said that Steve Wozniak was a 30x engineer. In the age of AI, that gap is only going to widen.

And yet, for years, recruiting at my own company wasn’t good enough. I failed to manage and direct it properly, and our processes suffered. We’ve only recently begun to dramatically improve through a number of initiatives, and it’s already making a huge difference.

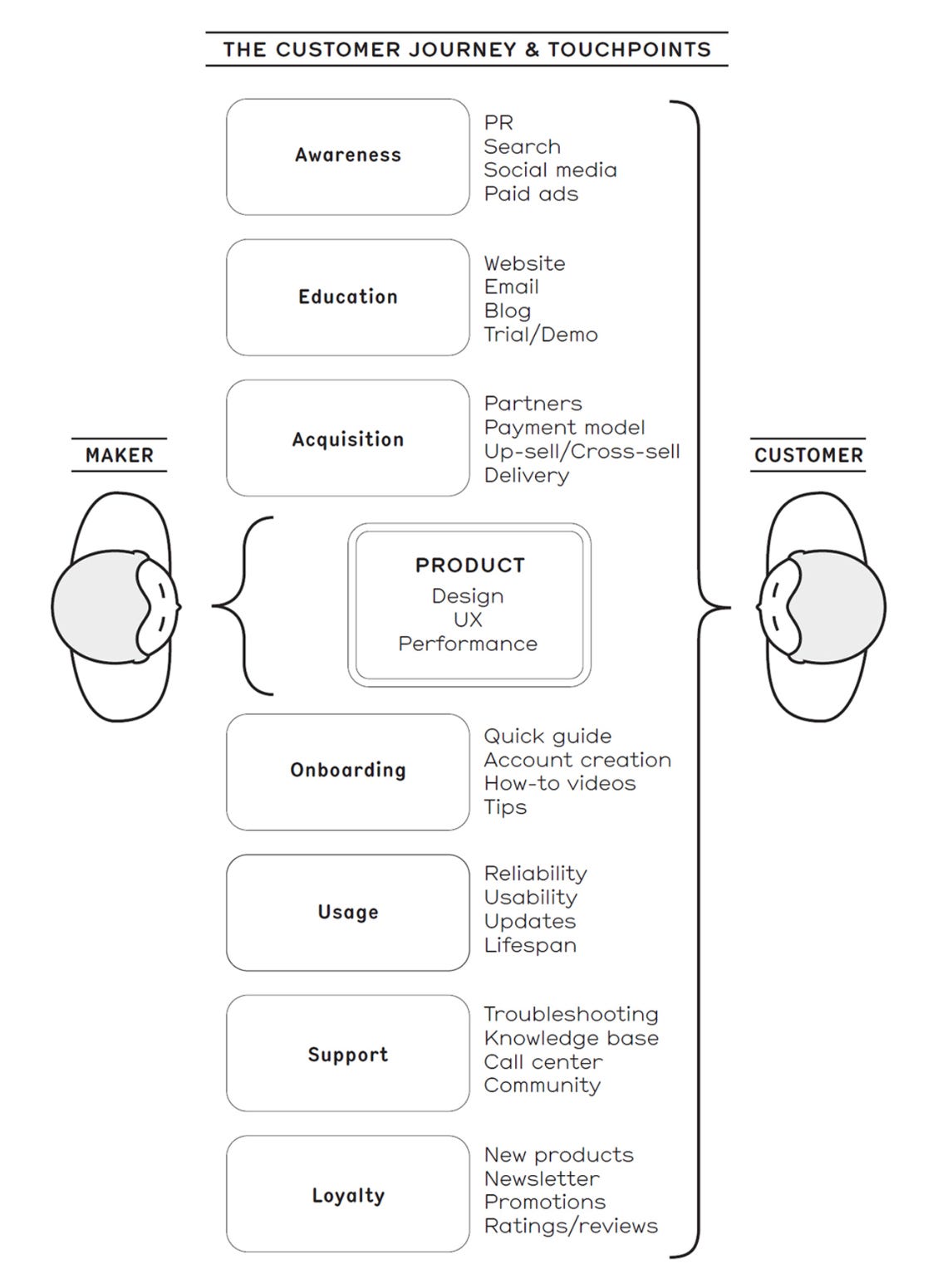

Today, I want to share one concept that has been top-of-mind for us: The Candidate Journey and Touchpoints.

This is my adaptation of a framework from Tony Fadell’s phenomenal book, Build. He talks about mapping the entire “Customer Journey”—from the moment a customer first hears about your product to the day it’s no longer in their life.

We’ve applied this by treating our recruiting candidates as our customers. We are now systematically mapping and optimizing every single touchpoint in their journey with us.

How do they first hear about our company?

What does the initial outreach email look and feel like?

What is the experience on our website’s career page?

Are our written tests and evaluations clear, respectful, and effective?

What is the tone and quality of every communication they receive?

For a long time, we were doing a poor job at this. We’re not perfect yet, but now we have a framework to focus our efforts.

If you believe that people are the most critical ingredient for success, I urge you to obsess over your candidate touchpoints. In today’s competitive market, attracting and hiring great people is one of the most powerful sources of advantage you can build.